Goldman Sachs (GS) is playing catch-up...

Goldman Sachs (GS) is playing catch-up...

The investment bank's CEO, David Solomon, recently admitted to partners in a private meeting that Goldman should have been more aggressive in cutting back last year.

He said that dealmaking activity and the economy are already slowing due to higher interest rates. In January, the bank joined many others in laying off personnel due to those declines. It's cutting 3,200 employees... or 6.5% of its head count.

That's far more than investment bank Morgan Stanley (MS), which cut 1,600 jobs at the beginning of December. The layoffs comprised about 2% of Morgan Stanley's global workforce.

And it easily outstrips BlackRock (BLK), the biggest asset manager in the world, which cut 500 jobs (less than 3% of its workforce) in January.

All told, banks have cut more than 15,000 jobs so far. Goldman's 3,200-person layoff is one of the biggest yet. It's also one of the largest layoffs in Goldman's history. Solomon admitted that the bank shouldn't have waited until early this year for the job cuts.

But investors haven't batted an eye. Goldman's stock is up 5% to start the year. It's barely down since the start of 2022.

Today, we'll look at why investors haven't budged on the storied investment bank... despite its massive layoffs and recent stumbling blocks.

Goldman has made a series of unexpected decisions...

Goldman has made a series of unexpected decisions...

Even before dealmaking activity slowed down last year, investors were puzzled by its growth into the consumer business.

Many of the bank's peers have paired up with consumer banks, like JPMorgan combining with Chase, and Merrill Lynch folding into Bank of America. But Goldman had long been focused on commercial banking... until more recently.

Back in 2016, Goldman launched online-banking platform Marcus. Since then, it has made a series of investments to draw in more customers...

The bank introduced the Apple (AAPL) card in 2019. Created alongside the well-known tech giant, the card is intended to be used mainly with Apple devices. In 2022, Goldman acquired a "buy now, pay later" provider called GreenSky to grow faster.

Considering the recent layoff announcement, it doesn't seem like these consumer-focused investments have done much for the business.

Investors have been skeptical about Goldman's consumer business for a while. The Federal Reserve has been reviewing Marcus since late last year to make sure it's properly protecting consumers.

As we discussed, though, the consumer business shows real promise...

As we discussed, though, the consumer business shows real promise...

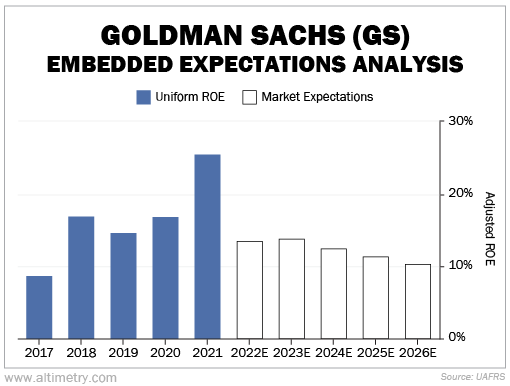

Since launching Marcus, Goldman's Uniform return on equity ("ROE") has gotten a lot stronger. In the past five years, its Uniform ROE expanded from 9% to 26%.

But the market seems to be punishing Goldman for its consumer division. We can see this through our Embedded Expectations Analysis ("EEA") framework.

The EEA starts by looking at a company's current stock price. From there, we can calculate what the market expects from the company's future cash flows. We then compare that with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to be worth what the market is paying for it today.

Right now, the market expects Goldman's Uniform ROE to fade to just 10% by 2026. It hasn't been that low since 2017, soon after the bank launched Marcus.

Take a look...

Funny enough, investors' low expectations are the reason Goldman has held up so well lately. The market was already prepared for a serious fade in profitability. So news of the layoffs wasn't much of a surprise.

The business is already having a tough time in today's environment. It may get even worse during a recession. But performance isn't the only thing that matters...

Goldman doesn't have much downside risk due to the market's seriously low expectations.

The past few years have proven the long-term potential of Goldman's consumer business. But investors aren't paying attention. They think it's on a one-way trip lower.

As far as banks go, Goldman is cheap today. It could be one to watch once the economy starts to improve.

Regards,

Rob Spivey

February 23, 2023

Goldman Sachs (GS) is playing catch-up...

Goldman Sachs (GS) is playing catch-up...