Last week, Joel talked about why asking questions leads to better stock picking...

Last week, Joel talked about why asking questions leads to better stock picking...

In the April 23 Altimetry Daily Authority, he highlighted the analysis of Philippines-based miner Nickel Asia (NIKL.PM) and how his embracing of the Socratic method allowed a big client to dodge a potential portfolio "torpedo."

As Joel explained, statements of fact can quickly turn into a never-questioned monologue by a speaker. If lecturers don't facilitate conversations and ask questions, they can create a useless echo chamber.

While Joel talked about Socrates, another philosopher who continued the conversation on conversation itself was John Stuart Mill.

A member of British Parliament and a proponent of classical liberal thought, Mill was a strong advocate for freedom of speech. He felt it was important for everyone to have a voice... and to be heard.

Mill didn't believe that every perspective was right. He felt the only way to help people get smarter was to engage in dialogue, as opposed to silencing points that went against the popular opinion or your side.

Allowing people to be heard would reduce intolerance since everyone would be informed of everyone else's views.

Mill believed pushing for constant dialogue was essential because the strongest opinions were often the least informed. Put another way, "The loudest voice is often the weakest."

When people dig their heels in – and aren't comfortable having a conversation about their opinion – it's usually because they're only seeking data that back up their point. They aren't having a dialogue... They're having a monologue.

It's impossible to be informed without following Socrates' example and learning through asking questions instead of only speaking.

That's why great investors are constantly seeking new data to challenge their beliefs.

Some of the most unsuccessful investors are ones who bury their heads in the sand... and ignore changing data because the information doesn't confirm their original thesis.

At Valens Research – the firm that powers Altimetry – one of our least-successful stock picks came from a lack of asking questions...

At Valens Research – the firm that powers Altimetry – one of our least-successful stock picks came from a lack of asking questions...

In January of 2019, we first recommended shares of luxury-goods retailer Tapestry (TPR) to our hedge fund and mutual fund clients.

We pick stocks as a team. But one person has to "own" a pick to push it forward. Tapestry was one of my picks, and I pushed for it hard.

When I first identified Tapestry, I saw the potential for it to follow in Paris-based competitor LVMH's (LVMUY) footsteps in the U.S.

Back in 1987, Louis Vuitton merged with Moët Hennessy to form a luxury conglomerate. By acquiring and cultivating premium brands – alongside leveraging economies of scale from consolidating distribution – LVMH saw its returns climb.

Meanwhile, Tapestry was looking to take a page out of LVMH's playbook through the merger of Coach and Stuart Weitzman in 2015 and the acquisition of Kate Spade in 2017.

CEO Victor Luis had previously worked at LVMH and looked like he was implementing the company's successful strategy.

