Even one of the most well respected firms on Wall Street can't dodge the 'At-Home Revolution'...

Even one of the most well respected firms on Wall Street can't dodge the 'At-Home Revolution'...

As we discussed last month, the commercial real estate ("CRE") market is one of the prime targets for disruption by the massive societal shift we're seeing in the wake of the coronavirus pandemic.

Many people are realizing that working from home doesn't have to mean lower productivity, and it can mean more satisfied workers.

Of course, some folks are sick of working at home and want to get back in the office. However, even when things return to a more normal world post-pandemic, it's clear that many businesses will grant employees more flexibility on working from home versus in the office. And that means companies won't need the office space they used to have.

That means higher vacancies... which means less cash flow for companies that control CRE assets. And that could lead to potential defaults on commercial real estate debt.

And one of the largest players in the CRE market just showed signs of those cracks developing...

Most people think of Blackstone (BX) as one of the most respected and powerful private-equity investors in the world. But in reality, significantly more of Blackstone's revenue and profits come from its real estate investments than its private-equity business.

For now, anyways... While the asset mix may not change anytime soon, the profitability of the CRE business might. Earlier this month, news broke that Blackstone is shuttering one of its real estate income funds that held significant commercial mortgage-backed securities ("CMBS") with leverage.

For anyone who remembers the first Bear Stearns fund related to residential mortgage backed securities going down in early 2008, it might feel like a similar "canary in the coal mine" situation.

The fund was down 24% in March alone as markets collapsed. CMBS delinquencies have risen steadily in May and June – thanks to retailers, offices, and hotels being shuttered. As such, Blackstone felt an "orderly wind down" was the right decision to help preserve investors' capital.

It may be the right move for the fund... And it's also a potential harbinger for problems to come for the CRE market.

When you really get to the point, there are two ways for a company to make more money...

When you really get to the point, there are two ways for a company to make more money...

The first is to sell additional products to the same people, which is often termed "wallet share."

A classic example of this is the strength of Apple's (AAPL) "ecosystem." The tech giant started by selling the iPod. Then it introduced the iPhone and convinced those same people who purchased the iPod to buy the iPhone. Then came the iPad, Apple Watch, and Apple TV.

Thanks to Apple's ecosystem, once people bought one product, they'd often want the others. Apple took more of their discretionary spending, thus taking wallet share.

The other option to make more cash is to sell products or services to more people. A company would do this by entering a new market and increasing its total addressable market ("TAM").

E-commerce titan Amazon (AMZN) is a great example of a company being able to grow its TAM. Over the past 30 years, Amazon has gone from being an online bookstore, to an e-commerce business, to a cloud powerhouse.

Not only did it sell more things to the same people by moving from a bookstore to an e-commerce business, but also plenty of people who don't buy books instead buy all the other things Amazon now sells. And the company's cloud business is focused on the enterprise market instead of the consumer market... It's a brand-new marketplace.

It takes a focused strategy for a company to grow its market size, and growing wallet share often requires a massive investment in both successful innovation and marketing.

In the cable market, it's even harder for a firm to successfully pursue these two strategies.

In this sector, cable companies grow wallet share by selling more products to the current installed customer base. If a company sells a cable bundler, it seeks to upsell users to a bigger cable bundler... broadband Internet... or even a "triple play" with "Voice over Internet Protocol" phones.

Cable companies improve their TAM by laying wires to get in front of more homes – a metric known as "home passed." This is extremely costly, as laying wires requires a significant capital investment.

For most cable providers, they've reached saturation across both of these strategies. That's why companies like Comcast (CMCSA) have also moved into buying media content like NBC.

One company that has seen massive growth through both of these strategies is Charter Communications (CHTR).

Charter has been able to increase its wallet share by offering customers bundled Wi-Fi, cable, and telephone services. It has also been able to increase the amount of homes passed... By leveraging its Spectrum brand and acquisitions, Charter has 52 million U.S. homes passed.

Impressively, Charter has continued to execute on driving growth even during the pandemic. Like many of the companies exposed to the At-Home Revolution, Charter has benefitted from people forced to spend more time at home than they ever have before. Folks are now expected to learn, work, and stream more from home.

