You've been able to see your doctor remotely over the past three months for a big reason... and it's not the one you think.

You've been able to see your doctor remotely over the past three months for a big reason... and it's not the one you think.

The wave of adoption of telehealth in the midst of the coronavirus pandemic has been eye-opening. Health care professionals across the U.S. and rest of the globe are using solutions to provide care for patients while still enabling them to social distance.

But it's raised an obvious question: Why haven't we been doing this already?

There's a simple reason... And it doesn't have to do with doctors not wanting to invest in the technology or not knowing how to. It doesn't even have to do with how superior health care is in person.

It's because doctors made significantly less money using telehealth until the pandemic.

At the onset of the crisis, the Centers for Medicare and Medicaid Services ("CMS") changed reimbursement rates for telehealth visits – making them equivalent to rates for traditional visits.

Previously, reimbursement rates for telehealth had been a fraction of the rates for an on-site visit. Because of this, doctors saw no reason to prioritize it.

And now, questions are coming up about what will happen if reimbursement rates revert back after the pandemic subsides. If this happens, it could disrupt a popular new trend in health care.

But unsurprisingly, like with most perks, it's hard to "put the toothpaste back into the tube." Once consumers get a taste, they don't want to give up this new offering.

So it's no surprise that we're hearing discussions about how and why Congress should extend the new reimbursement framework for telehealth going forward.

This is yet another example of how the "at-home revolution" we've talked so much about is here to stay, even after the pandemic recedes.

I recently had an interesting conversation with a friend about gold...

I recently had an interesting conversation with a friend about gold...

He knows I tend not to like gold as an "investment," but he tried to convince me otherwise.

This friend rattled off a number of dates when gold outperformed the market. Most important, he pointed out that if you had purchased gold just before President Richard Nixon decoupled gold from the dollar in 1971, and held it until today, its return would have beaten the market.

There's already an issue with this statement, whether or not it's true. It implies that the average investor was around to buy gold in 1970, he had the conviction that gold was going to retain its value once it was decoupled from the dollar, and he bought it at exactly the right time.

If one of these qualifiers isn't true, the whole conversation is a moot point... regardless if gold really did beat stocks over the past 50 years.

But it's a big statement to say that gold outperformed the market over a 50-year period, so we decided to do some digging.

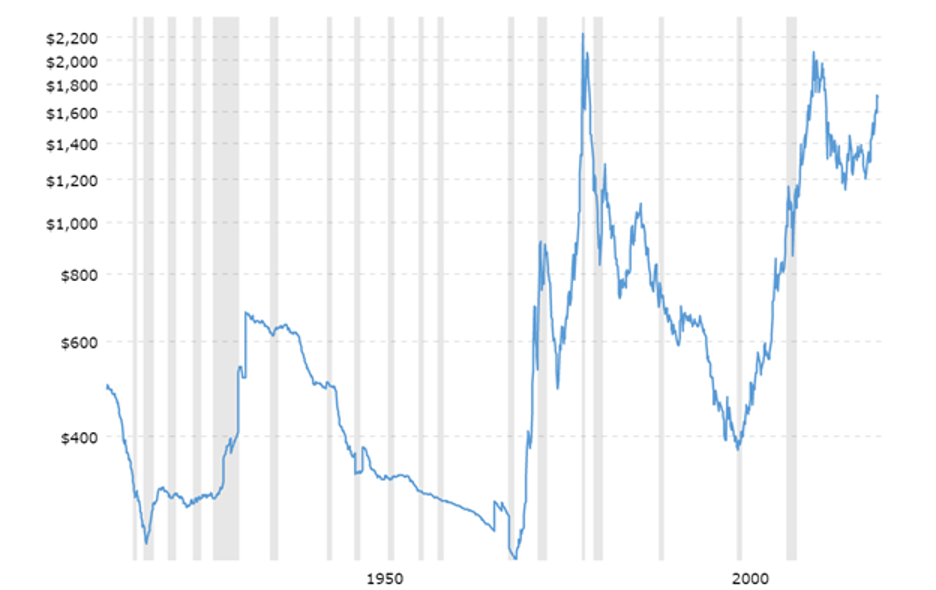

For context, here's a chart from Macrotrends of gold prices per ounce over the past 100 years:

The lowest price on the chart was in November 1970, so to give gold the best chance possible, we'll start our calculation there.

