Maybe flooding the venture-capital market with hundreds of billions of dollars wasn't a sound investment strategy...

Maybe flooding the venture-capital market with hundreds of billions of dollars wasn't a sound investment strategy...

Japanese banking giant SoftBank is still facing the repercussions of its irresponsible dropping of helicopter money on the world of venture capital through its Vison Fund.

Last week, the company announced it was seeking $10 billion to prop up businesses in the Vision Fund portfolio that have been impacted by the coronavirus outbreak.

And earlier this week, reports emerged indicating WeWork directors are concerned that SoftBank won't follow through with the deal that it struck when it rescued the company after its initial public offering ("IPO").

Investors haven't had to wait the normal 10-year life of a venture-capital fund to decide whether the Vision Fund's strategy – using huge amounts of money to turbocharge startups and consolidate companies – was successful.

At the time, venture capitalists were concerned about the moral hazard and agency risk that would be created by dropping massive amounts of cash on young firms that didn't know how to scale. With the huge influx of money, these businesses wouldn't be constrained to make smart investments and innovations to create sustainable competitive moats, but instead could try to spend their issues away.

It looks like the naysayers have been proven right... and SoftBank investors have had to pay the consequences.

SoftBank might be better off walking away from some of these portfolio companies – like a normal venture capitalist would – as opposed to chasing bad money with good money. Now, the sunk-cost fallacy SoftBank is facing is more severe, since there's so much more money invested in these companies than what's normal for a venture-capital firm.

Back in February, we covered one of the major U.S. cell tower companies...

Back in February, we covered one of the major U.S. cell tower companies...

As a reminder, the February 18 Altimetry Daily Authority covered Crown Castle (CCI) and its absurdly high valuations.

While the company is the No. 2 cell tower operator in the U.S., it's significantly lagging internationally. In this country, Crown Castle mainly competes with American Tower (AMT)... but American Tower has a much stronger international presence. To date, Crown Castle remains solely focused on the U.S. market, with just a small portfolio of towers in Australia through one of its subsidiaries.

As we said at the time, the late Jack Welch's wisdom has always been to become "No. 1 or No. 2 globally" or get out of the business.

Evidently, Welch's advice appears to be playing out with Crown Castle. It looks like the company has failed to establish a dominant presence, and it's going to lose out on the 5G infrastructure boom as a result.

But the market doesn't realize that yet. Crown Castle is expensive, trading well above market average price-to-earnings (P/E) ratios.

Today, we'll examine the third-biggest cell tower operator in U.S. – which looks poised to potentially take over the No. 2 spot in the future.

SBA Communications (SBAC) may be the third in the industry now, but it has some advantages over Crown Castle...

If you've ever seen an advertisement from a cell service company, you've likely seen a picture of the coverage map, which colorfully fills in most of the continental U.S.

Likewise, if you've ever traveled to a less developed country, you may have noticed spottier service or no option for 4G. But as these countries continue to modernize, not only will they eventually adopt 5G... but they'll have to invest in new towers to reach comparable coverage levels.

This is part of why Welch's advice is so valuable. Our viewpoint can sometimes be skewed by focusing on just the U.S., but thinking globally widens our scope.

And SBA has been doing just that.

The company has invested heavily in buying and building towers in the rest of the Americas beyond the U.S. – including in Canada, Central America, and South America. At this point, more than 25% of SBA's total towers are located in Brazil.

