BlackRock (BLK) has no intention of slowing down anytime soon...

BlackRock (BLK) has no intention of slowing down anytime soon...

It is the world's largest asset manager, with an impressive $11.5 trillion in assets under management ("AUM"). That surpasses the second-largest manager's AUM by 32%... and nearly triples the third largest.

BlackRock offers countless ways for its clients to invest, including exchange-traded funds ("ETFs"), mutual funds, index funds, private equity, alternative investments, and more.

However, this has never stopped it from continuing to pursue other opportunities...

Last year, we covered the asset manager's plans to expand into crypto – a promising, yet somewhat neglected, asset class. At the beginning of this year, BlackRock finally launched its first spot bitcoin ETF. Today, it has almost $27 billion in assets... making it the world's biggest crypto fund.

Now, in its push to stay ahead of the competition, BlackRock is moving on to its next endeavor...

It's expanding in the rapidly growing private-credit market and introducing tax-efficient funds within its Mutual Fund division to better compete with fellow investment giant Vanguard.

As we'll explain today, investors appear pessimistic about these new initiatives – even though they'll likely only benefit BlackRock in the months and years ahead.

Despite being a leader in many asset classes, BlackRock has fallen behind in private credit...

Despite being a leader in many asset classes, BlackRock has fallen behind in private credit...

The company lags smaller competitors like Apollo Global Management (APO) and Ares Management (ARES), who have dominated the space in recent years.

Unlike BlackRock, they were quick to set up business units that focused on lending directly to companies.

Now, BlackRock is revamping its private-credit business with a new Global Direct Lending division in hopes of closing the gap.

This move shows clients that it's just as capable as its peers in the world of private credit... and it makes it clear to investors that staying competitive is a priority.

As we explained this past August, private credit has surpassed private equity in returns since 2022. So it's certainly an attractive market to penetrate.

And it's exactly why BlackRock recently acquired two major players in the space, Global Infrastructure Partners and Kreos Capital.

Currently, the company aims to double its revenue from private assets by 2028.

Additionally, BlackRock is exploring opportunities in tax-efficient funds, which its rival Vanguard has been capitalizing on for a while.

Since 2001, Vanguard had a patent on a technique it called "heartbeat trades" that let it eliminate the tax burden from its mutual funds. That helped its investors hold on to an extra $100 billion in gains over more than 20 years.

However, Vanguard's patent on this model expired last year... which means BlackRock can apply to use the same technique to save its own investors money.

This underscores the shift toward lower-cost, tax-advantaged investment options as investors increasingly favor ETFs over traditional mutual funds.

BlackRock is currently awaiting approval from the U.S. Securities and Exchange Commission. And if it gets it, it'll have yet another tool to put itself on even footing with its competitors.

These new initiatives could prove very profitable for BlackRock, though investors appear skeptical...

These new initiatives could prove very profitable for BlackRock, though investors appear skeptical...

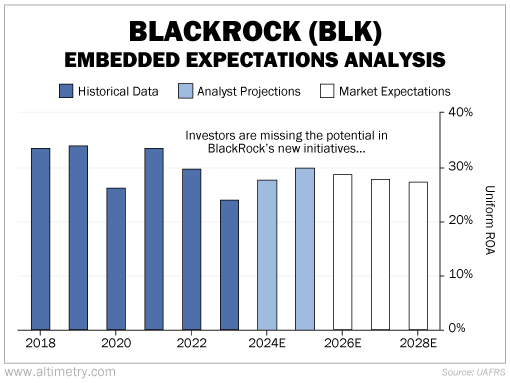

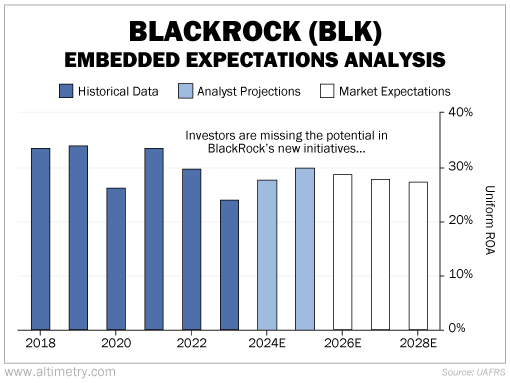

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA works a lot like a betting line in a sports bet. We use BlackRock's current share price to calculate what investors expect from future performance... and compare those forecasts with our own.

It tells us how well our "team" (the company) has to perform to justify the market's "bet" (the current price).

BlackRock's Uniform return on assets ("ROA") has averaged just above 30% over the past six years. It fell to 24% in 2023, partly due to its slow move into popular areas like private credit.

Now that it's turning this part of its business around, Wall Street analysts expect Uniform ROA to recover to 30% as soon as next year.

However, at the current price, investors expect BlackRock's Uniform ROA to settle around 27%... below its six-year average.

Take a look...

Considering BlackRock's dominance in the asset-management industry and its constant pursuit of new income streams, this expectation seems too pessimistic.

Sure, the company fell behind last year. It was slow to turn its focus to the private-credit market, and it's only just now trying to get on even footing in the mutual-fund business.

However, BlackRock has never sat quietly...

It's the biggest asset manager for a reason. And the market is clearly overlooking its new initiatives, which have the potential to drive greater profitability.

Regards,

Joel Litman

November 12, 2024

BlackRock (BLK) has no intention of slowing down anytime soon...

BlackRock (BLK) has no intention of slowing down anytime soon...