Charter's ability to improve wallet share and TAM so rapidly has made the company wildly popular on Wall Street. Over the past five years, CHTR shares jumped from $200 to more than $550.

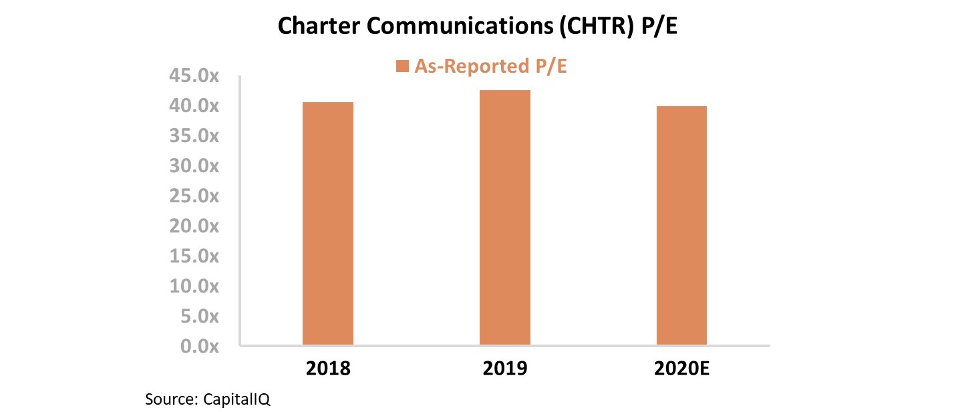

However, after this massive gain, the company is trading at a price-to-earnings (P/E) ratio of 39 – nearly twice corporate averages of 20 times. Since Charter is trading at such a huge premium, some investors wonder if the company has run too far.

It's rare for any company to trade at a P/E ratio this much greater than corporate averages. For a company in a staid, finite industry like the cable business, this puts up immediate red flags for valuation-focused investors.

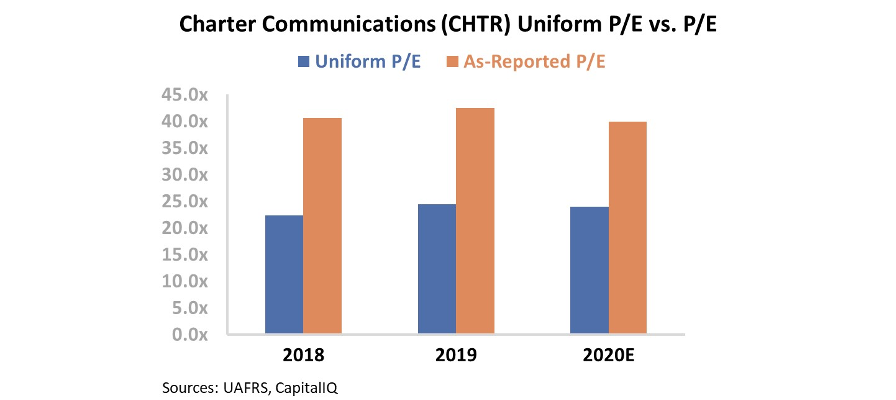

But the as-reported numbers aren't showing the complete picture. Due to the warping nature of GAAP accounting, the reality for Charter is vastly different. Large distortions in interest expense and amortization expense – among other accounting "noise" – are misrepresenting Charter's true earnings and making the company look much more expensive than it actually is.

In reality, Charter trades at a Uniform P/E ratio of 24, which is only a slight premium to the market. Take a look...

Charter has done an excellent job in growing its customer relationships faster than most of its competitors, growing at 5% last year. With that context, a slight premium to market-average P/E ratios is warranted.

Those investors who have written off Charter for valuation concerns (or even sold shares short), are likely to be disappointed. The Uniform metrics show that if the company can continue to deliver on growth, it has continued potential for stock appreciation going forward.

Regards,

Joel Litman

July 23, 2020

Even one of the most well respected firms on Wall Street can't dodge the 'At-Home Revolution'...

Even one of the most well respected firms on Wall Street can't dodge the 'At-Home Revolution'...