The biggest change resulting from the 'At-Home Revolution’ has been where money is spent...

The biggest change resulting from the 'At-Home Revolution’ has been where money is spent...

We talked about this radical shift back in October regarding golf equipment manufacturer Callaway Golf (ELY). Since the coronavirus pandemic began, folks are spending more on goods and less on experiences.

It's a big change from the trends over the past decade, when spending had been moving more toward services and "experiences," as opposed to goods.

The pandemic has caused disruptions in travel, dining, and other experiences. But with that spending shut off, consumers haven't acted like they need to build a bigger nest egg...

Instead, they've had travel budgets burning a hole in their pocket. They're looking elsewhere to spend that money.

A recent Bloomberg article highlights how U.S. household spending is expected to fall 7% this year. That's indeed a drop... but it's not as dramatic as one might expect considering the context.

The bulk of the decline is due to an expected 34% drop in travel spending. The difference has been made up by consumer spending in tangible goods.

Travel remains restricted across much of the world, so people are spending their money differently. This has led to a shift to spending on home goods and the things to entertain at home.

Spending is flowing to different outlets this year, and not all retail is under pressure from the pandemic...

One big winner from this shift in demand for material goods is RH (RH).

One big winner from this shift in demand for material goods is RH (RH).

Formerly known as Restoration Hardware, the company provides upscale home furnishings. RH sells its products through retail stores, catalogs, and its online presence.

Anyone who has been to an RH "Design Gallery" knows that it's an experience as much as a place to shop. They're filled with upscale furniture, and the showrooms are arranged to look like the rooms of a beautiful mansion.

RH stores are a destination, even for folks with no current plans to buy the products. This focus on the experience continues to bring customers back and helps build brand loyalty for when these folks do decide to purchase.

RH has also built brand loyalty by employing a clever "membership" model. This is similar to how bulk retailer Costco Wholesale (COST) has learned to target a higher-income client base and make them feel like they have an "in" using its membership program.

RH customers can pay an annual fee of $100 to get access to discounted prices across the company's stores. The membership encourages folks to come back, just like it does for Costco customers. RH sees additional spending from loyal members thanks to the perceived value they're getting.

Additionally, memberships provide RH with a steady income stream. With more than 400,000 members, the company continues to take in revenue even if shoppers aren't making purchases. These buyers drive more than 95% of sales, between their purchases and membership fees.

