Senior management's job is to understand its business' risk-taking strategy...

Senior management's job is to understand its business' risk-taking strategy...

Many of our readers are business owners, in senior management, or even potentially retired and investing in or advising businesses. As such, they need to understand that the main job they have is to take on risk and oversee risk-taking.

Otherwise, companies won't grow... and won't create wealth.

It's a novel yet true way to think about the job of both senior management and advisors at any business, and helps change how to take on decision-making at a company.

It's something Joel and I think about on a daily basis when we look at the strategy we're pursuing as we seek to grow Altimetry with our partners.

With that in mind, one thought leader that we respect focuses on the world of both risk-taking and risk oversight. He recently came out with a new book on the topic that's worth reading.

David Koenig, who along with Joel and I is a member of the executive advisory board at the Center for Advancing Corporate Performance, published The Board Member's Guide to Risk.

For those of you who are involved in senior management, ownership, or oversight at a company, we recommend you think about picking it up. You can read more here, and we hope it helps you with your thinking on risk-taking, both how you frame it and how you track it. These topics are essential areas for any successful business.

We'd love to share other book recommendations in the future... Are there any books on either investing or life in general that you think are relevant to share? If you have any, send them over to [email protected].

The 'At-Home Revolution' has changed every single industry...

The 'At-Home Revolution' has changed every single industry...

One might argue no sector has been affected more than logistics – specifically, last-mile logistics. The little-known businesses in last-mile shipping are necessary to help companies like Amazon (AMZN), Walmart (WMT), and others. Without them, these e-commerce giants wouldn't be able to ship out packages all over the world in only a matter of days.

These companies are especially important now, considering how the At-Home Revolution has been accelerated by the pandemic. People are spending more time at home... and they're increasingly shopping online. In June alone, online shopping was up 76% compared to the same month last year.

Even though we're seeing more shipments than ever before, people still want to receive packages, food deliveries, and prescriptions to their doorstep as quickly as possible.

Amazon and other e-commerce retailers need a whole logistics warehouse infrastructure to support this growth. Most of them have zero interest in owning the entire supply chain themselves. That would take a lot of investment, not to mention building an expertise in the space.

One company they've often been turning to for help is Prologis (PLD).

Prologis helps in the transfer of more than $1.3 trillion of goods each year. It's an integral part of many companies' supply chains, and helps to solve its clients' operational needs.

Prologis is one of the few commercial real estate ("CRE") companies that benefits from the changes we've seen over the past months... But it's different from National Retail Properties (NNN).

National Retail Properties' fundamentals resist the negative disruption in its sector, because the company's tenants are different than those of most retail real estate investment trusts ("REITs"). On the other hand, Prologis and other logistics firms have bucked the trend of the entire CRE industry... because they're fundamentally betting against the industry.

And yet, the market seems to be treating Prologis like every other CRE firm. It sees Prologis' miniscule as-reported returns and assumes the company isn't profiting from the changing trends.

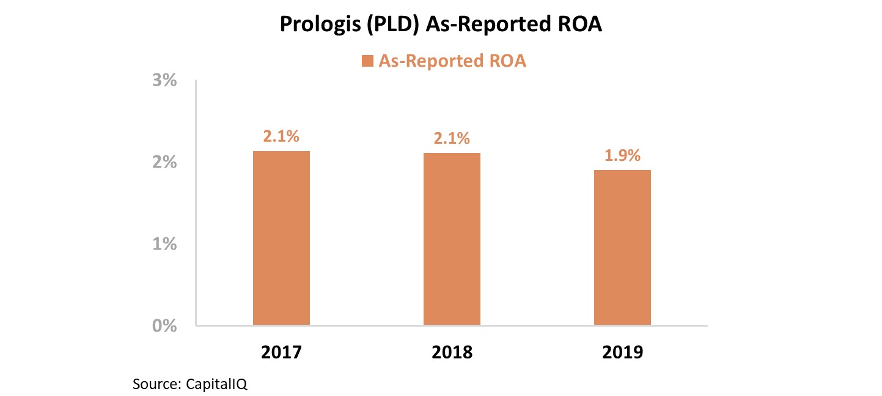

Prologis' as-reported return on assets ("ROA") has been below 3% since 2007, well below the cost of capital. Specifically, over the past three years, Prologis' ROA has been 2%. This paints a picture of an unsuccessful business.

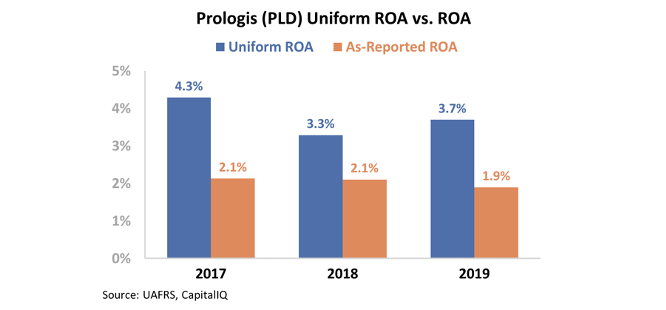

As usual, as-reported metrics aren't telling the entire story. Prologis' asset base is being artificially increased due to the misrepresentation of depreciation and long-term investments, and profitability is being distorted by other GAAP misstatements. These issues are incorrectly lowering the company's ROA.

In fact, Prologis' Uniform ROA has been greater than the as-reported numbers show during every year over the past decade... and in some years, more than double. Take a look...

The Uniform metrics show a company that's much more profitable than the market thinks it is. But that doesn't mean Prologis has no problems at all...

Unlike National Retail and other REITs, Prologis has a much lower dividend yield. National Retail pays its shareholders 6% per year, while Prologis only pays out 2%. This means investors need to see greater stock appreciation with Prologis, which makes understanding market expectations critical...

Using our Embedded Expectations framework, we can do exactly that.

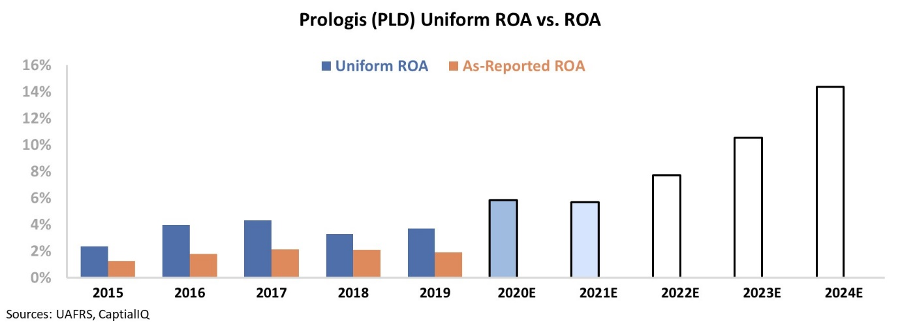

The chart below shows Prologis' historical corporate performances in terms of Uniform ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

Given the current share price, the market is expecting Prologis to triple its returns by 2024. This will be a tall order... It already took Prologis a decade to double its ROA to where returns are now. Economic tailwinds will have to give a great boost to the company if ROA is going to triple in the next five years.

The GAAP metrics show that the company would have no chance to grow. As-reported returns have been dismal for more than a decade.

Uniform Accounting shows slow improvement... But to justify its stock price, Prologis must revolutionize its business, starting now.

Prologis still may be too expensive to own at current valuations, but at least market optimism makes sense looking at Uniform data... in a way it doesn't when you look at the incorrect, as-reported numbers.

Regards,

Rob Spivey

August 6, 2020

Senior management's job is to understand its business' risk-taking strategy...

Senior management's job is to understand its business' risk-taking strategy...