Another 'platform' can't stay profitable...

Another 'platform' can't stay profitable...

We've spent a decent amount of time here in Altimetry Daily Authority highlighting the issues with platform businesses that don't make money, like ride-hailing company Uber (UBER) and food-delivery service Grubhub (GRUB).

Just last week, another platform primed for an initial public offering ("IPO") joined the loss-making crew...

Accommodation business Airbnb reported losses of $322 million for its past nine months through September 2019. In the prior year, the company made $200 million in profits, but costs rose significantly in 2019.

These platform businesses claim that gaining scale will allow them to dominate the market and become incredibly profitable. But Airbnb, for instance, is actually competing against an already massive and strong market – hotels and lodging.

Regulatory pressures – sometimes even rivalling those of Uber – limit its opportunity.

This appears to be yet another example of an overhyped platform "unicorn" that's primed to disappoint the market.

Former General Electric (GE) CEO Jack Welch has many famous rules...

Former General Electric (GE) CEO Jack Welch has many famous rules...

When we wrote about the conglomerate back in October, we discussed several of Welch's initiatives that helped "turbocharge" General Electric in the 1980s.

First, Welch introduced stock options as a way to compensate executive managers – a tactic that was fairly new at the time and was successful in aligning upper management with shareholders.

Welch was also a supply chain master in his own right, and he adopted a "Six Sigma" approach for process improvement which dramatically reduced the number of defects in the company's various businesses.

More important, Welch followed a rule to help him decide whether a business was worth keeping and investing in. Within a market, if General Electric wasn't "No. 1 or No. 2 globally," Welch would sell the business.

And a top position has more to do than just scale – Welch focused on factors like financial strength, technology, and growth opportunities.

In other words, the business needed to be a leader in its industry and maintain that leadership position. Otherwise, Welch would sell it... like the more than 71 other businesses he dropped within his first two years as CEO.

Furthermore, Welch was a visionary for looking outside of his own country. Being No. 1 in the U.S. but No. 7 internationally wasn't going to cut it at General Electric. This forced the company to adopt a global mindset, allowing it to compete with rapidly growing Japanese peers.

Welch's tactics aren't just valuable in the world of corporate strategy... Investors ought to follow a similar mindset when looking at stocks.

While we don't exclusively discuss the biggest players in an industry, some of our favorite picks are market leaders or smaller companies that are making a run for the top spot. Meanwhile, we tend to be more cautious about businesses that look like they're running out of steam.

Also in October, we wrote about an industry with a lot to gain from the 5G revolution... We discussed cell tower company American Tower (AMT) and its leadership position in the industry.

Although as-reported financials made the company look just average, Uniform Accounting metrics showed why American Tower has outperformed the stock market over the past several years.

The whole cell tower industry is poised to benefit from adoption of 5G broadband because wireless companies are forced to rent more tower space to cover the same amount of land.

That said, Welch's rule still applies if you're looking to make an investment...

So today, let's look at the current No. 2 U.S. cell tower company: Crown Castle (CCI).

In terms of size, American Tower and Crown Castle are neck and neck. As of January 23, American Tower owned 40,586 towers, while Crown Castle owned 40,039. The next closest, SBA Communications (SBAC), owns just 14,873.

