Since 2015, the private credit market has ballooned from $500 billion to $2 trillion...

Since 2015, the private credit market has ballooned from $500 billion to $2 trillion...

And it's attracting everyone from Wall Street giants to insurance companies and pension funds.

At the center of the boom is a small company called Egan-Jones Ratings.

The agency employs just 20 analysts. But it graded more than 3,000 private credit deals in 2024 alone. Egan-Jones' quick process and generous grades have made it the go-to name for credit issuers and buyers alike.

But recent defaults are revealing an explosive setup...

Life insurers bought into Egan-Jones' fast-and-loose assessments back in 2019. And now they're starting to take hits.

Today, we'll explain why private credit's rapid expansion may be masking dangerous cracks.

Cheap, fast, and generous ratings fueled an unsustainable gold rush...

Cheap, fast, and generous ratings fueled an unsustainable gold rush...

Egan-Jones offers rating assessments in as little as five days... based on minimal documentation and low fees.

It relies on brief management calls and borrower-supplied data. Many of its final ratings take up just one page.

Credit giants like Moody's (MCO) and S&P Global (SPGI), on the other hand, spend weeks conducting due diligence.

Still, insurers have taken Egan-Jones' ratings at face value...

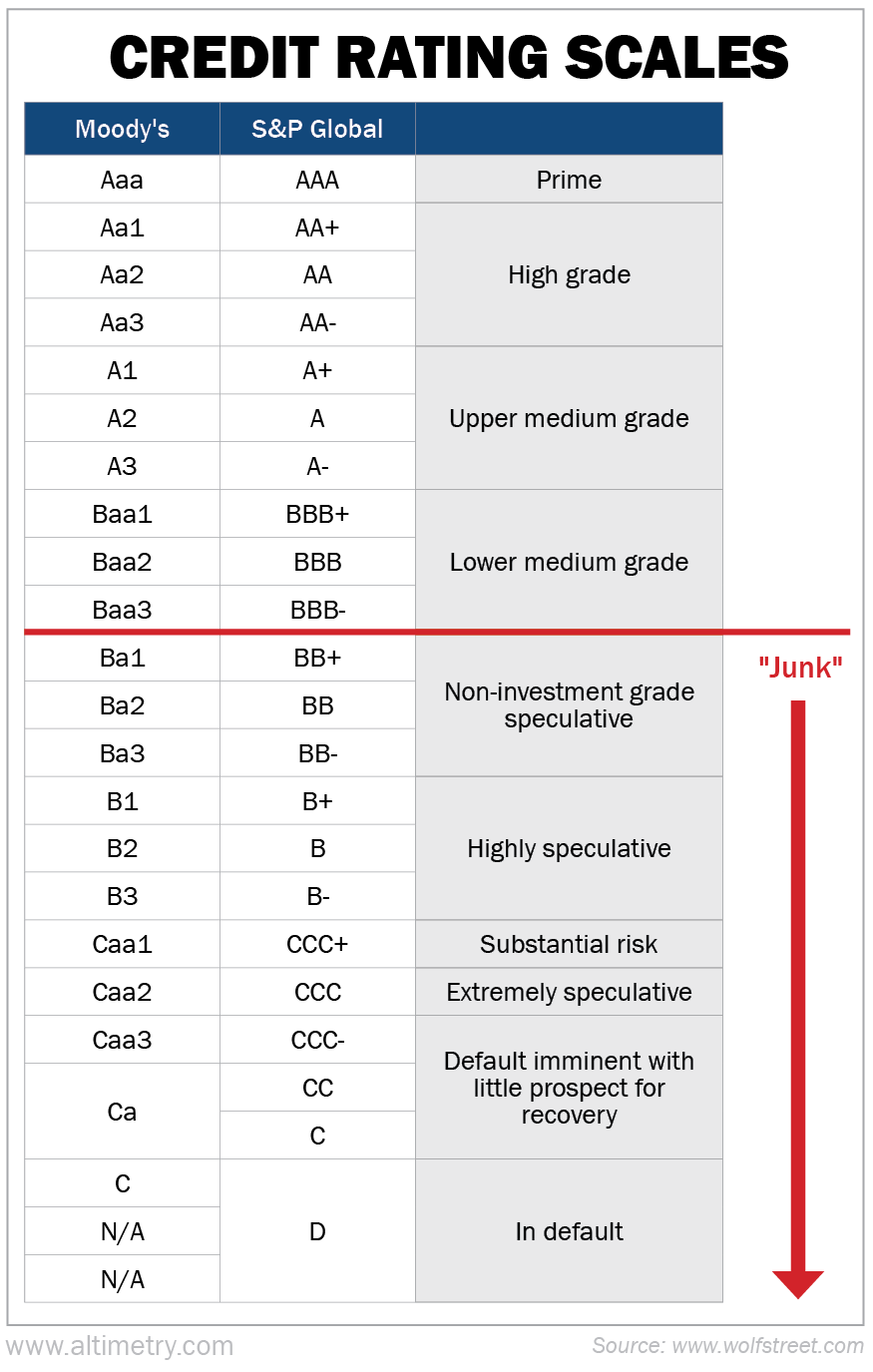

Insurers with decent credit ratings can hold far less capital than those with "junk" ratings. For instance, a BBB-rated loan, which is "lower medium grade" under S&P Global, needs just $1.5 million in reserves. A level B junk loan needs $9.5 million.

The bottom line is, Egan-Jones' credit ratings don't reflect lenders' true risk. It shows that private creditors resort to shoddy methods when times get tough.

And recent events back up that claim...

And recent events back up that claim...

The National Association of Insurance Commissioners ("NAIC") issued a warning earlier this year. It reported that ratings from firms like Egan-Jones were consistently more generous than internal assessments... by as much as six grade levels.

The NAIC quickly withdrew its report due to backlash from insurers. And predictably, that sparked concerns across the industry.

Ultimately, borrowers couldn't pay back the high interest on their loans, and they began defaulting...

Crown Holdings, a business owned by real estate investor Moshe Silber, received a respectable BBB rating for several loans. A few weeks later, it collapsed in a fraud scandal.

Chicken Soup for the Soul Entertainment, the parent of Redbox, filed for bankruptcy within months of an Egan-Jones' investment-grade nod.

These aren't isolated incidents. They're warning signs...

These aren't isolated incidents. They're warning signs...

Private credit isn't inherently bad. In many cases, it helps where banks won't. And it provides crucial financing to small and midsize firms.

But questionable ratings and minimal oversight aren't the solution.

Egan-Jones' rapid rise and recent stumbles underscore the risk of unchecked private credit. As defaults climb and scrutiny grows, the entire sector is facing a reckoning.

Unless the ratings backbone becomes more credible and transparent, the private credit powder keg could explode.

Regards,

Joel Litman

July 16, 2025

Since 2015, the private credit market has ballooned from $500 billion to $2 trillion...

Since 2015, the private credit market has ballooned from $500 billion to $2 trillion...