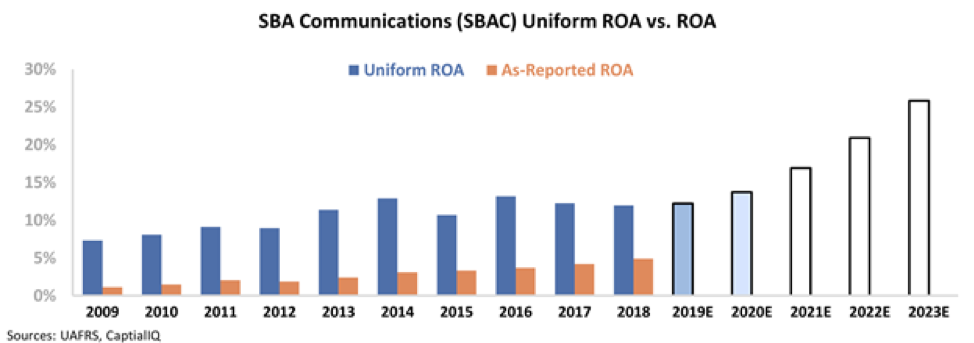

Looking at SBA's financials, it appears this expansion strategy is paying off. Over the past decade, the company's return on assets ("ROA") has expanded consistently – from near zero in 2009 to 5% in 2018...

With this level of expansion, SBA looks poised to be the next American Tower.

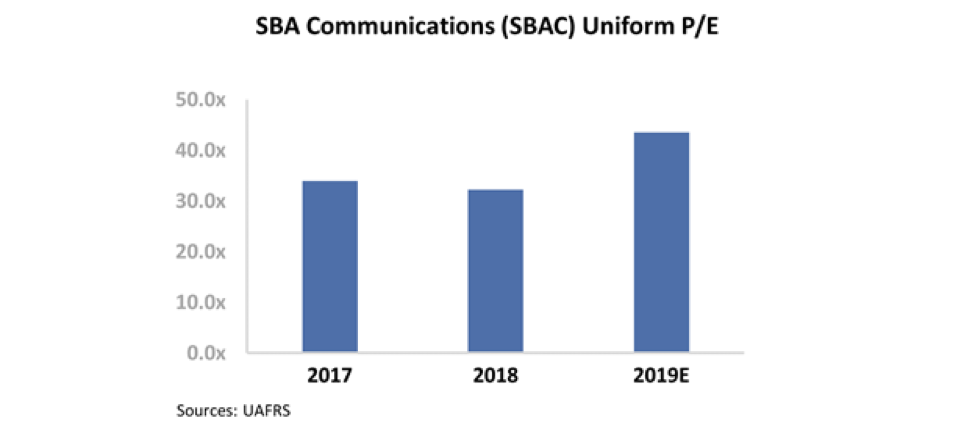

And investors seem to be reacting to this momentum. SBA's Uniform P/E ratio is well above market average levels – currently around 44 times earnings. Take a look...

This is expensive compared to the market, so investors must be expecting SBA to overtake Crown Castle in terms of global positioning. This in turn would likely continue SBA's ROA expansion, which has already happened consistently over the past decade.

But SBA hasn't been able to do this, despite what the as-reported numbers show...

Once we apply Uniform Accounting metrics, we can see that the company's ROA has actually been roughly flat since 2014...

While its Uniform returns are stronger than the as-reported numbers show, this alone isn't enough to justify SBA's current valuations.

P/E ratios well above market averages indicate expectations for ROA expansion, and SBA's recent performance suggests that the company is having difficulty delivering on this... even as 5G begins rolling out globally.

Furthermore, using Uniform metrics, we can see what ROA levels investors expect from SBA in the future at current valuations.

The chart below highlights SBA's historical corporate performance in terms of Uniform ROA (dark blue bars) versus what sell-side analysts think the company is going to do for full year 2019 and this year (light blue bars) and what the market is pricing in at current valuations (white bars). As you can see, current valuations would require SBA's Uniform ROA to more than double over the next five years...

This is likely the "best case" scenario for SBA, and implies that the deck is stacked against the company if it's unable to execute perfectly.

It's yet another example of as-reported accounting leading to the wrong insights for investors, and for management's strategy.

Regards,

Joel Litman

March 26, 2020

Maybe flooding the venture-capital market with hundreds of billions of dollars wasn't a sound investment strategy...

Maybe flooding the venture-capital market with hundreds of billions of dollars wasn't a sound investment strategy...