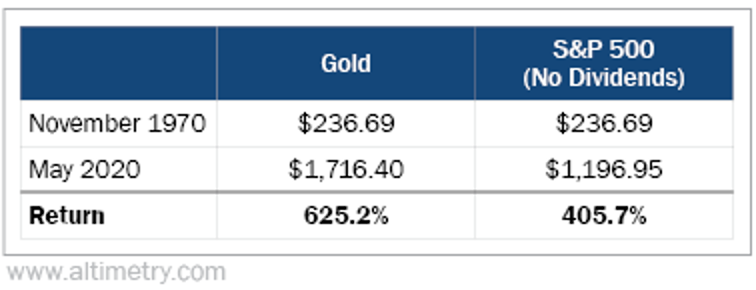

The price for an ounce of gold in November 1970 was $236.69, so that will be our common denominator.

As of late May, that same ounce of gold would be worth around $1,700 – roughly a 625% return.

That's not bad, even compared to the benchmark S&P 500 Index. If you had taken that same $236.69 and invested it in the market in November 1970, it would only be worth about $1,200 today (after adjusting for inflation).

This is a big difference in returns, and it seems to prove my friend's point. However, it's missing the most important detail that makes investing in the market so worthwhile: capital gains aren't the only return you get from owning stocks.

You see, if you had purchased a physical ounce of gold in 1970, you could do whatever you wanted with it.

You could've used it as a paperweight, turned it into jewelry, or put it someplace for safekeeping.

Fifty years later though, when you went to get the gold... it would still be just that – an ounce of gold. Gold is a great store of value, but it's not really an investment.

By comparison, your investment in the market – while not tangible in the same sense – would have changed over those 50 years.

Let's take one constituent company as an example... We used it previously when talking about another asset people love – real estate. We'll look at snack and beverage giant PepsiCo (PEP), which has been a pretty average performer.

One of the big things Pepsi has accomplished over the past 50 years is the growth of new businesses. Since 1980 alone, the company has grown more than 20 billion-dollar brands, including Frito-Lay, Taco Bell, Pizza Hut, and KFC.

As Pepsi has grown, so have its cash flows. The company returned some excess cash to shareholders through dividends, and some of its brands have even spun off into their own entities – Yum Brands (YUM) now owns KFC, and has since spun off Yum China (YUMC).

If you were a Pepsi shareholder back then, you'd have three sources of value: stock price appreciation, dividends, and spin-off shares. Pepsi today doesn't look like Pepsi 50 years ago.

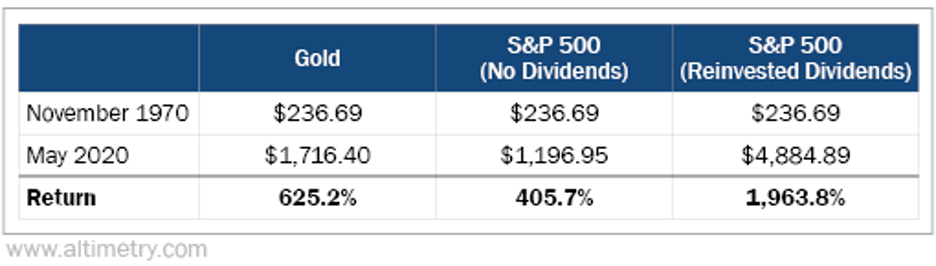

Considering this, we need to account for stock dividends to understand the full picture of the performance of equities versus gold.

After adjusting for reinvested dividends, we can see that gold never stood a chance... even when giving it the best chance possible. As you can see, with reinvested dividends, the S&P beats gold by roughly triple...

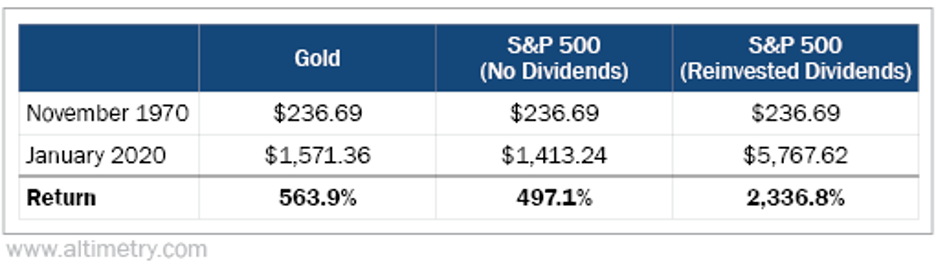

The difference becomes even more striking if you look at the same chart ending just before the coronavirus pandemic began.

In this case, the market beats gold by roughly 4 times. Take a look...

This goes to show, even if you knew exactly when to buy gold at its lowest point in the past century... owning a shiny piece of metal is still no match for a value-creating investment in the market.

Regards,

Joel Litman

June 1, 2020

You've been able to see your doctor remotely over the past three months for a big reason... and it's not the one you think.

You've been able to see your doctor remotely over the past three months for a big reason... and it's not the one you think.