Investors breathed a collective sigh of relief after the World Series...

Investors breathed a collective sigh of relief after the World Series...

Even if you're a die-hard Philadelphia Phillies fan – or if you were tired of seeing the Houston Astros in the championship for the fourth time in six years – it was hard to wholeheartedly root for Philly.

You see, there's a superstition about Philadelphia baseball teams. Whenever they win the World Series, the economy crashes.

The Philadelphia Athletics (before they moved to Oakland) won the World Series two weeks before the 1929 market crash that kicked off the Great Depression... and again in 1930. The Phillies won in 1980 amid plummeting stocks and mass layoffs.

Philly's fourth and most recent World Series victory came in 2008, during the lead-in to the Great Recession.

Philadelphia baseball is four-for-four on economic disasters. Superstitious investors were hoping it wouldn't become five-for-five.

To these folks' relief, the Houston Astros won the World Series in six games. I'm sure for many, it was too close for comfort.

That being said, a Phillies loss doesn't guarantee there won't be a recession.

Of course, there's no causation between Philadelphia wins and economic ruin. It's pure coincidence.

One metric does mean we're almost certain to see a recession in the next six to 24 months, though.

Unlike Philly wins, this signal is much more consistent...

Unlike Philly wins, this signal is much more consistent...

I'm talking about the inverted yield curve.

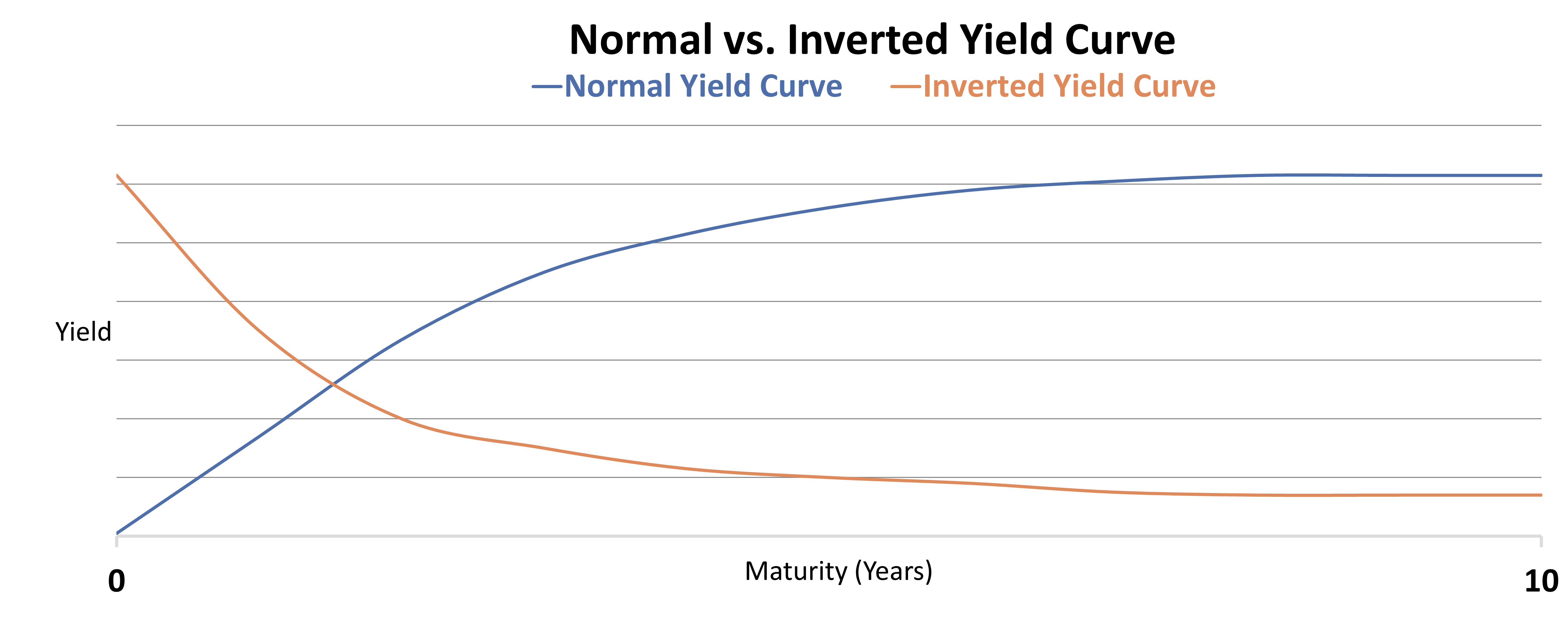

The yield curve measures interest rates of U.S. Treasury bonds over various time horizons. Normally, longer-dated bonds have higher rates because there's more uncertainty that far out. An inverted yield curve is when short-term bond interest rates climb above long-term interest rates.

A normal yield curve means that investors are optimistic about the immediate future. When the curve inverts, it shows the market believes the economy will be worse in the short term than in the long term. That's why it tends to indicate a looming recession.

Comparing two yields is quite simple. All you need to do is subtract the short-term rate from the long-term rate. If the result is negative, the yields are inverted.

When that happens, it looks something like this...

Yields get higher over time in a normal curve. With an inverted curve, they become lower the further out you go.