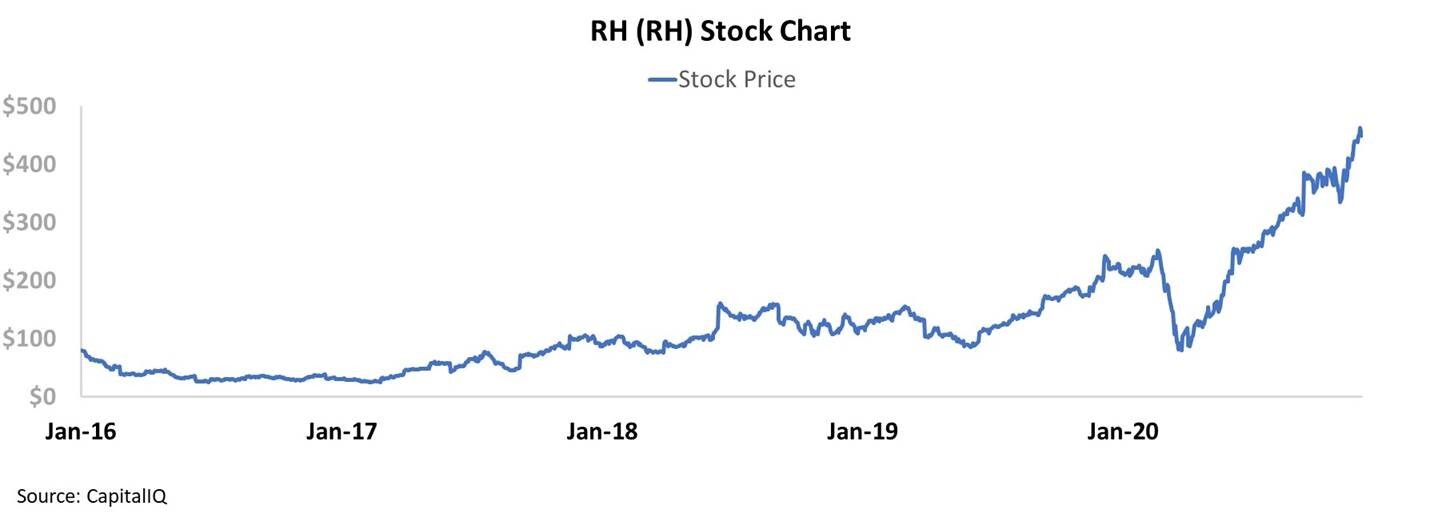

Investors looking at RH's stock price would assume this strategy has been a success. Since the membership introduction in 2016, RH shares have risen from $80 to around $450 – a gain of roughly 460%.

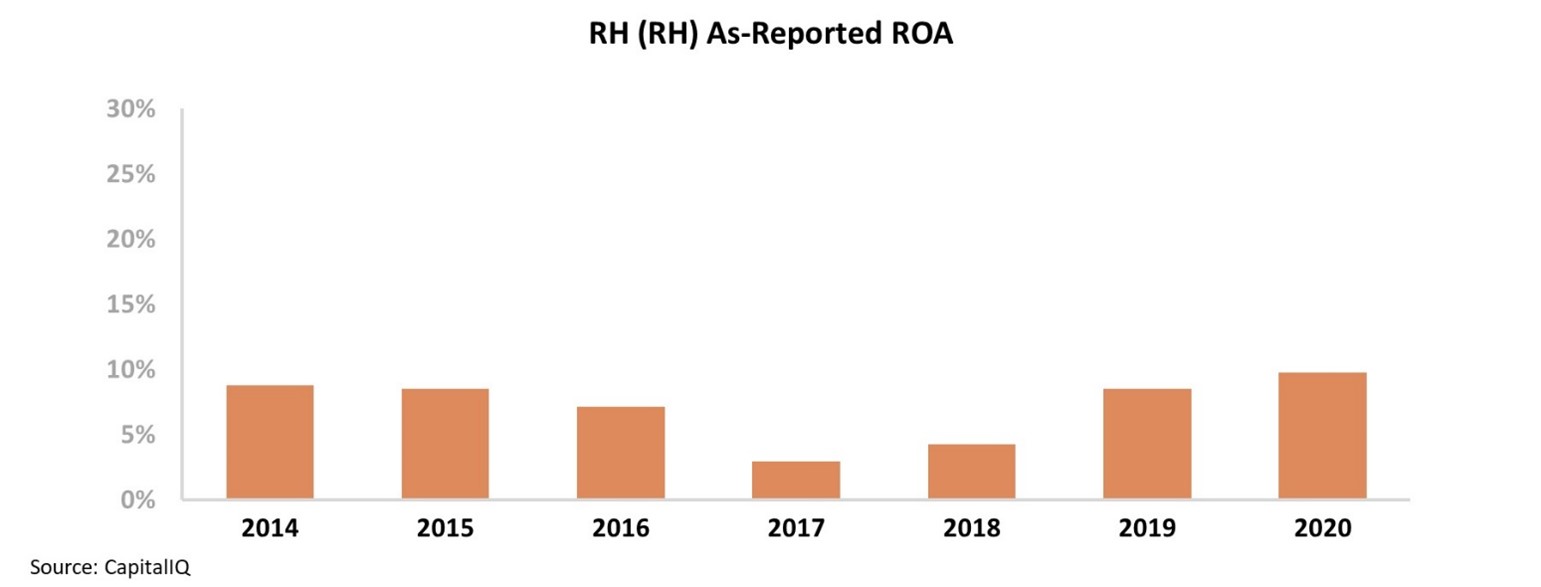

However, looking at as-reported metrics for RH, it appears investors may be way ahead of the company's fundamentals. The company's as-reported return on assets ("ROA") has only grown from 7% in 2016 to 10% in 2020.

