Tesla (TSLA) is hoping to reel in more retail investors...

Tesla (TSLA) is hoping to reel in more retail investors...

The popular electric-vehicle ("EV") manufacturer finalized its 3-for-1 stock split on August 24. The move tripled the number of shares outstanding for the company while cutting individual share prices by one-third.

Stock splitting is a popular way for companies to make their shares look more attractive. Investors are more willing to put their money into cheaper shares.

Tesla joined the likes of Amazon (AMZN) and Google parent company Alphabet (GOOGL), both of which artificially lowered their share prices with stock splits this year.

Amazon's stock was trading for roughly $2,000 per share before its 20-for-1 split in June. It now sits at about $129 per share. And Alphabet sliced its shares from more than $2,200 in July. The stock now trades for about $109 per share.

In Tesla's case, shares were almost $900 before the split. Now, the stock trades for about $284 per share.

Stock splits look great on the surface – but it's all smoke and mirrors...

Stock splits look great on the surface – but it's all smoke and mirrors...

Any savvy investor must understand the mechanics of a stock split. With a split, the total number of shares in existence – called "shares outstanding" – goes up. So in a 3-for-1 split, the company now has triple the original number of shares. And the price per share falls by the same amount.

These two changes cancel out. In other words, the company's market cap remains the same. It has more shares available for purchase. But each of those shares is worth far less than before.

It's like if Tesla founder and CEO Elon Musk buys one pizza to feed eight friends, but 16 people show up... So he cuts each of the slices in half.

Despite lowering share prices and increasing shares outstanding, Tesla's size hasn't changed at all. And so far, the stock hasn't responded to the split.

Musk likely hoped that by lowering the barrier to entry for investors, demand would skyrocket. He's attempting to raise capital to increase production and continue improving profitability.

That's because the market expects a lot from Tesla...

That's because the market expects a lot from Tesla...

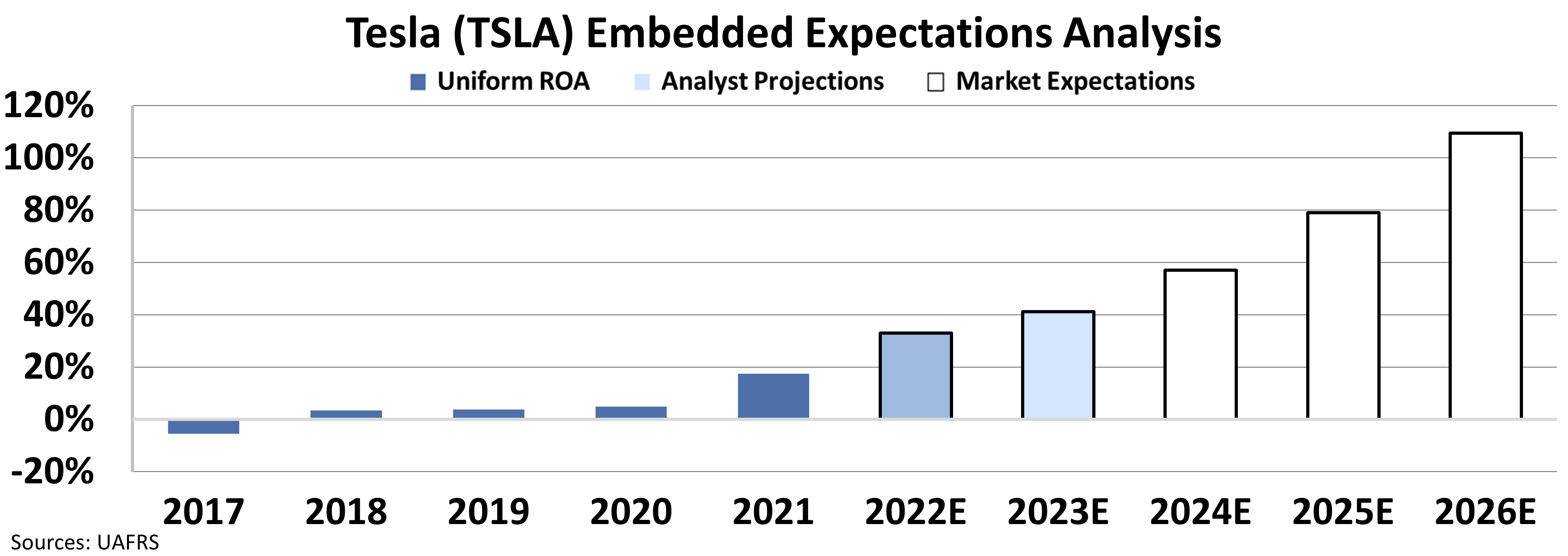

To understand this, we can look at our Embedded Expectations Analysis ("EEA") for Tesla. The EEA framework uses stock prices to determine exactly what the market expects a company to do at the current stock price.

