The coronavirus pandemic has altered nearly every industry...

The coronavirus pandemic has altered nearly every industry...

The sports industry is certainly no exception. Professional leagues suspended games for months, and fans still aren't allowed in most stadiums... both in the U.S. and internationally.

But as market-research firm PitchBook explained in late July, this financial pressure might be providing private-equity ("PE") investors with an opportunity to invest in sports teams across the globe. This move isn't a surprise, as PE firms have been seeking to invest in professional sports assets for a long time. Few folks are better at seeing through short-term disruptions to find the "trophy assets" hidden underneath.

As such, given the sports industry's financial hardships, many leagues need the influx of money that PE offers. The deal value of PE in sports has already increased massively over the past decade... and the current crisis may speed up the process.

One company with an interesting strategy for this is RedBall Acquisition Corp. The firm is a special-purpose acquisition company ("SPAC"). Also known as "blank-check companies," SPACs have become increasingly popular in recent years. They're essentially shell firms with few or no operations, and their sole purpose is to acquire or merge with another company and take it public without the headache of a traditional initial public offering ("IPO").

Last month, RedBall held its IPO and raised more than $500 million. This opens up a two-year window for the company and its co-chairman – famed baseball general manager Billy Beane – to find a professional sports franchise to acquire.

While Major League Baseball and Major League Soccer recently announced they will allow PE investors to own teams, RedBall will likely look internationally. Europe has many popular soccer leagues, each with roughly 20 teams – giving RedBall many options to consider.

It won't be easy, and the clock is already ticking... but given the hardships sports have faced recently, RedBall likely has a strong chance of finding a team to buy.

However, SPACs aren't only investing in sports leagues...

However, SPACs aren't only investing in sports leagues...

Interest in SPACs has been surging – and is likely to continue – as this is an efficient way for companies to go public.

However, not all SPACs – both before and after bringing a private company to the public markets – are great investments. Knowing how to find the right ones requires a lot of research.

But for investors looking to get in on the ground floor of SPAC investing, we have good news...

Next Thursday, October 8, our friends at Empire Financial Research are hosting an event called the SPAC Investment Summit.

During this world premier online event, you'll learn everything need to know about making money in SPACs. You'll even hear from investing legend Bill Ackman, who launched his own SPAC earlier this year.

To learn more about the ins and outs of these uncharted waters – and how to find the SPACs that look the most compelling based on what they're investing in – save your seat for the event right here.

Here in the U.S., one trophy asset out of reach for the RedBall SPAC is the New York Knicks...

Here in the U.S., one trophy asset out of reach for the RedBall SPAC is the New York Knicks...

Over the years, many deep-pocketed investors have tried to get their hands on the famed basketball team... but all have been unsuccessful.

James Dolan currently oversees day-to-day operations for the Knicks and hockey's New York Rangers. These two teams call the largest city in the country home and have plentiful capital to leverage, and yet have performed poorly for extended periods of time. Dolan has been accused of running the Knicks and the Rangers into the ground by both impassioned fans and sports pundits.

(Full disclosure, as most of our U.S.-based employees' allegiance lies with either Boston or Philadelphia sports franchises... they aren't complaining. I proudly wear both the Eagles' Kelly green and Red Sox colors, depending on the season.)

The Dolan family controls the Knicks, Rangers, and other smaller teams through Madison Square Garden Sports (MSGS). Despite holding roughly 21% of the company's equity, the family owns the majority of voting shares. This makes a potential sale highly improbable, as the family has made its interest in retaining ownership clear.

Today, Madison Square Garden Sports has a market cap of nearly $4 billion. According to some estimates, the Knicks could be worth $4.6 billion on the open market... and the Rangers $1.7 billion.