While RH has seen rising profitability, it's still at below-average levels. Investors hoping the subscription model and focus on experience would drive above-average returns may be disappointed, and RH appears to be another retailer unable to differentiate itself.

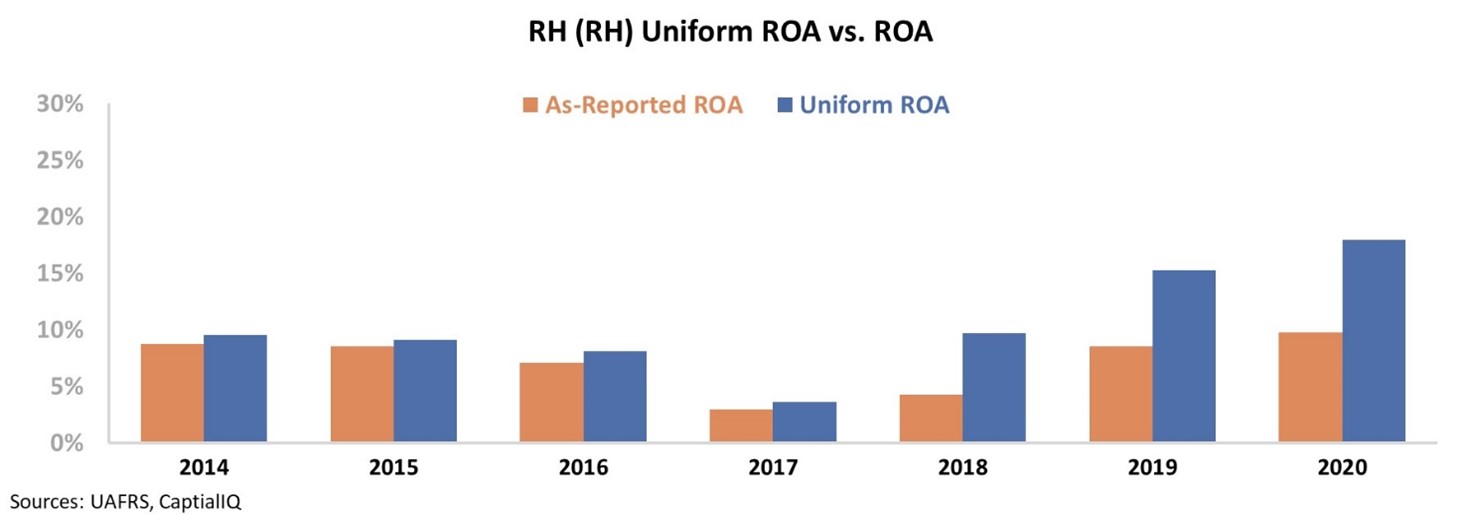

However, due to distortions in as-reported accounting, this picture of RH's performance isn't accurate. GAAP's treatment of interest expense – among other distortions – means that Wall Street has missed RH's true profitability.

RH's Uniform ROA has been higher than as-reported numbers since 2014. Just last year, the company's Uniform ROA was a robust 18%, compared to the 10% as-reported return.

Additionally, RH's Uniform ROA doubled from 2016's 9% figure. RH's membership initiative has enabled the company to increase profitability and reduce cyclicality.

Its focus on providing unique experiences has created strong demand for its products. Looking at Uniform Accounting metrics, the growth of RH's stock price looks justified – the company has robust profitability.

Ultimately, management's focus on unique experiences and the membership model has positioned RH for success. As consumer spending on goods increases, RH is set to thrive with its unique business model.

Regards,

Rob Spivey

December 1, 2020

P.S. The At-Home Revolution has become the fastest-moving financial trend of the decade. As more people are staying home, spending trends are shifting. It's changing our world... and it will mint fortunes for investors who get it right. We've identified the best ways to profit from this massive societal shift... Learn more right here.

The biggest change resulting from the '

The biggest change resulting from the '