We're not the only ones who are still bullish on this market...

We're not the only ones who are still bullish on this market...

Regular Altimetry Daily Authority readers know all the macro data we look at is telling us to stay optimistic about the market. And we're not alone...

Our friend Dr. Steve Sjuggerud over at our corporate affiliate Stansberry Research is hosting a free online event next Wednesday... and when Steve speaks, we listen. He knows what he's talking about – especially when it comes to his market outlook.

Steve has consistently nailed calls on this bull market all the way back to 2013. And next Wednesday, February 12, he's updating his outlook. We'll be tuning in, and we highly recommend you do so as well.

Steve won't just be talking about his market outlook and why you should still be bullish... he'll also tell attendees about one of his favorite stocks for 2020 – and you can only hear it if you attend the event. Steve will also discuss his outlook on the FAANG stocks and what his favorite sector is for 2020.

We like to hear Steve's analysis because his research process is very different from how we look at things here at Altimetry... and yet we consistently seem to line up with his thinking. If you like what we're doing here, you can't afford to miss this event.

It's free to attend, but you must register in advance – save your spot right here.

One company has delivered food for much longer than AmazonFresh has...

One company has delivered food for much longer than AmazonFresh has...

It has been delivering frozen food directly to homes since 1952 when Marvin Schwan first packed his 1946 Dodge panel van with homemade ice cream.

Schwan was trying to figure out how to generate more revenue for his farm, Schwan's Dairy of Marshall, Minnesota. So he got in his panel van and started to deliver ice cream across the area.

It was an immediate success... and Schwan quickly had to scale his business.

First, he upgraded from a passenger vehicle to a refrigerated van. Next, he opened additional distribution centers so the operation could expand further.

After the first 10 years, Schwan's Dairy was no longer just a dairy company – it was delivering a variety of frozen foods to eight midwestern states.

This growth was great news for me – growing up outside Utica in upstate New York, the family of a friend of mine used to get Schwan's ice cream delivered every week. His family was nice enough to invite me for dinner each time they restocked.

Schwan didn't stop there, either. Today, the company generates over $3 billion in annual sales of frozen food. Because it was an early adopter to food delivery, Schwan reached a level of scale it never would have otherwise.

This scale allowed the company to expand into new products like pizza, which it sold to primary schools and grocery stores under the Red Baron brand.

Because the company cleverly scaled in a way not many companies started doing until recently, it gained many customers for life – including my friend's family.

In the days before e-commerce, these types of product home-delivery services used to have the opposite feel. What's now a matter of convenience used to be a way for companies to interact more personally with their customers.

In addition to helping companies grow, it was exciting to receive that weekly care package. Home delivery built a lot of goodwill with Schwan customers.

Schwan's isn't alone with this business model... and another company's decision to follow this strategy is still paying dividends today.

Snap-on (SNA) was created a century ago with the goal of simplifying tools. Its early tagline was "five do the work of fifty," thanks to its patented system of interchangeable sockets and handles.

The company was wildly successful early on, and it quickly became a trusted supplier for the U.S. government. As World War II heated up, Snap-on grew significantly to support America's industrial needs.

After the war, the company had to look to new strategies to drive growth. Similar to Schwan's strategy, Snap-on built a fleet of trucks to visit mechanics and other customers on a weekly basis.

Not only was this convenient for customers, but it created recurring selling opportunities and stronger bonds than a traditional brick-and-mortar store would.

To this day, Snap-on still sends its dealer vans to customers on a weekly basis – you might notice one the next time you're on the road.

But with the rise of other delivery services, investors don't seem keen on the value of Snap-on's sales model.

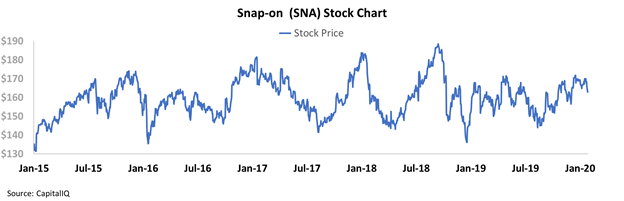

Over the past five years, the company's stock has been largely range-bound, never able to maintain its gains. It's up only 23% since early 2015.

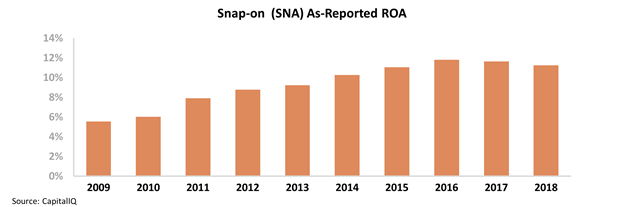

This lackluster stock performance isn't entirely a surprise given the company's recent returns. Coming out of the Great Recession, Snap-on's return on assets ("ROA") has only recovered from 6% to a peak of 11% in 2016. With corporate average ROA at 10%, it appears Snap-on is just an average company.

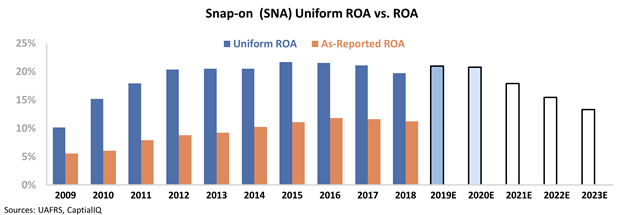

However, as-reported ROA fails to capture how much Snap-on has actually recovered since the recession.

Once we apply Uniform Accounting – adjusting for misleading figures like the treatment of goodwill, non-operating investments, and removing the company's financial subsidiary – we can see that investors may be missing the real story...

The chart below highlights the company's historical performance in terms of ROA (dark blue bars), Wall Street analyst expectations for full-year 2019 and 2020 (light blue bars), and what investors expect the company to do at current stock prices (white bars).

As you can see, Snap-on has recovered to a 20% ROA – double corporate averages. Additionally, investors currently expect to see the company's ROA fade back to just 13% over the next several years to levels not seen since Snap-on was recovering from the recession...

This appears overly bearish, considering that Snap-on has continued executing on the same principles that made it successful in the first place.

Clearly, investors can't see the value of a "personalized delivery" sales model with the spread of competitors like Amazon (AMZN)... But Uniform Accounting has the ability to see through this noise, give better signals, and see the real story for Snap-on.

Regards,

Rob Spivey

February 4, 2020

We're not the only ones who are still bullish on this market...

We're not the only ones who are still bullish on this market...