Walmart (WMT) is squeezing its suppliers like never before...

Walmart (WMT) is squeezing its suppliers like never before...

President Donald Trump's tariff announcements have put the retail giant in a tight spot. And now, it's asking Chinese manufacturers to do the impossible...

Walmart has demanded up to 10% in price cuts to offset new import duties. To put it bluntly, manufacturers will either absorb some of these costs or risk being dropped.

Yet most suppliers say they can't afford it... Their margins are already razor thin. Some are shifting to cheaper sources like Vietnam, which may compromise quality. Others say even a 2% price cut would erase their profits.

Now, Walmart wants to keep its prices low. But with vendors pushing back, the pressure may soon hit the company's bottom line.

Today, we'll show why Walmart is caught in a financial squeeze with no easy way out... and why investors should be wary of the market's optimism.

The old low-price model doesn't work like it used to...

The old low-price model doesn't work like it used to...

Walmart has spent decades perfecting its global sourcing and manufacturing at the largest-possible scale. That's why it offers the lowest prices in the retail industry.

This model thrived in a world of cheap labor and smooth trade relations. But times have changed...

Tariffs are back. Supply chains are under stress. And consumer behavior is shifting fast. Walmart CEO Doug McMillon also noted that shoppers are trading down – buying less as money runs out at month's end.

In other words, Walmart's customer base is strained. And this is limiting the company's pricing power. Unlike Target (TGT) and Best Buy (BBY), which are warning customers about price hikes, Walmart is trying to hold the line.

But the cost has to land somewhere. And with suppliers pushing back hard, that cost is starting to boomerang back to Walmart.

Despite these concerns, the market still has high hopes for the low-margin business...

Despite these concerns, the market still has high hopes for the low-margin business...

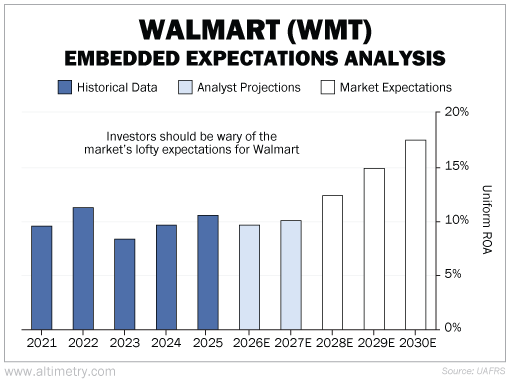

We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, that tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Historically, Walmart's Uniform return on assets ("ROA") has hovered around 10% – near the 12% corporate average.

Analysts expect that trend to continue... with a slight retreat below the 2025 level (10.6%) in the next two years. However, the market sees the retailer's Uniform ROA jumping to about 17% by 2030.

Take a look...

Simply put, the market expects Walmart's profitability to climb to new all-time highs.

That's a big ask for a retailer that already operates on thin margins. And as cost pressures rise and pricing flexibility declines...

The gap between expectations and reality could widen...

The gap between expectations and reality could widen...

Walmart has earned its reputation as a top performer. In tough times, consumers flock to its low prices. But today's trade war is creating a new kind of challenge.

There's little room left to cut supplier costs – and even less room to raise prices. So, in reality, Walmart is boxed in.

Yet investors continue pursuing this stock... Market expectations are sky-high while Walmart battles volatility and softening consumer demand.

That means it could easily fall short of what the market is pricing in.

Walmart hasn't reached crisis mode yet, but the warning signs are flashing. And for investors chasing stability, this may be the wrong time to expect perfection... even from a recession-proof juggernaut.

Regards,

Joel Litman

April 10, 2025

P.S. My April Master Class session is all about how companies' strategic plans, execution, and metrics connect to their true worth. I cover some secrets of our investing approach... and the link between business strategy and valuation.

Armed with this knowledge, you'll be able to see through the "noise" in the market. And you can focus on what truly drives stock prices over time.

More than 1,000 people tuned in for my previous Master Class lessons. I'm convinced this could be one of my most valuable topics yet. Learn how to access my most recent session – and every lesson we've covered so far – right here.

Walmart (WMT) is squeezing its suppliers like never before...

Walmart (WMT) is squeezing its suppliers like never before...