The pandemic has caused some devastating changes to the travel industry...

The pandemic has caused some devastating changes to the travel industry...

Even though leisure is the most common reason for air travel, profitability in the airline business doesn't hinge on families taking vacations. Rather, the real moneymaker has always been in corporate business travel.

Business travel used to be considered a sure-fire income stream for commercial airlines. It had excellent forward visibility and a strong resilience during periods of weak travel demand.

Historically, companies have been willing to pay a premium for airfare flexibility. Business trips can change on a whim at any point leading up to the aircraft's departure. This means companies often bulk travel deals guaranteeing a certain number of seats regardless of timing.

But the pandemic may have changed how corporations think about business travel forever.

Corporations are having people travel less, and when they do, those tickets aren't always at the front of the plane like during pre-pandemic times.

Meanwhile, vacation travelers have come back strong and appear to be rethinking their spending patterns too.

Leisure travelers are more willing than before to splurge on more legroom. But these passengers will never be as insensitive to price changes as business bulk buyers who used to snatch up business class seats.

This pandemic shift is an airline's worst nightmare. The old-school operating model was that 20% of a plane's passengers sitting near the front of the cabin comprised 70% of its revenue.

A demand pivot away from business class will force airlines to raise prices for the back half of the aircraft.

While leisure travel has already made its recovery to pre-pandemic levels, business travel is still down 40%. Experts are unsure whether it will ever return to pre-pandemic levels.

Those changes are forcing airlines to adapt quickly...

Those changes are forcing airlines to adapt quickly...

Now, airlines are starting to focus more on the premium economy and economy plus seats.

They are tearing out big sections of their prior business class seats that aren't selling and replacing them with denser middle-tier seating that is more attractively priced.

On a price-per-square-foot basis, these new premium economy seats generate 6% more than business class seats.

The increased density of seats slightly outweighs the price cuts. It's still commanding a staggering 33% higher premium per square foot than regular economy seats.

Even more powerful, because these premium economy seats are closer in service and installation costs to regular economy seats, they are a staggering 40% more profitable than business class seating.

This could be shaping up to be a revolution in the economics of airline classes and a fantastic example of how challenging times can spawn new smarter ways of doing business.

This doesn't just impact the airlines, but also the airline seat makers...

This doesn't just impact the airlines, but also the airline seat makers...

Premium economy seats cost between $8,000 and $20,000 to install. This is more expensive than regular economy ones but less than the $75,000 to $250,000 that a lie-flat seat in business or first class may cost.

If airlines permanently shift away from buying these higher price business class seats, one of the biggest losers is B/E Aerospace.

This is one of the few brands that make airline seats. After a series of corporate mergers, B/E Aerospace was folded into Raytheon Technologies (RTX) last year.

Raytheon must now work through how this great shift for airlines will negatively affect its business.

If investors were listening to as-reported financials, they would see a business already struggling.

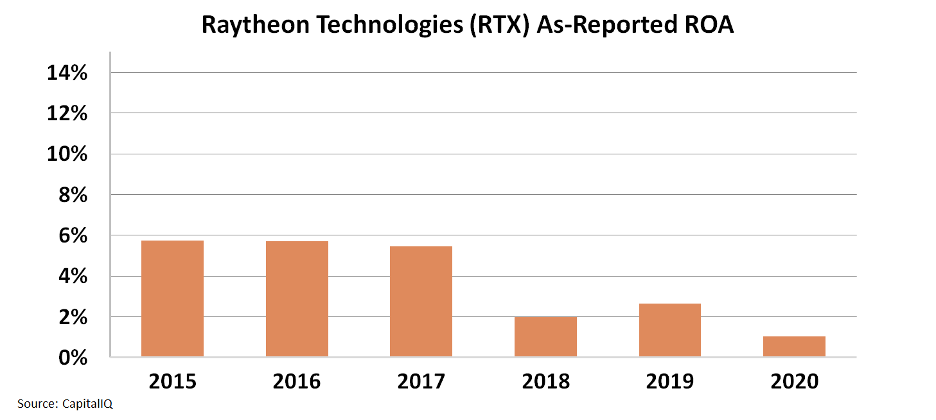

As-reported metrics show that return on assets ("ROA") fell from 6% before the B/E Aerospace acquisition to 1%.

It looks like Raytheon made a mistake getting into the airplane seat business. That said, this may have more to do with arbitrary accounting principles than it does with business fundamentals.

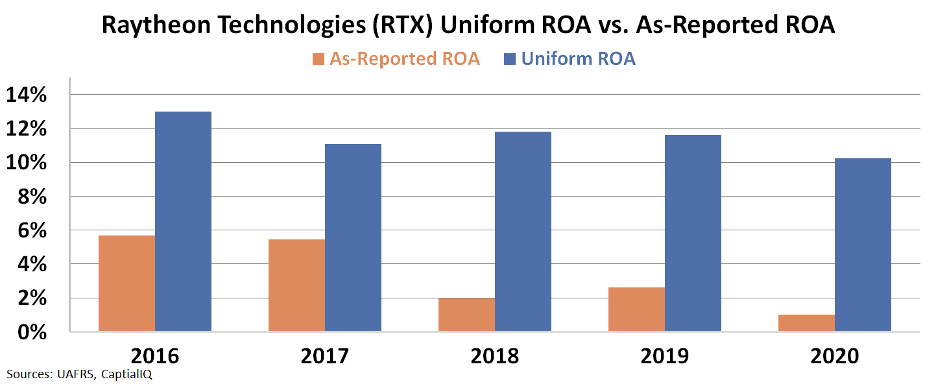

Looking at the Uniform Accounting numbers, we can see the division which operates B/E Aerospace is actually the most profitable portion of Raytheon's business. It is why for the last five years, Uniform ROA has consistently hovered above 10% levels.

Investors are likely failing to appreciate how important Raytheon's acquisitions have been to its real economic profitability. As B/E Aerospace experiences headwinds never foreseen during the acquisition, investors may need to watch for sudden pressure.

We will continue monitoring Raytheon and other competitors in the aviation space...

Here at Altimetry, we grade and analyze more than 4,000 other companies to identify winners and losers...

Here at Altimetry, we grade and analyze more than 4,000 other companies to identify winners and losers...

We just identified a microcap stock we think could turn into a 10-bagger in our Microcap Confidential service from our research.

I recently shared this tiny stock's name and ticker symbol in a presentation at Stansberry Research's annual conference in Las Vegas.

And for a limited time only, you can watch my recent presentation – with no e-mail address or credit card required – by clicking right here.

Regards,

Joel Litman

November 10, 2021

The pandemic has caused some devastating changes to the travel industry...

The pandemic has caused some devastating changes to the travel industry...