An ideal capitalist system creates losers and winners from market forces...

An ideal capitalist system creates losers and winners from market forces...

The "invisible hand" should promote smart, intuitive businesses to thrive and push unsuccessful companies out of existence. However, as Japan has shown, this doesn't always happen in practice...

In the second half of the 20th century, the country's economy was on a roll. Japan became one of the world's economic engines... and was a source of everything from cars to electronics. For years, asset and equity prices saw huge year-over-year growth.

However, Japan's economy ground to a halt in 1991. This started what economists termed the "lost decade." Some analysts might argue it's been the lost three decades.

When Japan's central bank raised interest rates to curb speculation and inflation, the bubble popped. Asset prices plummeted and stifled gross domestic product ("GDP") growth. To this day, the country's stock market index, the Nikkei 225, has yet to reach the all-time highs it achieved in the 1990s.

After the initial crash, "zombie firms" were a big reason growth never recovered. These are companies that should have already gone bankrupt... But they continue to operate due to easy access to liquidity.

Japan's loose standards for credit prevented creative destruction. Inefficient businesses didn't go under to make way for new ones... This made it difficult for the country to become more efficient and start to grow again.

Today, some economists and investors are nervous that the same thing will happen in the U.S. As a recent Economist article highlights, the number of zombie firms across developed nations is on the rise... and it's possible that the coronavirus pandemic could exacerbate the problem.

This could be an issue for the U.S. economy. Not only do zombie firms have horrible returns, but studies show they can also hold back competitors.

Looking ahead, the question now is whether the U.S. will see its own lost decade.

Two ingredients are needed to create zombie firms...

Two ingredients are needed to create zombie firms...

These are low interest rates and easy access to credit.

Right now, interest rates are at all-time lows. In order to allow companies to continue borrowing money, the U.S. Federal Reserve slashed interest rates when the coronavirus pandemic began.

The Fed also implemented the Main Street Lending Program, which gives five-year loans out to small and medium-sized business that were in a sound fiscal position prior to the pandemic. Additionally, the federal government took similar action with the Paycheck Protection Program.

The priority of this easy access to credit has been to keep people employed and businesses open. The repayment of the loans is a secondary concern.

In a normal economy, this isn't how lending should work. Creditors shouldn't give loans just to keep companies open if they can't survive. After all, the first rule of lending is "lend to borrowers who don't need your money."

But now, experts are starting to worry about aggregate debt levels. Over the past decade, debt levels had already been rising... and the surge in lending over the past several months has only accelerated this.

However, only looking at total debt levels paints an incomplete picture. As we've discussed in the past, it's important to look at companies' ability to pay off debt along with the total amount of debt.

It's true that companies have a lot of debt right now. With a low cost to borrow, some of these over-levered zombie companies will continue to survive... and our aggregate recovery rate analysis shows some worrying signs that confirm this.

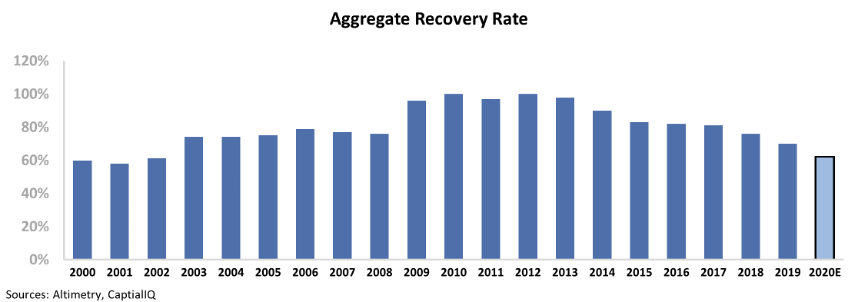

The recovery rate represents a company's ability to pay back debt by liquidating assets. As you can see below, the current recovery rate is at its lowest level since 2002 and has been falling since 2012...

This means asset values are declining, or total debt relative to assets is increasing... and it appears the latter is the bigger contributor. In other words, companies are relying on debt to survive more than ever.

It's no wonder some economists are sounding the alarm about a rise of zombie companies. However, those saying the U.S. is following in Japan's footsteps are missing the whole picture...

