With folks spending so much time at home, they're thinking about homes differently than in the past. They have a different idea of where they want to live, how much square footage they need, and how to go about buying a new place.

The household is no longer just somewhere to sleep and eat. It's now an office or classroom as well. And that means people want larger homes.

With the widespread work-from-home environment, proximity to the office also doesn't matter as much. If folks don't have a commute to their city offices each day, they can move deeper into the suburbs. For those who don't need to go back to the office ever again – like employees of Facebook (FB), Twitter (TWTR), or Square (SQ) – they can go anywhere they want.

Additionally, new innovations around homebuying have been necessary advancements during the pandemic. With in-person events difficult and dangerous, the real estate sector has turned to 3-D home tours and virtual staging. Agents have also used drone footage to give prospective buyers an understanding of a home's footprint.

Even home closings are different. The use of remote notaries has become common for closing out transactions.

All these technologies are powerful in how they smooth out the process. It makes it easier for people to buy and sell.

At this time last year, buying a home without seeing it in person would be hard to comprehend...

At this time last year, buying a home without seeing it in person would be hard to comprehend...

However, it's now becoming more common. And buying it "sight unseen" could bring on some issues. It may be easier for buyers to miss issues with the house before finishing the transaction.

This means homebuyers may need to invest more in new houses than they would have originally believed at signing. And that's before even considering how more people moving from luxury city apartments to larger suburban homes means more home renovations.

That's why anyone who has tried to do a renovation project at home can confirm that the wait for getting a contractor is impressively long. Be it a backlog of labor or of parts – and often, both – lead times are building.

This includes the demand and lead times for premium fixtures new buyers are investing in. These could include things like Delta faucets, Kichler lighting, and premium Hüppe showers.

Masco (MAS) owns all these brands, which means that the company is benefiting from more people investing in their homes.

With such a strong portfolio, it's no surprise that Masco has strong returns...

With such a strong portfolio, it's no surprise that Masco has strong returns...

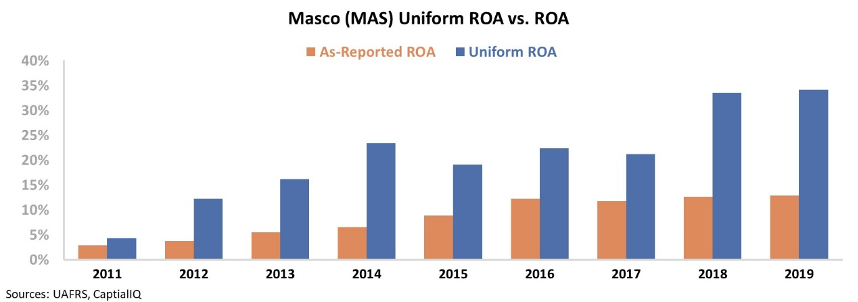

As the chart below shows, Masco has been improving its return on assets ("ROA") since 2011. While as-reported ROA and Uniform ROA have the same trend during this time, only Uniform Accounting shows how dramatic the move has been.

While Masco's as-reported ROA only reached 13% in 2019, its Uniform ROA reached 34%. Distortions in GAAP's treatment of goodwill and intangibles – among other line items – is causing the difference.

With Masco already able to improve profitability prior to the pandemic, investors may be wondering what levels the company could achieve going forward.

To get an idea of what analysts and the market are expecting, we can use our Embedded Expectations framework...

To get an idea of what analysts and the market are expecting, we can use our Embedded Expectations framework...

Most investors determine stock valuations using a discounted cash flow ("DCF") model. This uses future assumptions to produce the "intrinsic value" of the stock.

However, models with garbage-in assumptions based on distorted accounting only come out as garbage. So here at Altimetry, we turn the DCF model on its head. Instead, we use the current stock price to determine what returns the market expects the company to make.

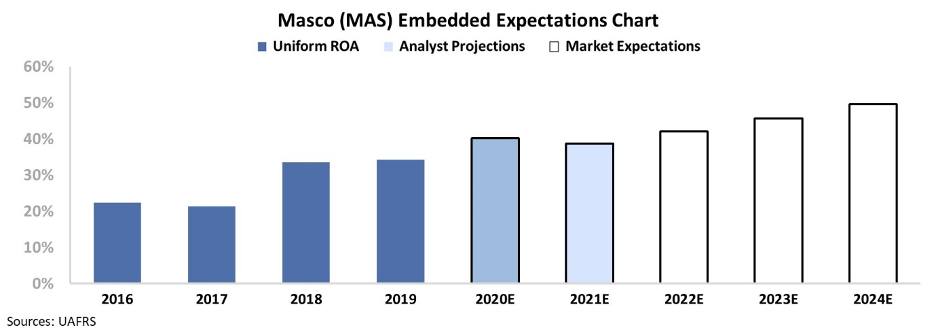

In the chart below, the dark blue bars represent Masco's historical corporate performance levels in terms of ROA. The light blue bars are Wall Street analysts' expectations for the next two years. Finally, the white bars show the market's expectations for how Masco's ROA will shift in the next five years.

As you can see, Wall Street analysts expect Masco's profitability to continue to grow. With the frenzy in the housing market, more people are going to want to personalize their homes. As such, analysts expect Masco's Uniform ROA to reach 40% in 2020 and 39% in 2021.

The market is similarly pricing in this acceleration to continue. By 2024, the market is expecting Masco's Uniform ROA to reach 43%. While this would be the highest profitability level for the company, it's barely higher than what analysts expect for 2020.

With this cycle likely kicking off renovations and other home investments for years after homes close, the tailwinds from the pandemic may last long after 2020. (For example, I know that Altimetry Director of Research Rob Spivey already probably has five years' worth of projects he wants to do to his new cabin up in Maine.)

While investors may wonder about Masco's valuations, our Embedded Expectations analysis shows that a four-year runway to improve Uniform ROA by a couple percentage points and meet those expectations doesn't look out of the question.

Regards,

Joel Litman

January 13, 2021

As we

As we