Here's how it looks for Tesla...

Based on the chart above, we can see that the market predicts immense growth for this company. Investors think its return on assets ("ROA") will climb to 113% by 2026.

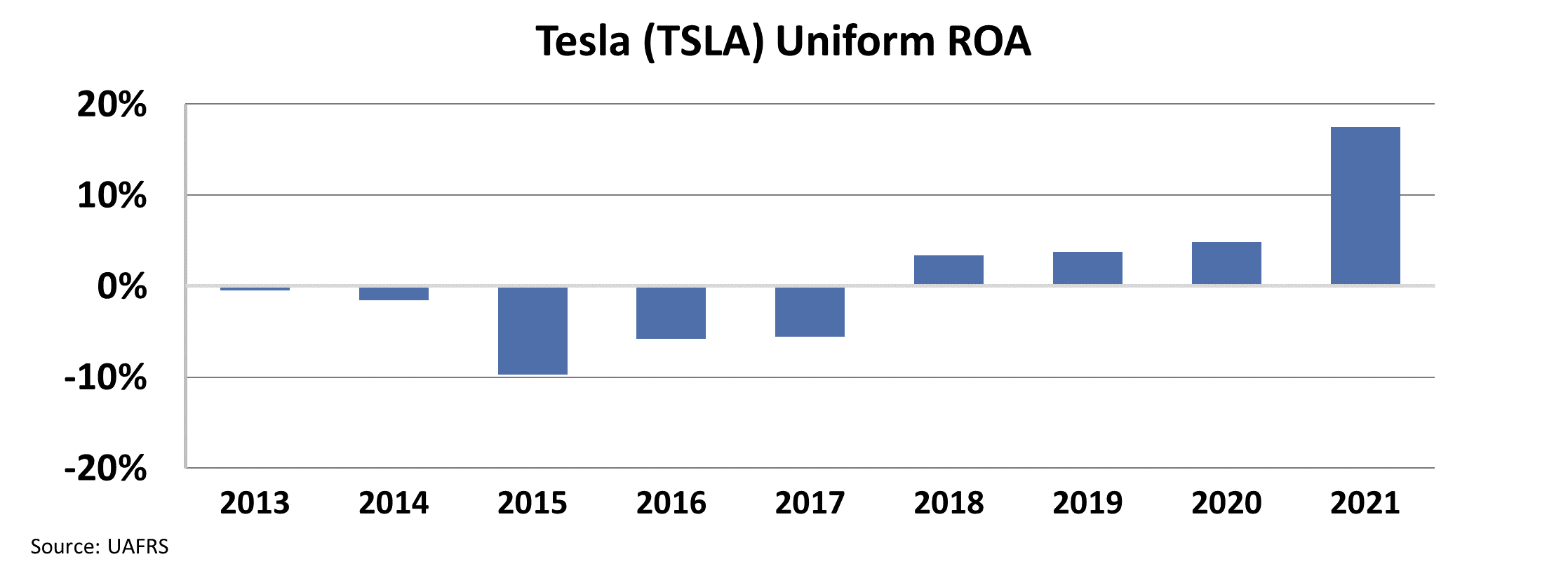

But by examining Tesla's Uniform ROA, we can see that this is unrealistic. The company wasn't even profitable until 2018, when its Uniform ROA hit 3%. Take a look...

Tesla's returns never even climbed above its 5% cost of capital until last year, when returns hit 18%. Yet the market is expecting ROA to rise sixfold from here.

Tesla is still the market leader today. But competition will increase as EV demand increases. Even so, investors expect the company to grow unimpeded by competition until it accounts for one-third of the world's vehicles.

Regardless of where you believe Tesla will end up, the market is expecting a miracle.

By splitting its stock, the company hopes to inflate its share price and raise capital to meet these assumptions. But fundamentally, nothing has really changed about Tesla's business.

Regards,

Rob Spivey

September 8, 2022

Tesla (TSLA) is hoping to reel in more retail investors...

Tesla (TSLA) is hoping to reel in more retail investors...