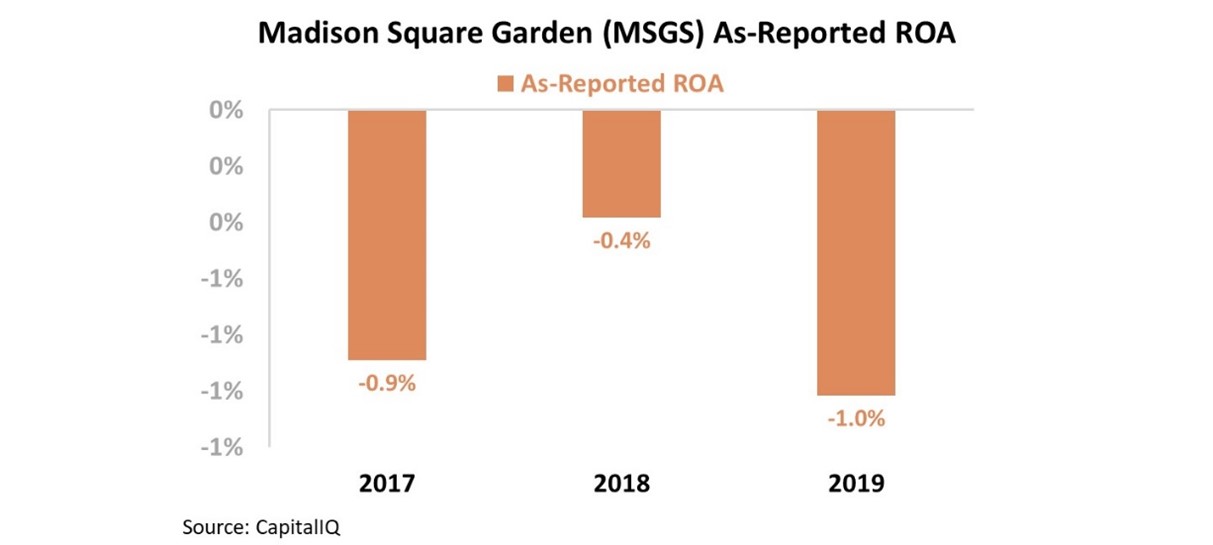

However, these estimates come into question when looking at Madison Square Garden Sports' financial metrics. Since 2013, the company's as-reported return on assets ("ROA") has never been above cost-of-capital levels, or even positive.

Perhaps investors shouldn't be in such a rush to pay up for these assets...

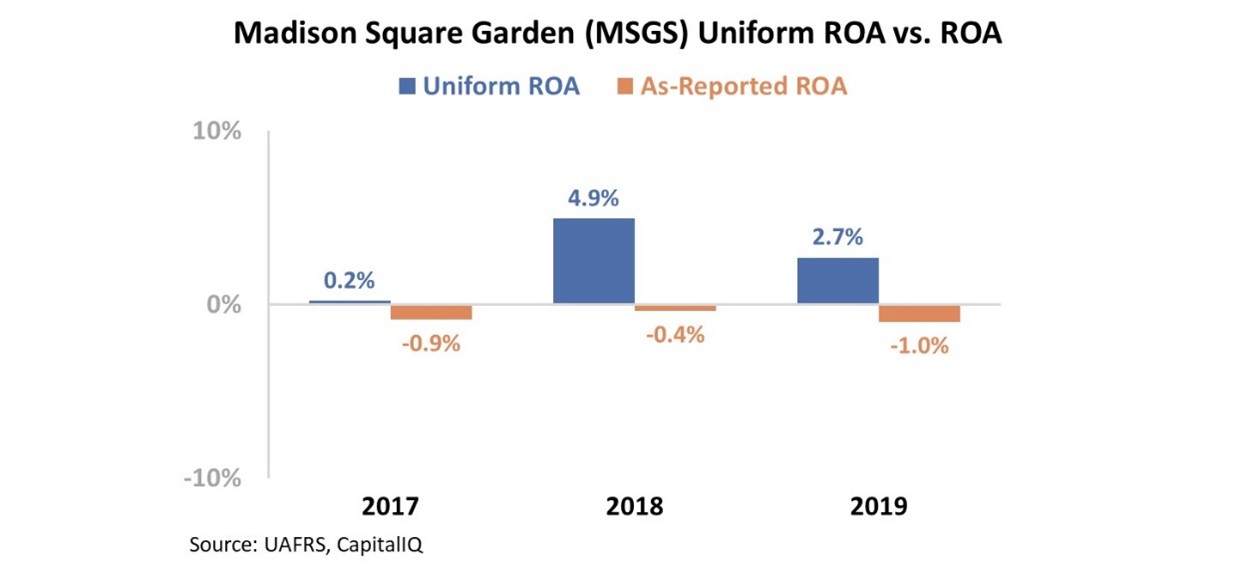

However, investors looking at those numbers are being as misled as anyone who gets excited when the next washed-up general manager or coaching candidate comes to a Dolan-hosted press conference to fix the Knicks.

