Sadly, supply and demand still aren't cooperating...

Sadly, supply and demand still aren't cooperating...

A few months ago, the U.S.'s third-quarter gross domestic product ("GDP") was forecast to come in at an impressive 6%.

By the time the Bureau of Economic Analysis published the actual figure in late October, it was only 2%.

It felt like the rug was pulled out from under the economy, which is a great representation of the economic dynamics during the whole pandemic.

Big logistics firms like Hub (HUBG) regularly receive products a month later than expected.

The delays are a result of the chaos unleashed on global supply chains by the pandemic.

Factory shutdowns due to virus outbreaks, massive port bottlenecks, and labor shortages for truck drivers are crucial components of the economy.

There is plenty of debate about whether these issues are going to be temporary or whether they will persist longer than initially expected.

Some economists are more optimistic than others...

Some economists are more optimistic than others...

Some experts are calling for a significant reversal in the fourth quarter of 2021 toward forecasts for stronger growth seen earlier in the year.

They point to the quick improvements in unemployment from the elevated levels seen at the height of the recession.

These economists also note that a major issue driving current supply chain challenges is the redeployment of consumption from services to goods over the past two years.

Instead of spending as much on haircuts and eating out, many more Americans are now spending their pent-up savings on goods like cars and home appliances.

The Economist even calculates that consumption of goods is roughly 15% higher than before the pandemic. On the other hand, consumption of services is running below trend.

Those calling for economic strength going forward argue that this shift in consumption is the key trend to watch.

When the pandemic subsides, consumers will become more confident about going out and spending on services.

This will then take the pressure off of supply chains, and concerns about inflation will start to recede... or so they say.

Capex is part of the solution...

Capex is part of the solution...

We've talked regularly about what we see as the real solution for resolving supply chain issues: capital expenditure ("capex").

For the economy to heat up, management teams need to invest in essential equipment for operations.

This constitutes everything from factories and warehouses to ports and logistics.

Once these investments are made, supply chains will become more resilient and able to deal with the pressures they're currently facing.

To know when it will occur is another matter.

Fortunately, we can watch one key metric to get a sense of when the next capex cycle will take off.

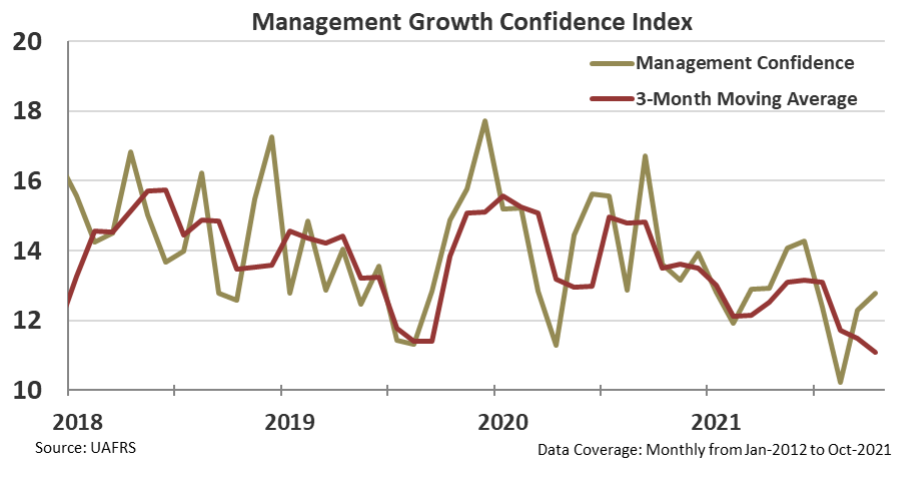

It's called the Management Growth Confidence index, and it tells us how management teams currently feel about capex spending.

The problem is that the index shows that management teams are very pessimistic about investing in growth.

That means they may be uncertain about the economic outlook and unwilling to take big risks by spending on new plants and equipment.

You can see for yourself in the chart below. The headline (green line) and three-month moving average (red line) of the index have fallen from recent peaks over the past few months.

Weak management confidence about investment spending might suggest the fourth quarter will be another bumpy quarter for growth in GDP.

That is... until we finally see management teams become confident and start deploying funds for capex spending.

A supercycle looms...

A supercycle looms...

A return of management confidence will kick off what could be an epic capex cycle in 2022 and beyond.

This coming capex boom has the potential to be a major tailwind for companies across all industries. This means capex in the sense of hardware, but also the software that powers that hardware, and many of those companies are Software as a Service ("SaaS") platforms.

That's why, in our recent backtest, we found that 72 of the last 75 times that a company transitioned to a SaaS model, the stock was up... with an average gain of 759%.

As we explained on Friday, SaaS companies like Shopify (SHOP) had a historic year thanks to their more approachable software pricing... and with the upcoming capex cycle, it's likely more companies will jump on this trend.

I just published a brand-new presentation where I walk you through the powerful SaaS business model and show you how to get the name of the next potential big SaaS winner. You can watch it here.

Regards,

Joel Litman

December 6, 2021

Sadly, supply and demand still aren't cooperating...

Sadly, supply and demand still aren't cooperating...