Investors look at many different kinds of yield curves. One of the most widely used is the "2-10 spread." This compares the yield of two-year and 10-year U.S. Treasury rates.

While it's widely used, we don't think the 2-10 spread is the best recession indicator...

While it's widely used, we don't think the 2-10 spread is the best recession indicator...

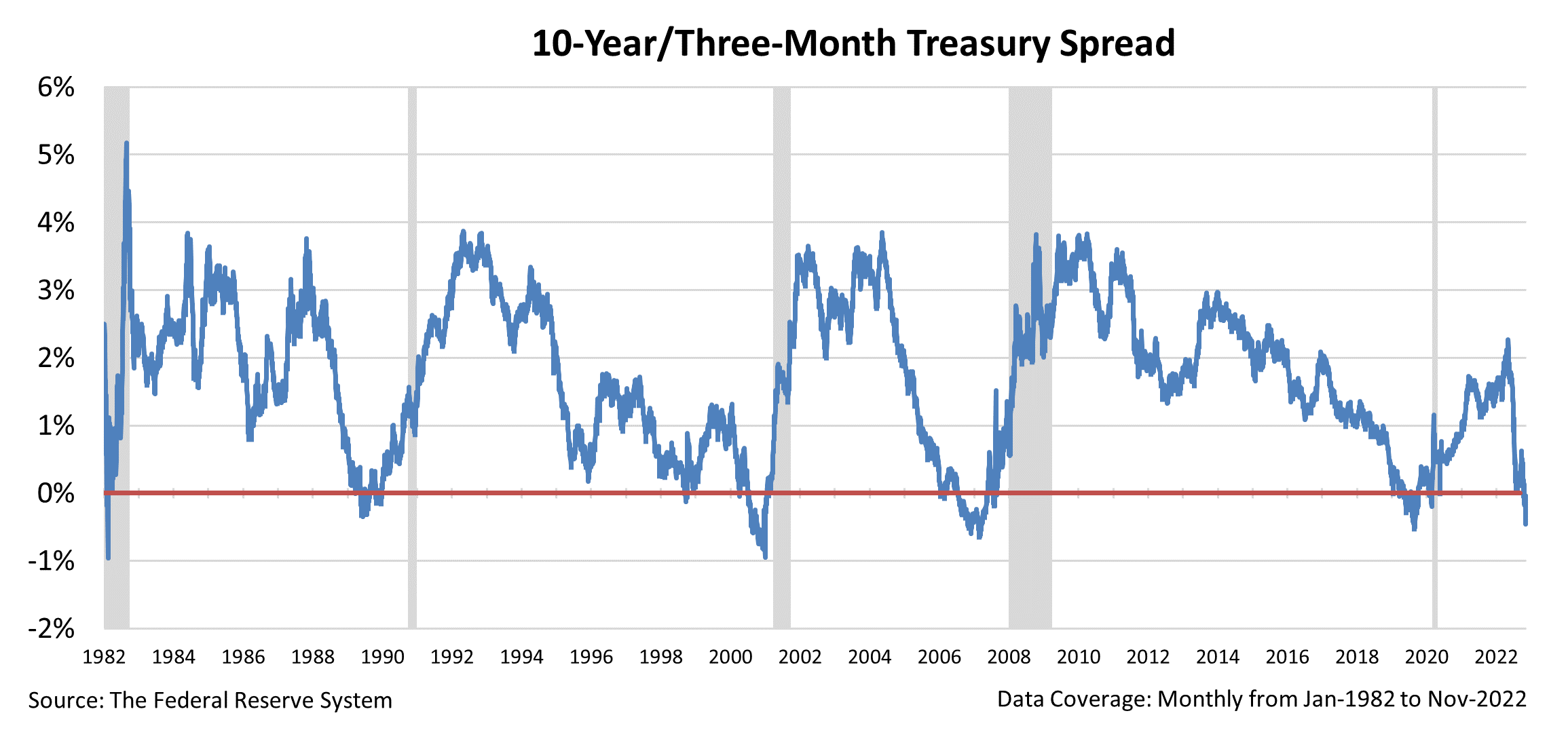

Our research shows that the 10-year/three-month spread is actually a better way to identify a pending downturn.

Even as rates have risen, this curve has remained positive for some time. Ten-year rates were consistently higher than what you'd find on three-month bonds. And the economy continued to chug along.

Unfortunately, this couldn't last forever.

The 10-year/three-month spread finally inverted in late October. It was the first time this happened since late 2019 (not long before the sharp but short-lived pandemic recession).

Take a look...

As you can see, on October 18, the three-month yield hit 4.04%. The 10-year yield sat at 4.01%.

Now, this doesn't mean we're going to see a recession tomorrow.

The 10-year/three-month inversion has historically preceded a recession by between six and 24 months.

This confirms that the Federal Reserve's interest-rate hikes are likely guiding us toward a recession. But as we explained in August, that doesn't mean it will be a bad recession.

The Fed is managing the economy by raising rates. While this will likely lead to a minor downturn, it should rein in inflation. So don't panic...

Investors have been bracing themselves for a lot of risk lately. Stock prices are reflecting that. If anything, we'll likely see a sideways market until the Fed gets inflation under control.

Regards,

Joel Litman

November 14, 2022

Investors breathed a collective sigh of relief after the World Series...

Investors breathed a collective sigh of relief after the World Series...