Through Uniform Accounting, we can remove misrepresentations around stock option expense, as well as other distortions. Once we make these adjustments, we can see that Madison Square Garden Sports has realized a positive ROA over the past two years. Take a look...

Despite the Knicks' and Rangers' poor performance in recent years, Madison Square Garden Sports owns valuable assets and possesses an economic moat given its geographic location and installed base of fans. This allows the Knicks and Rangers to charge high prices for tickets and receive lucrative TV contracts, even if the teams are currently underperforming... and this has led to returns significantly better than the as-reported metrics would have investors believe.

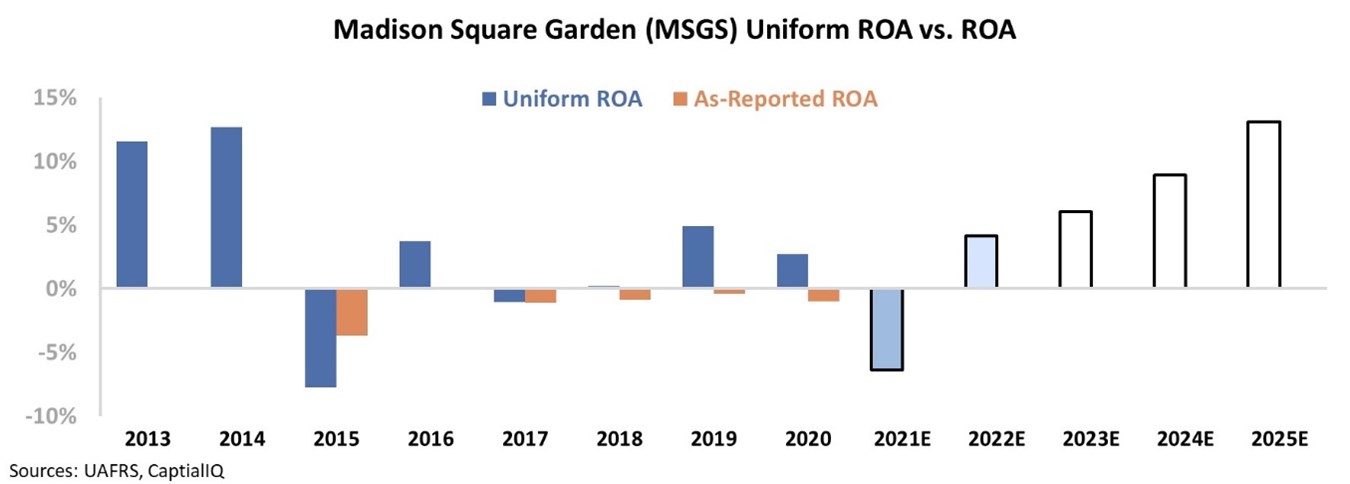

Even with the stronger Uniform Accounting financial results, Madison Square Garden Sports will have to continue improving to justify its current share price. To understand market valuations further, we can use the Embedded Expectations Framework.

The chart below explains the company's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

Considering the ongoing pandemic, Madison Square Garden Sports' performance will certainly suffer this year. However, Wall Street analysts see the company's Uniform ROA rebounding back to positive levels next year. Then, the market is expecting the firm to continue improving returns to the all-time highs it reached in 2012 and 2013. These years were a brief and pleasant surprise for the two New York teams – both made the playoffs in the earlier part of the decade and were more competitive.

The sports world currently looks bleak in New York. The pandemic will likely keep fans out of the iconic Madison Square Garden venue for the foreseeable future. Furthermore, these two major sports teams haven't performed well in recent years.

As-reported metrics paint a dire picture for not just the teams, but for Madison Square Garden Sports as well. They show a company with negative profitability and few signs of improvement. But Uniform Accounting shows that Madison Square Garden Sports has had more positive results in recent years than as-reported metrics let on. It shows that market expectations for the firm are almost attainable...

However, it appears that Madison Square Garden Sports will need to fix the Knicks and Rangers' performance quickly in order to meet market expectations. The market may be hoping someone will take these trophy assets out of Dolan's hands, so the firm can see better performance. If that doesn't happen, it may be difficult to justify the Madison Square Garden Sports' share price.

Regards,

Rob Spivey

October 2, 2020

The coronavirus pandemic has altered nearly every industry...

The coronavirus pandemic has altered nearly every industry...