Today, it feels like investors aren't sure if the economy is doing well... or if it is teetering on the edge of recession...

Today, it feels like investors aren't sure if the economy is doing well... or if it is teetering on the edge of recession...

On one hand, they seem convinced the major stock indexes – which rebounded to all-time highs at the end of last year – will continue to rally.

On the other hand, they're pricing in six rate cuts by the end of 2024. They expect the Federal Reserve to lower rates from their 22-year high of 5.5% down to around 4%. Of course, an aggressive move like that wouldn't mean the economy is in good condition.

Greg Jensen, co-chief investment officer of hedge-fund heavyweight Bridgewater Associates, recently commented on this setup... saying that something has to give.

At the 2024 World Economic Forum in Davos, Switzerland earlier this month, Jensen noted that the market appears to be pricing in lower inflation and the U.S. avoiding a recession. According to him, "We've got pretty much the perfect scenario priced in, which is both impressive and a concern going forward."

In other words, it's impressive that the market has held up so well... yet it's also concerning because, at today's valuations, there doesn't seem to be much more room for the market to run.

Today, we'll explain why Jensen is exactly right. Investors have gotten ahead of themselves... and they may be running out of reasons to send stock prices higher.

Investors are acting like the worst is already over...

Investors are acting like the worst is already over...

In the middle of last year, economists said the likelihood of the U.S. entering a recession was near 100%.

The labor market and consumer spending had proved resilient. Inflation was still double the Fed's target. And more rate hikes were likely on the way.

However, when we didn't immediately see a recession, investors put those fears behind them... and stocks went on to rally.

Then, in October, war erupted between Israel and Hamas. The conflict initially roiled markets, though stocks were quick to shrug off the volatility. They climbed another 11% to end the year.

Now, investors seem to be pricing in an "all clear"...

As we said earlier, they expect the Fed to cut interest rates six times in 2024. However, we have rarely seen so many rate cuts without the market crashing...

Still, investors continue to send stocks higher. They're forgetting two of the biggest drivers of market valuations: inflation and tax rates.

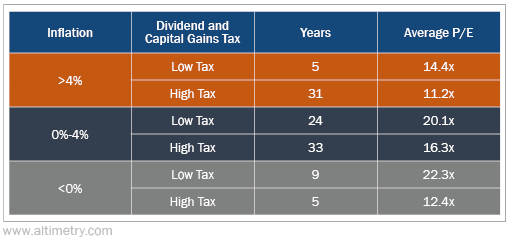

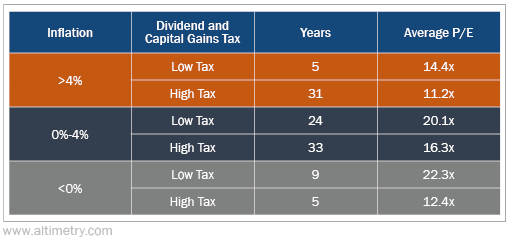

You see, data from the past hundred-plus years shows that there's a strong relationship between inflation, tax rates, and valuations.

When inflation and tax rates are lower, the market tends to trade at higher price-to-earnings (P/E) multiples. (A high P/E ratio means investors are willing to pay more for a company's earnings.)

The chart below shows the market's average P/E ratio under different tax and inflation environments since 1914. It also shows how many years of data we have for each environment.

For instance, since 1914, we've had 24 years where tax rates have been low by historical standards and inflation has been below 4%. And in environments like this, the market has averaged a P/E ratio of around 20.1 times.

Take a look...

Even in environments where tax rates are low and inflation is less than zero, the market's average P/E ratio is still only around 22.3 times. (That's why, generally speaking, we usually say the market average is around 20 times.)

Today, though, the corporate average is 25 times.

Not only is this much higher than what today's average P/E ratio should be, it's one of the highest valuations we've seen in any circumstance.

The market is priced like we'll have continuously low tax rates and head toward near-0% inflation over the next decade...

The market is priced like we'll have continuously low tax rates and head toward near-0% inflation over the next decade...

That's an unlikely scenario.

To Jensen's point, with an average corporate P/E ratio of 25 times, investors expect smooth sailing from here. Those folks are in for a rude awakening...

Geopolitical issues will influence U.S. assets more than folks currently believe. And not only that, U.S. bankruptcies will continue to rise.

Overall, when the market is priced this high, it's tough to find any real value opportunities. Many expensive stocks have nowhere to go but down.

Regards,

Joel Litman

January 29, 2024

Today, it feels like investors aren't sure if the economy is doing well... or if

Today, it feels like investors aren't sure if the economy is doing well... or if