Many folks thought interest-rate hikes were hurting banks...

Many folks thought interest-rate hikes were hurting banks...

In reality, they were actually making them even more profitable.

The banking crisis shook investor confidence earlier this year. But at the end of the day, that's exactly what it was... a crisis of confidence, not a crisis in real performance.

Silicon Valley Bank and other regional banks were brought down because they made poor investment decisions in the current environment. Their deposits were invested into assets like U.S. Treasurys that lost value as interest rates rose.

Depositors panicked and withdrew their money. This created a cycle that led to a bank run.

Banks had to sell investments to meet withdrawal demands. That led to larger bank losses... which then led to more fear and withdrawals until several banks went under.

But it's not all bad news. High interest rates are actually a good thing for banks. They widen the spread between what banks pay on deposits and what they earn on loans (also called "net interest margin").

Said another way, banks can charge borrowers more on loans... and they don't have to offer much more to depositors. For most banks, this spread has risen for the past two years.

Consulting firm McKinsey estimates that banks saw a $280 billion profit boost in 2022 from higher rates. The firm believes that number could be even higher this year as rates rise even more.

But as we'll talk about today, investors just aren't paying attention... which creates a long-term opportunity in banks.

Regional banks had a great 2022...

Regional banks had a great 2022...

Compared with major Wall Street banks, these smaller banks typically earn more of their revenue from traditional lending. Activities like trading and investment banking dilute the lending revenue of big banks.

For instance, smaller bank Regions Financial (RF) had a record 2022. Revenue was up 12% year over year to an all-time high of $7.2 billion. And this growth was primarily because net interest margin widened.

Regions Financial isn't an isolated case. And yet, the market is pricing in miserable times for all regional banks going forward...

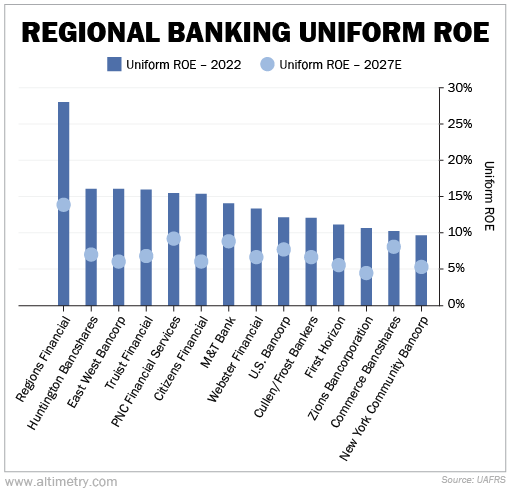

We can see this by comparing 2022 Uniform return on equity ("ROE") across the industry with market projections for 2027.

Take a look...

As you can see, the market expects a dramatic drop in regional banks' Uniform ROE through 2027.

If you believe investors, banks like Regions Financial, Huntington Bancshares (HBAN), and East West Bancorp (EWBC) could see their Uniform ROEs cut in half.

And if you don't believe investors... these regional bank stocks are looking seriously undervalued at the moment.

Now, just because regional banks are cheap doesn't mean we're giving an 'all clear' signal...

Now, just because regional banks are cheap doesn't mean we're giving an 'all clear' signal...

We're still approaching a serious spike in defaults among U.S. corporations this year. Individual consumers and consumer real estate aren't in much better shape, thanks to high interest rates.

Our point is simple... After the banking crisis earlier this year, the market is already pricing these regional banks for a recession.

So even though recession fears could cause them to drop a bit more, these stocks are already cheap. They'll only get cheaper.

Don't bet against banking stocks. This isn't 2009... Once investors realize banks aren't in trouble, these regional bank stocks will have a lot of room to run.

Regards,

Rob Spivey

October 31, 2023

Many folks thought interest-rate hikes were hurting banks...

Many folks thought interest-rate hikes were hurting banks...