Again, low interest rates and easy access to credit are necessary for the creation of zombie companies. However, those two data points alone aren't sufficient to create a nationwide problem... A country also needs to have other issues that stifle creative destruction.

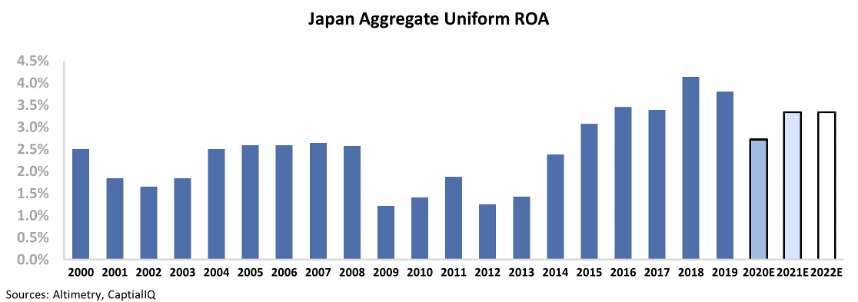

For decades, Japanese companies have been unable to drive profitability above the cost-of-capital. Aggregate Uniform return on assets ("ROA") in Japan has hovered between 1% and 4% since 2000. Take a look...

Japan's lackluster profitability levels stand in stark contrast to those of the U.S. This also hints at the other factor that helped contribute to Japan's zombie companies...

Japanese corporate culture is significantly different from that of the U.S. The "Keiretsu" – the big conglomerates that dominate the country – have a specific purpose in Japanese culture. They're as much the welfare state for their employees as they are profit-making firms. The Japanese government and banks are unwilling to force them to make tough decisions.

The Keiretsu also have complex holding structures. Different firms all own shares in each other, in convoluted crossholdings. This makes it harder for takeovers to occur... and for outsiders to push companies to evolve.

Some of this has changed over the past eight years since former Prime Minister Shinzo Abe started pushing "Abenomics" in 2012 after his election. He sought to help facilitate creative destruction in the country's corporate culture and to bring in outside voices. Unsurprisingly, this led to Japan's corporate Uniform ROA rising to 20-year highs in 2018 and 2019.

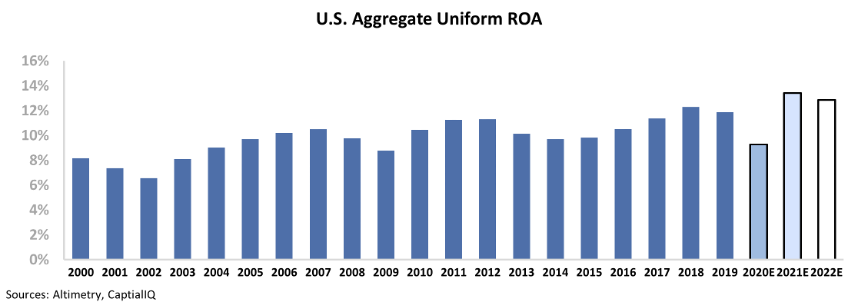

Here in the U.S., those cultural issues aren't a problem... and corporate profitability shows it. Our corporate average for ROA are roughly four times higher than Japan's average. Even more important, profitability levels have been steadily rising.

As you can see in the chart below, aggregate ROA was as low as 7% at the beginning of the century and has since moved to 12% in 2019...

It's easy to see rising debt levels and falling recovery rates and sound the alarm. However, a closer look using Uniform Accounting shows that there are major differences between Japan during its lost decade and the U.S. today.

American firms have sustained large and improving profitability. Worries regarding the increased reliance on debt financing are valid... but the concern of a financial zombie apocalypse is overblown.

Regards,

Joel Litman

October 26, 2020

Have you seen any specific signs that have you concerned about the risk of a "lost decade" for the U.S., or other longer-term trends that have you concerned about the country? Let us know at [email protected], and we might dive into the topics in a future Altimetry Daily Authority.

An ideal capitalist system creates losers and winners from market forces...

An ideal capitalist system creates losers and winners from market forces...