There's a false narrative playing out in the oil and gas market today...

There's a false narrative playing out in the oil and gas market today...

Last Thursday, I joined my good friend and nationally syndicated financial columnist Chuck Jaffe on his podcast Money Life to talk about what I'm seeing. You can listen to our entire conversation right here.

But today, I want to highlight two big, timely themes that Chuck and I discussed...

The first theme is the "capex supercycle," which we've talked about often in these pages. The other theme is relatively new – and still developing...

In short, a renaissance in U.S. shale is coming.

Excitement about the oil patch is new for us at Altimetry...

Excitement about the oil patch is new for us at Altimetry...

After all, oil has been a risky – and often painful – investment for much of the past 15 years.

Our excitement isn't as simple as "oil is high" or "the world is turning against green energy, and now wildcatters are going to go punching holes in the ground again!"

Rather, many institutional investors are praising oil and gas exploration and production (E&P) companies. They're the companies that find oil and extract it from the ground.

And over the past few years, U.S. E&P companies have focused on returning capital to shareholders instead of reinvesting in their businesses. Thanks to how unprofitable drilling has been for a decade now, investment has dried up.

But the E&P-loving institutional investors are missing a key point...

I'm talking about drilled but uncompleted wells ("DUCs"). And importantly, this data explains why E&P companies haven't been investing over the past few years.

DUCs are the wells drilled and ready to be pumped out. Then, they're sealed up for the future.

E&Ps create DUCs when oil prices are low. Then, when the time is right, they actually start drawing oil or gas from the wells.

After the last shale bubble burst in 2014 and 2015, oil and gas prices plummeted. And in turn, prices for all the equipment and services that E&P companies need to drill wells became cheap, too.

E&P companies used those low prices to spend to build a massive inventory of wells on standby. They planned to start pumping when the wells became economical.

In other words, the E&P companies would start pumping as soon as they could make money.

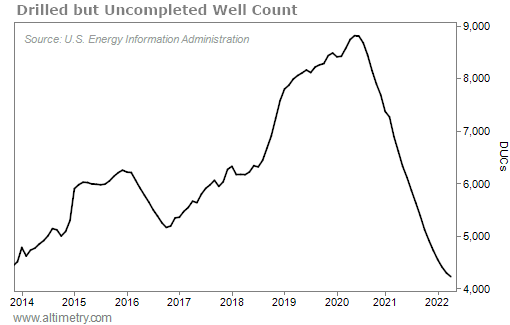

The number of DUCs in the U.S. rose from just above 5,000 in late 2016 all the way up to almost 9,000 in late 2020. When oil prices started spiking in 2020 and early 2021, E&Ps easily ramped up supply by just taking the cap off these wells and turning on the pumps.

Suddenly, unprofitable E&P companies were throwing off tons of cash flows. Prices were good... And they had already invested in the wells.

Investors have been abuzz about this "renaissance" in the oil patch since then.

However, the high-profit, low-investment days are nearing an end...

However, the high-profit, low-investment days are nearing an end...

You see, over the past year and a half, DUCs have fallen from almost 9,000 to just above 4,000. That's the lowest level since 2012. Take a look...

Oil and natural gas prices are high. And oil futures tell us we can expect them to stay that way for several years. But a big problem is developing...

With DUC counts running low, the E&Ps are about to run out of easy inventory.

That presents a unique opportunity for specific companies in the energy sector...

Wildcatters in their offices across Texas are thinking back to the 2010s and the "drill, baby, drill" boom times. And with those memories in mind, they're about to start investing again.

The problem for E&P companies is that they'll need to start paying the full costs for each well – instead of the cheaper way of just bringing DUCs into service.

That's why we disagree with most institutional investors about the best opportunity in oil and gas...

The big winners won't be the E&P companies. Instead, it will be the equipment and services ("E&S") companies...

E&S companies sell the drilling equipment that the E&P companies will need to ramp up production. So in the months ahead, the utilization rates for E&S companies' drilling equipment will soar. And as demand surges, they'll be able to raise their prices.

Those moves will eat into the profits of E&P companies. And in the end, we believe E&S companies will prove to be the best way to play this boom in the energy sector.

In fact, just yesterday, we shared a brand-new recommendation in this space with our Microcap Confidential subscribers. It's a small company that could soar triple digits as this trend plays out.

If you want to learn more about Microcap Confidential – including how to get a full year for 50% off the regular price – be sure to check out my colleague Joel Litman's recent interview. He also gives away the name and ticker symbol of his No. 1 small-cap stock to buy right now... and one to avoid at all costs. Watch the interview right here.

Best,

Rob Spivey

June 15, 2022

There's a false narrative playing out in the oil and gas market today...

There's a false narrative playing out in the oil and gas market today...