Bonds can seem overwhelming at first...

Bonds can seem overwhelming at first...

Just ask James Carville, the famously opinionated and successful political adviser to former President Bill Clinton. When asked about reincarnation back in 1994, Carville famously quipped...

I used to think... I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.

Carville was referring to how bond investors can force governments to do whatever investors want by pushing them to the brink of bankruptcy if they're irresponsible.

But plenty of investors agree with Carville for a different reason...

There are about 6,000 tradeable stocks on the U.S. markets at any given time. There are more than 500,000 bonds available.

All that debt totals more than $51 trillion... or $5 trillion larger than the U.S. equity markets.

Stocks seem to grab all the headlines because of the potential for huge price swings. Everyone wants to know what's next for massive companies like AI favorite Nvidia (NVDA) and "meme stock" darling GameStop (GME).

But in times of economic uncertainty, bonds can be a more attractive option... if you're brave enough to branch out. Savvy investors can unlock healthy profits from bonds while taking on far less risk than the stock market would bring.

In yesterday's edition, we explored a key piece of many bond contracts called a "change of control" provision. It offers protection for bondholders if the issuing company's management team sells the business.

Today, we're looking at another important aspect of any bond investment. As you'll see, understanding this one critical detail can set a good bond investor apart from the rest of the pack.

When we make any investment decision, our goal at Altimetry centers around one word... mispricing.

When we make any investment decision, our goal at Altimetry centers around one word... mispricing.

We look for opportunities where the market believes an investment will do much worse than it really will. This objective is just as important for researching bond ideas as it is for finding mispriced stocks.

It all boils down to one simple question... Can this company pay back its bond?

As bond investors, that's No. 1 on our list. If we believe a company is in danger of defaulting on its bond, we stay far away.

We determine this using our Uniform Accounting tool set to better model real obligations and cash flows. We also look at how well the company's assets – things like inventory, factories, and even patents – support its debt.

But our work isn't over when we're satisfied with the fundamentals. We still have to take one of the most important steps... digging into the fine print of these bond contracts to make sure no one can pull a fast one on us.

One of the ways we protect ourselves as bondholders is by looking at something called 'debt hierarchy'...

One of the ways we protect ourselves as bondholders is by looking at something called 'debt hierarchy'...

The relationship between borrowers and lenders is getting increasingly tense. As corporations become more desperate for financing, they become open to bond deals that prioritize new lenders ahead of older ones.

This wouldn't matter much in a healthy economy, since all creditors will likely get their money back. However, we're not in a healthy economy anymore. Creditors are beginning to turn against one another to protect their investments.

It's crucial for bond investors to know where they stand before investing.

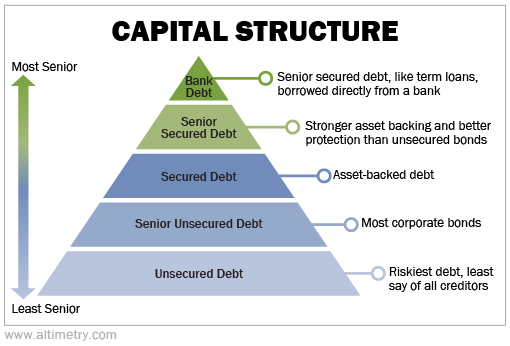

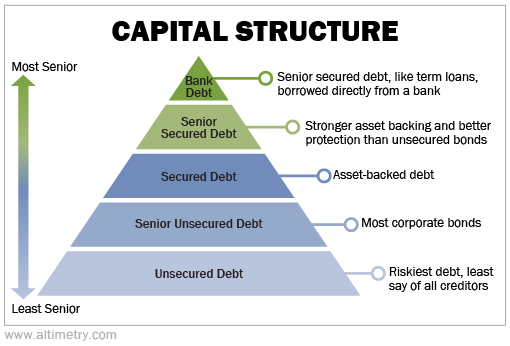

You see, all companies have a tier list of owners called the "capital structure." If the business goes bankrupt, the people at the top of this list get paid first. They can decide what to do with the remaining assets.

Folks at the bottom get whatever is left... if anything.

Equity holders are at the bottom of this list by default. So we don't worry about this when investing in stocks.

But with bonds, the opposite is true... Senior bondholders have a legal right to push around more junior members of the capital structure. So as bond investors, it's critical to know where we stand before we invest.

Here's how the capital structure typically looks...

By knowing where we fall in the capital structure, we can assess how much we'll get paid in the unlikely event of a bankruptcy. This is one of the keys to sound bond investing.

Understanding credit is like an investing superpower...

Understanding credit is like an investing superpower...

It's critical for finding the best safe bond ideas. It can also help you find stocks that are about to take off... and avoid torpedoes that could sink your portfolio.

Most important, it can give you a clearer picture of the entire economy. And when you know what to expect from the markets, you'll sleep far better at night.

We firmly believe learning about the credit markets is one of the most important ways you can improve your investing strategy. That's why a year ago, we launched Altimetry's first bond-research service... Credit Cashflow Investor.

A lot of people are nervous to wade into the bond market. We don't blame them. Our team at Credit Cashflow Investor does all the heavy lifting every month to put your mind at ease.

We make sure the company's financials and credit health are sound... the management team will make smart decisions... and more-senior bondholders can't pull the wool over our eyes.

And we make sure you understand the ins and outs of the company's credit structure and debt maturities... before you ever invest a dime.

We believe anyone can benefit from our research at Credit Cashflow Investor, even if you're brand-new to bonds. You can learn more – including how to get 50% off, plus $8,400 in free tools and bonuses – by clicking here.

With the right market conditions, it's possible to earn stock-like returns or better in the bond market. Don't let this unfamiliar market scare you away.

By opening your eyes – and your portfolio – to the credit world, you'll be able to take advantage of equity-like returns... but with far less risk than you'll find in stocks.

Regards,

Rob Spivey

October 3, 2024

Bonds can seem overwhelming at first...

Bonds can seem overwhelming at first...