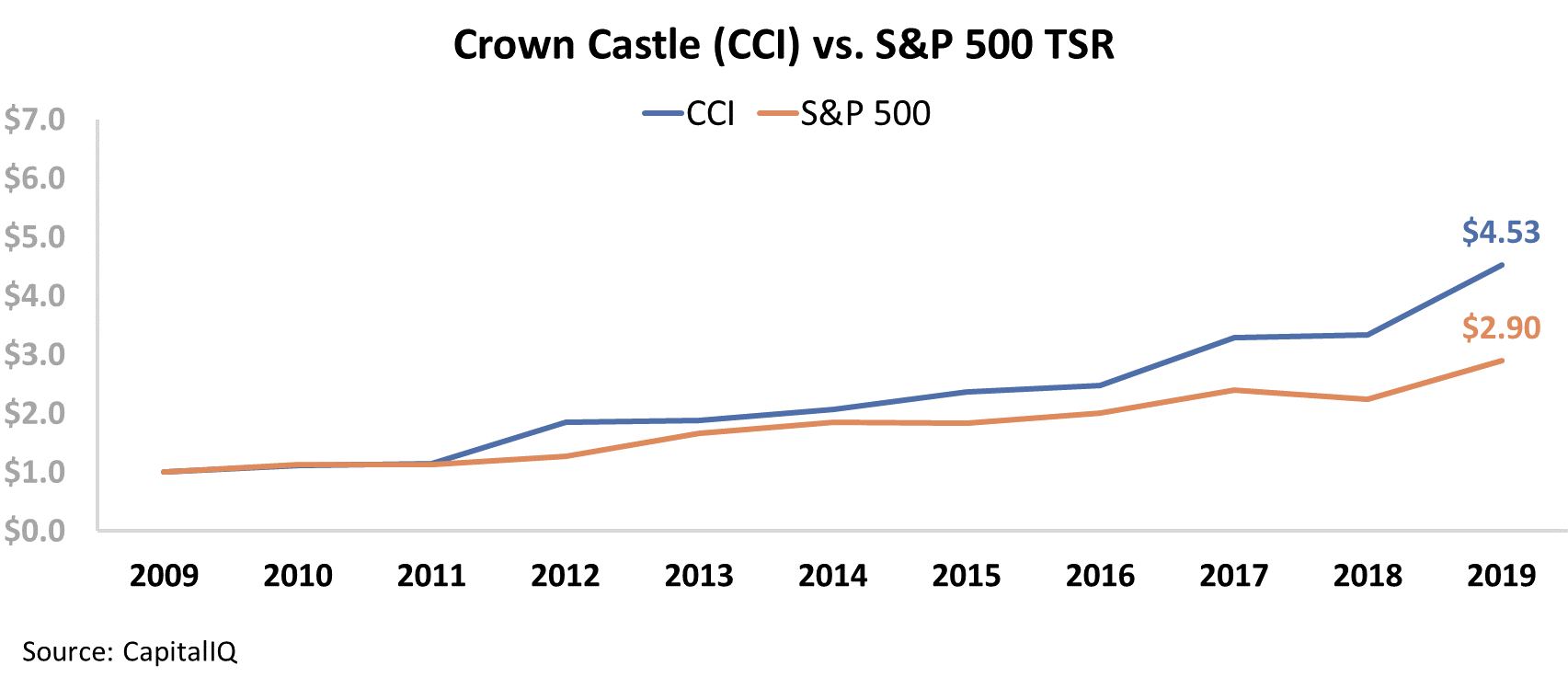

Unsurprisingly, Crown Castle has performed almost as well as American Tower since the Great Recession. While $1 invested in the S&P 500 Index in 2009 would have grown into $2.90 by the end of 2019, that same dollar would be worth $4.53 when invested into Crown Castle. The chart below shows the total shareholder returns ("TSRs"). Take a look...

However, investors may be expecting too much out of Crown Castle. As we mentioned, Crown Castle and American Tower are easily the top two tower companies in the U.S. But when you think like Jack Welch and start looking at the global market, Crown Castle doesn't look nearly as promising...

American Tower operates more than 170,000 cell towers internationally – more than four times its total in the U.S. Crown Castle, on the other hand, still only operates about 40,000... The company has failed to expand outside of the country.

Furthermore, several international competitors exist with higher growth and more total towers than Crown Castle. And at current stock prices, valuations have gotten quite high for the company.

