Work from home is changing the gig economy, and the study of economics...

Work from home is changing the gig economy, and the study of economics...

When thinking about the "At-Home Revolution," most people assume Zoom meetings, T-shirts and sweatpants, and avoiding the daily commute. However, earlier this month, a Bloomberg Opinion piece argued how working from home can change our entire outlook on economics.

We're already seeing the tangible benefits from a move to a work-from-home culture. Employees are happier to have a greater control over their schedule, and companies will save money on office space.

In addition, Bloomberg columnist Conor Sen argues that the traditional "gatekeeping" of the corporate structure will begin to fade away within a remote workplace. The typical hierarchy of a business means that it's sometimes challenging for a contrarian viewpoint to filter through the system. Now, with everyone brought to a level playing field, more varied opinions are heard.

For example, consider 28-year-old Nathan Tankus... He hasn't finished bachelor's degree, and created a newsletter that follows the U.S. Federal Reserve, the U.S. Securities and Exchange Commission, and the U.S. Treasury. He slowly built a small following since 2015... but this year, his readership took off when he started breaking down the government agencies' response to the current crisis.

Under a formal publishing structure, Tankus would have been unable to get his thoughts out. However, as the Internet and further decentralizing forces have democratized information, Tankus was able to be discovered and make a career outside of a traditional publishing house.

Politics and the music industry have also seen more decentralization. Through grassroots polling, activists outside of Washington, D.C. demonstrated the viability of Alaska as a battleground state. And traditionally, music needed to be mixed and mastered all in one location... but different parts of Taylor Swift's new album were created in New York, Los Angeles, and Nashville.

By sourcing from talent in unlikely places, independent contractors are able to advertise their talents more than ever. Furthermore, the importance of geographic centers of an industry will fade, such as cities like Washington, D.C. and New York.

The At-Home Revolution isn't just letting new voices being heard... it's causing companies to rethink how they bring on talent. Remember, this isn't a new thing from the coronavirus pandemic... it's something that has been building for some time, and the current crisis has just accelerated it.

Over the past decade, one of the biggest developments in the labor market has been the rise of the independent contractor...

Over the past decade, one of the biggest developments in the labor market has been the rise of the independent contractor...

As we mentioned earlier, some of the trends in independent contracting mirror what we've seen in the media industry. Media gatekeepers are no longer as relevant for mandating who gets heard. New voices have been able to come to the forefront as the industry has changed.

In much the same way, large corporations and 9-to-5 jobs aren't as necessary as they once were to employ the masses. Instead, people have more flexibility in how they prioritize work. This gives independent contractors the ability to set their own hours and create their own jobs. However, it can also be much riskier, as this arrangement erodes the safety net when contractors come on hard times.

People who are self-employed generally aren't eligible for unemployment. But luckily for the rising number of independent contractors, since this economic crisis has been unique, the government has also responded differently...

Through the CARES Act, unemployment checks have been sent to everyone affected – regardless of the type of work before the pandemic. This includes independent contractors who aren't able to find work.

This was essential to ensure that many people weren't forced into truly crippling situations in the midst of the pandemic. It also had the added effect of possibly disrupting the unemployment and workforce participation rates.

In the current environment, independent contractors receive unemployment benefits if they're forced out of work and show up on the unemployment roll. However, the U.S. Bureau of Labor Statistics normally only counts people filing for unemployment after losing a "normal" job.

This can create a strange contradiction where people can receive unemployment benefits yet not be classified as unemployed... or be classified as unemployed without having been let go from a job that would normally qualify them for unemployment.

This means that to truly understand unemployment, simply counting the number of unemployment checks going out is insufficient.

Furthermore, the future of the unemployment benefits themselves is uncertain. The extra $600 for weekly unemployment checks ended at the end of last month, and many Americans are unsure of what will happen next.

The federal government handles large-scale unemployment benefits. However, the Senate is on recess and isn't scheduled to return until after Labor Day. Moreover, Democrats and Republicans don't see eye to eye... and nothing suggests that the two sides will be able to reach an agreement.

As the political stalemate continues, the unemployment rate will be useful to monitoring the economy's recovery.

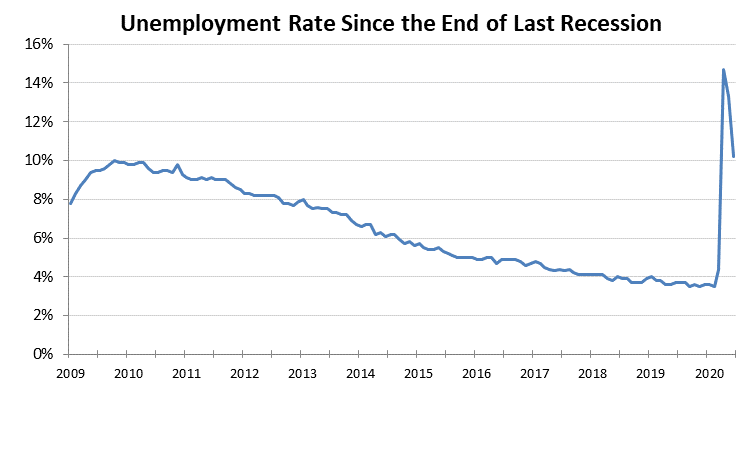

The chart below shows the unemployment rate since 2009. Since the last recession ended, the rate slowly moved lower over the years... and then jumped massively as the pandemic escalated. Take a look...

As the economy shut down, many companies simply couldn't afford to keep all of their employees. However, as we explained last month, the sharp spike has made way to the initial steps of a recovery.

Unemployment numbers have started to drop slightly... but are still at elevated levels. Without a vaccine, it's plausible that they'll stay high. Nevertheless, it's important to remember these levels may be artificially inflated – not just because of higher unemployment benefits, but because the rate includes part of the workforce that might not normally be counted.

In short, the situation may not be as dire as it seems.

Monitoring both independent contractors and unemployment overall will help investors understand how quickly the economy as a whole can continue to recover. Looking deeper into the calculation will also be important.

Just like how as-reported accounting metrics don't always offer a complete picture of economic reality, as context changes, just taking macroeconomic metrics at face value can lead to incorrect conclusions.

Regards,

Joel Litman

August 31, 2020

Work from home is changing the gig economy, and the study of economics...

Work from home is changing the gig economy, and the study of economics...