All anyone wants to discuss is the debt ceiling...

All anyone wants to discuss is the debt ceiling...

If you've been reading the news recently, you've likely noticed a trend. It seems like almost every story is focused around the U.S.'s huge amount of debt.

Naturally, everyone feels the need to insert their 2 cents into the argument. And with so much commentary, what's going on might seem confusing.

In reality, the story is simple. The U.S. has to raise its debt ceiling in order to pay for bills it already agreed on (it's not about future spending). Congress is using this as an opportunity to discuss the government's accounting responsibility... and to score political points.

The country has run at a deficit for more than a decade. The U.S.'s total public debt has exceeded its gross domestic product ("GDP") since the end of 2012. Debt is now 20% greater than GDP.

Congressional Republicans are focusing on how we can cut costs. The Democrats, including President Joe Biden, want to talk about how we can increase revenue (raise taxes).

And the entire debate has turned into a classic game of chicken.

Each side is using the issue to try to get something they want. They'll both make a point of showing the effort they're putting into negotiations... a "good faith" gesture to win over U.S. voters.

Eventually, one side will jump ahead in the public opinion polls. The side that's behind in the polls will cave at the last moment. And the entire process will almost certainly continue until the eleventh hour.

There's an important detail that's being overlooked, though. As we'll explain today, folks should pay attention to what actually drives the country's ability to borrow. The government's balance sheet is in no real danger.

The U.S. is as safe a borrower as ever...

The U.S. is as safe a borrower as ever...

The headline debt-ceiling story is about whether the limit will be increased so the U.S. can borrow more.

However, we also need to discuss the government's ability to pay its current debt obligations. If it can't handle what it owes now, it probably shouldn't raise the borrowing limit.

There's a simple reason not to worry – the U.S. still remains a global superpower.

We're still spending more on research and development (R&D) as a percent of GDP than Europe and China. And that's leading to a consistent stream of innovations in areas like tech and energy. In 2020, U.S. companies had more than three times as many innovation assets on its balance sheets as China.

American businesses are set up to benefit from infrastructure spending as the supply-chain supercycle ramps up. There's plenty of strong demand for goods and services as we emerge from the pandemic.

And the U.S. is home to the largest public market by far. Almost 60% of the world's total equity market value is in the U.S... and the next-closest country is Japan, at 6%.

The U.S. dollar is still the world's reserve currency, despite all the noise about how it won't be for long. Countries have to deal in USD to participate in world markets, which increases our ability to borrow.

I'm not just saying this because I'm bullish on the U.S.'s long-term prospects... which I am.

I'm not just saying this because I'm bullish on the U.S.'s long-term prospects... which I am.

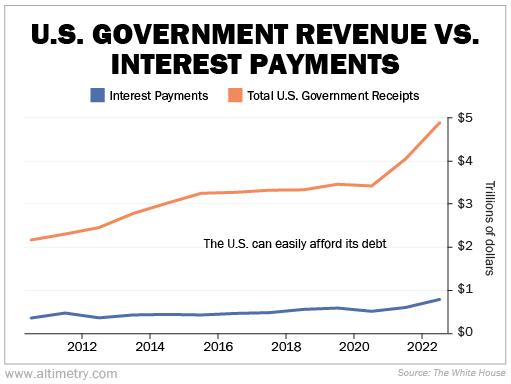

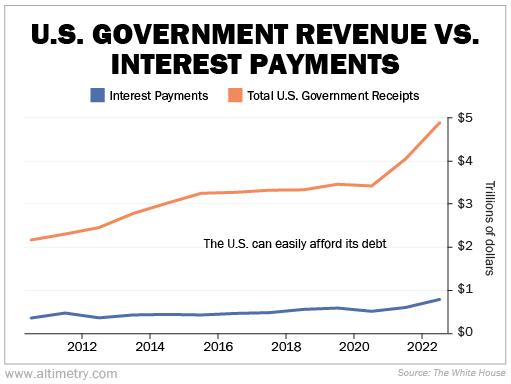

The data backs me up. Take a look at the following chart. It shows U.S. debt and income-like financial statements...

U.S. tax revenue continues to rise. It hit $4.9 trillion in 2022. That makes it much easier for the U.S. to spend less than it collects.

On the expense side, it can easily afford the annual cost of its debt. In 2022, that number was $770 billion. And even if the U.S. did struggle to make its debt payments, it has hundreds of trillions of dollars in assets that it could sell.

There's no reason to think the U.S. will default in the short term. Much of the market's worries are out of place.

We're just a few weeks away from the June 1 debt-ceiling headwall. We've been keeping an eye on negotiations... and we don't see any reason Congress would fail to reach an agreement.

Still, even if that happens, the U.S. balance sheet is healthy. Our place at the top of the global economy isn't going anywhere.

Regards,

Joel Litman

May 22, 2023

All anyone wants to discuss is the debt ceiling...

All anyone wants to discuss is the debt ceiling...