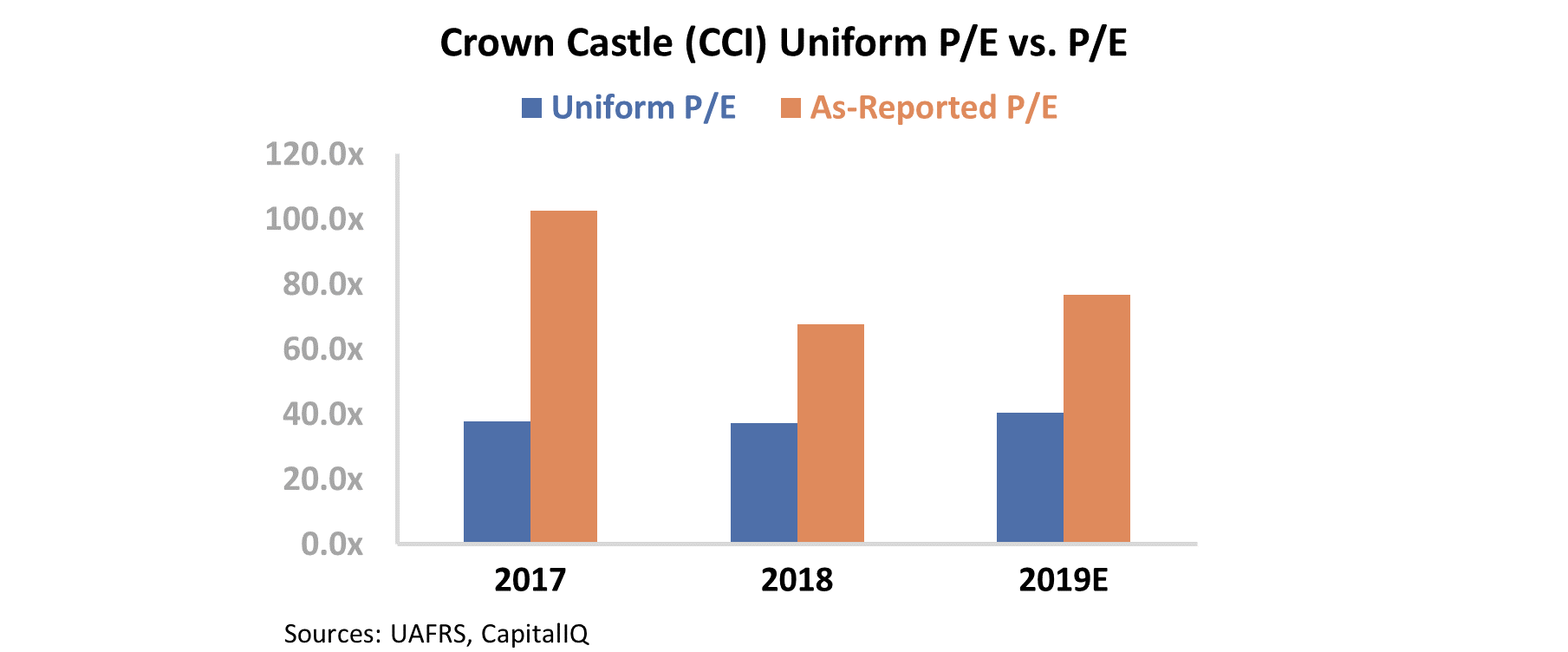

On both an as-reported and a Uniform basis, Crown Castle is trading well above corporate averages when looking at its price-to-earnings (P/E) ratio. Its current P/E ratio is 40, which is well above average levels near 20. This indicates investors have bullish expectations for Crown Castle.

We can see these expectations even more clearly, when looking at the company's profitability...

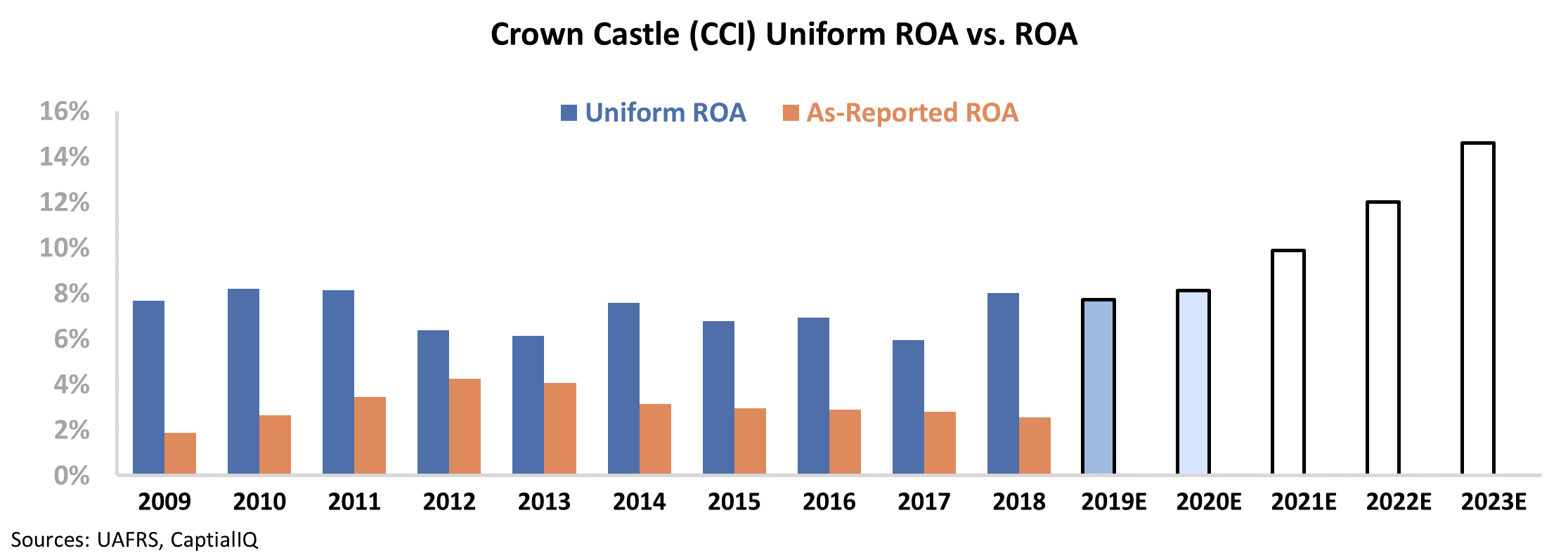

After making the proper Uniform Accounting adjustments for Crown Castle – adjusting for inconsistencies in as-reported metrics like the treatment of goodwill, capitalizing versus expensing operating leases, and the impact of special items – we can see the company's real returns.

The chart below shows Crown Castle's historical corporate performance levels in terms of return on assets ("ROA") (dark blue bars) versus what sell-side analysts think the company is going to do for full year 2019 and this year (light blue bars) and what the market is pricing in at current valuations (white bars).

Despite Crown Castle's Uniform ROA being stronger than its as-reported ROA, we can see that returns have been largely flat over the last decade. Furthermore, at current stock prices, investors expect the company's ROA to double from current levels...

While this may be possible for a company like American Tower – which has been growing internationally and maintaining its global leadership position – Crown Castle is unlikely to keep up.

While it's a start to follow the rules of one of the best businessmen of all time, without the Uniform Accounting metrics, it's impossible to turn those rules into an investment strategy.

Regards,

Joel Litman

February 18, 2020

Another 'platform' can't stay profitable...

Another 'platform' can't stay profitable...