Just when we think oil prices have stabilized, another crisis hits...

Just when we think oil prices have stabilized, another crisis hits...

OPEC and its allies (OPEC+) made a surprise announcement last weekend that it was cutting oil production by 1.16 million barrels per day. This follows a cut of 2 million barrels per day last October.

The organization cited concerns about weak global demand. It said that it wants to support market stability.

Regardless, the news caused huge volatility in the markets. Oil prices rocketed above $80 per barrel.

The actual reason behind this decision appears to be something else entirely.

Back in November, the U.S. committed to buying oil below $70 per barrel for the Strategic Petroleum Reserve ("SPR"). That still hasn't happened... So Saudi Arabia decided to take matters into its own hands.

The move has analysts and industry specialists debating where oil prices will go next. Some experts, including Goldman Sachs (GS), UBS (UBS), and Rystad Energy, are calling for oil to reach $100 per barrel into 2024.

These folks think there's no stopping oil prices as long as the global economy stays resilient.

As we'll explain today, OPEC's move is going to end with one of two outcomes. But no matter how things play out, one industry stands to benefit in the short term.

When OPEC retreats, U.S. shale charges in...

When OPEC retreats, U.S. shale charges in...

U.S. exploration and production (E&P) companies tend to increase production when prices spike. And when all that American oil floods the market, it balances prices.

But OPEC seems to think the shale responses are getting slower and smaller. And the thought is justified...

Oil and natural gas prices shot higher through much of late 2021 and into 2022... before spiking higher again as Russia invaded Ukraine. Even then, U.S. shale capital expenditures never really took off.

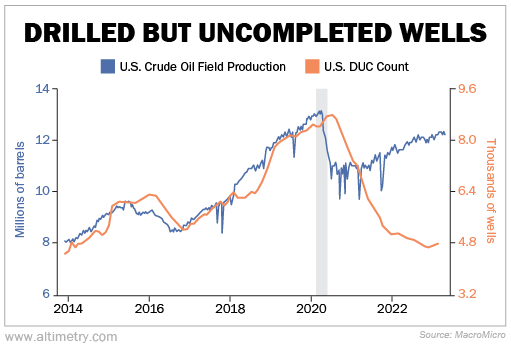

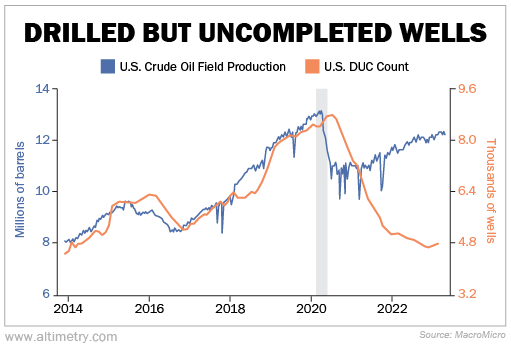

We can see this through the number of drilled but uncompleted ("DUC") wells during that time.

Regular readers know we first brought up DUC wells last June. These are wells that E&P companies have all but finished... They've done all the hard work, but capped the wells until energy prices improve.

When that happens, they'll uncork those wells like a bottle of Texas champagne... and reap the profits.

For E&P companies, the number of DUC wells is like the "inventory" for future production. That number peaked at 8,778 in 2020. It has been falling ever since.

Take a look...

As energy prices surged in 2022, we weren't alone in thinking that DUC well numbers would stop falling at worst. At best, we expected them to start rising as producers invested again.

But that's not what happened. The number of DUCs fell throughout 2022 – albeit slower than it fell in 2021.

Many E&P companies have been beaten to a pulp by investors over the past six years or so. The market has been pressuring them to stop throwing their cash down wells... and to return it to shareholders instead.

As DUC numbers continue to fall, there are two possible outcomes...

As DUC numbers continue to fall, there are two possible outcomes...

The first is that U.S. shale engineers finally re-embrace the phrase that used to be posted on their walls like a pin-up girl...

Drill, baby, drill.

It's true that there's pressure on investors to stop funding fossil-fuel projects. That doesn't mean they'll completely turn their backs on such tempting prices. Investors might still give management teams room to invest in future production.

The second possible outcome is that OPEC's cash grab goes too far... and squeezes too much.

Higher oil prices act as a tax on consumption. If oil prices stay too high for too long, it can actually force a recession.

Economic growth is already stressed. If OPEC overshoots its goal of "supporting prices," it could push the global economy into a recession. After all, it has happened multiple times before.

No matter what happens, there's a short-term beneficiary...

No matter what happens, there's a short-term beneficiary...

This might end with U.S. shale expanding production in the face of rising prices. Or the world could head into a recession in the midterm.

Either way, energy companies will likely get a brief boost.

If they raise production and take market share, these companies might benefit from sustained higher prices.

And if the U.S. doesn't meet OPEC's cuts head-on with more production, it's the same story. Energy companies could benefit from a surge in higher prices. Even if they aren't producing more oil, they can still make more money on the barrels they're already producing.

Oil producers will either really win... or they won't lose, at least for the next few quarters. And that's one more reason to keep an eye on the energy patch.

Regards,

Rob Spivey

April 11, 2023

Just when we think oil prices have stabilized, another crisis hits...

Just when we think oil prices have stabilized, another crisis hits...