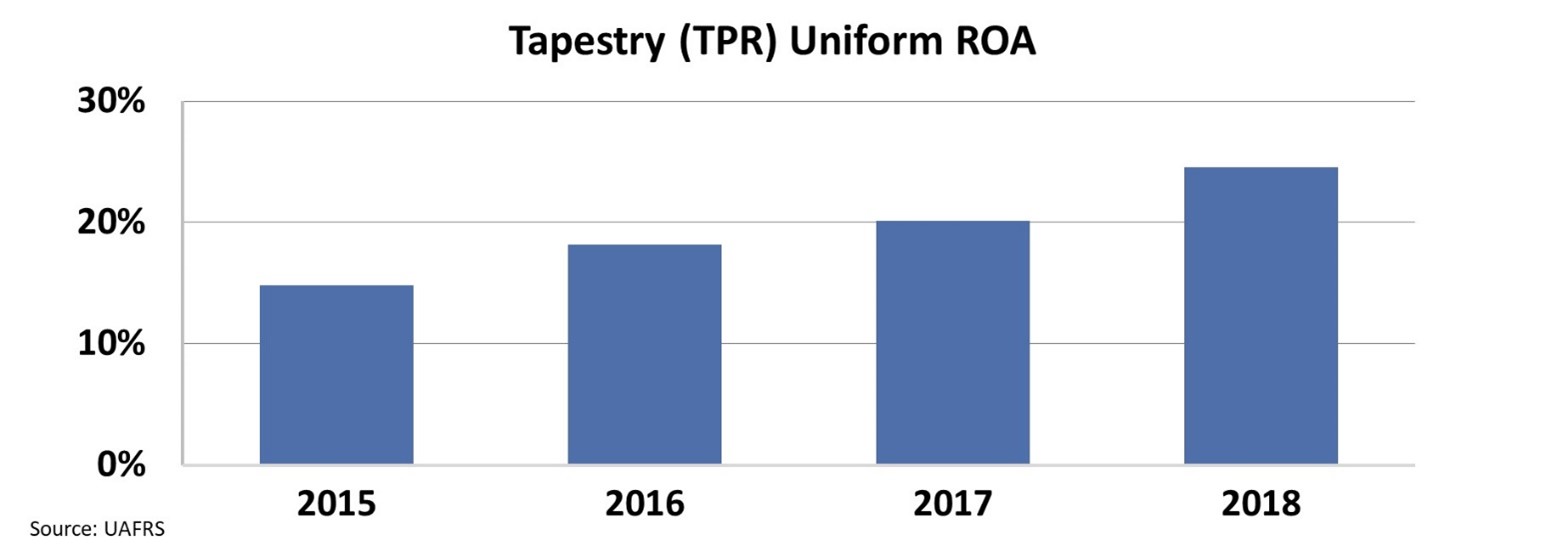

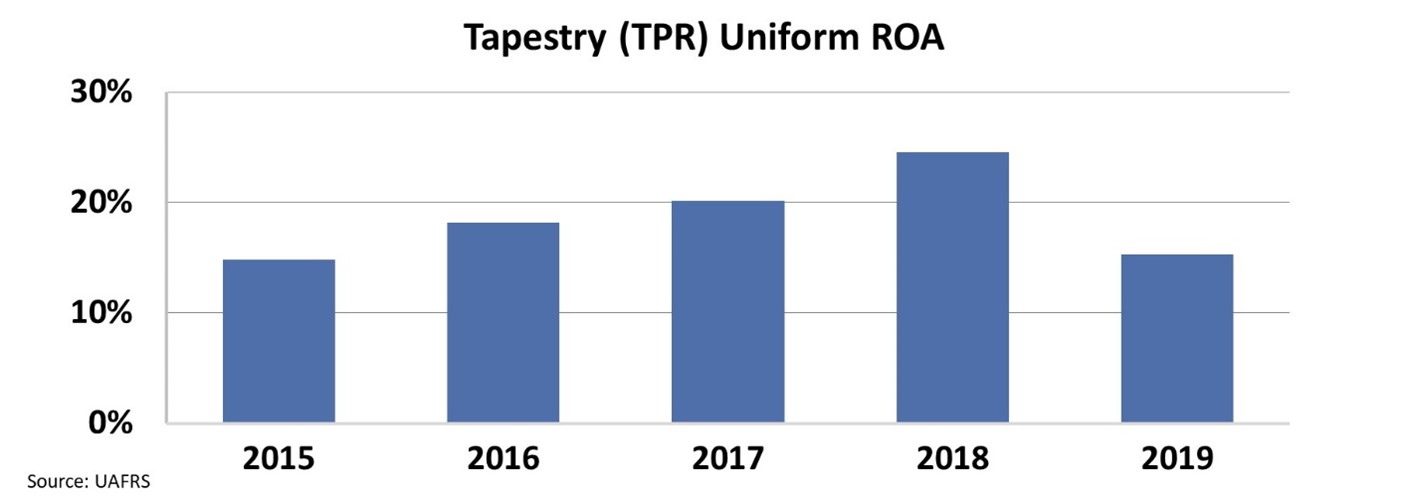

He was focused on changing the company, and his acquisition strategy already appeared successful. After the Stuart Weitzman and Kate Spade purchases, Tapestry's Uniform return on assets ("ROA") steadily climbed to above 20%. That's an impressive level for a luxury brand in the midst of ongoing struggles in the retail sector.

The historical data backed my thesis, so I thought it was a no-brainer...

The historical data backed my thesis, so I thought it was a no-brainer...

When returns began to flash signals of a possible decline in the summer of 2019, our team started raising concerns about weaknesses in the underlying brands. However, I argued we couldn't overreact to short-term data. As I said at the time, brands could have minor volatility... But the trend was up!

Then, CEO Victor Luis was fired in September. It wasn't exactly a vote of confidence for the company's strategy. But I said, "Let's give it another quarter... The chairman taking over the business is the one who hired Luis for this strategy, so he can see it through."

When I finally embraced the writing on the wall and we recommended exiting the position, TPR shares were down 54%.

By the end of 2019, Tapestry's Uniform ROA had fallen to just 15%. The company hadn't seen these levels since 2015, before it had embarked on its new strategy. While the approach worked for LVMH, Tapestry was unable to source the same high-quality brands and generate big profitability.

It wasn't a great look. And there was a big reason why...

It wasn't a great look. And there was a big reason why...

Looking back, I can see that the process wasn't structured to be conducive to the Socratic method – asking questions to get to the truth. If my voice was the loudest in the room, and we were delaying taking in new information because of it, that wasn't a winning formula if it led to a big loss like with Tapestry.

To fix the problem, we completely changed our stock-pitching structure to foster both freedom of speech and a dialogue within the entire company.

We took senior management out of the stock-pitching process. Instead, our analyst team works to find and present stock ideas, with senior management asking questions about potential risks or shortcomings and upside potential.

This sidesteps a potential echo chamber, as more inexperienced analysts aren't forced to challenge senior folks on their ideas. Instead, they bring forward new or underexplored ideas... and can learn to be better stock pickers in the process.

This fosters a dialogue in our investment research committee, instead of a strong opinion that is hard to challenge or change.

If we asked more questions, we could have avoided the big loss in Tapestry. But by learning from the great thinkers who came before us, we're working to avoid the same mistake again.

When combined with the power of Uniform Accounting, a stock-picking process that embraces opposing viewpoints and data is powerful...

When combined with the power of Uniform Accounting, a stock-picking process that embraces opposing viewpoints and data is powerful...

In our Altimetry's Hidden Alpha service, we've been able to identify four companies whose stocks went on to double the money of subscribers who followed our advice to buy shares. And another 20 recommendations in the portfolio are currently sitting on double-digit gains.

On Monday, we have a brand-new issue coming out with two stocks primed for big upside ahead as an industry in the tech sector takes off... To learn more about a subscription to Hidden Alpha and make sure you're on the list to receive these upcoming picks, click here.

Regards,

Rob Spivey

April 30, 2021

Last week, Joel talked about why asking questions leads to better stock picking...

Last week, Joel talked about why asking questions leads to better stock picking...