Back in November, we highlighted some potential merger and acquisition (M&A) activity in the financial-services sector...

Back in November, we highlighted some potential merger and acquisition (M&A) activity in the financial-services sector...

We mentioned the potential Janus Henderson (JHG) and Invesco (IVZ) marriage. The rumored deal still hasn't occurred... But the motivations showed the moves some companies in the asset-management space might need to make.

Competition is stiff between asset-management firms. Additionally, passively managed funds are taking a larger piece of the pie. Exchange-traded funds ("ETFs") have grown increasingly popular, and control of them lies with a small handful of firms.

BlackRock (BLK), State Street (STT), and Vanguard dominate the field. They offer hundreds of ETFs and manage trillions of dollars in ETFs alone.

The ubiquity of ETFs has also been a key reason why fees have been falling in the industry, making it difficult for smaller players to stay competitive. The need for consolidation was a big factor in Morgan Stanley (MS) announcing its planned acquisition of Eaton Vance (EV) back in October.

And a similar transaction recently took place when Australia's Macquarie Group announced plans to buy Waddell & Reed Financial (WDR). Once the deal closes, Waddell & Reed's wealth management arm will be sold to LPL Financial (LPLA).

Getting scale helps eliminate of back-office redundancies, improves profits, and can help the combined company stay competitive in asset management.

Consolidation is likely to be a long-term industry trend...

Consolidation is likely to be a long-term industry trend...

Many asset managers have suffered in the race to the bottom to lower fees and are now unprepared to operate in the current climate. However, some saw it coming... And one of those firms is Affiliated Managers Group (AMG).

Over the years, the company has been a serial acquirer of boutique asset managers, hedge funds, and private-equity firms. Affiliated has realized the value in offering a back-end platform to a range of asset managers under one umbrella. A unified back-end reduces costs in aggregate.

This allows Affiliated to reach economies of scale. As the company grows, it spreads out its fixed costs over all its firms – becoming more efficient and profitable. Affiliated now has more than $600 billion in assets under management.

Another part of Affiliated's strategy is to purchase only 50% to 75% of target companies. This means the original owners and employees still have equity, which aligns them with Affiliated.

Making sure its asset managers still have "skin in the game" means the company should have higher performance and attract better managers who want to keep betting on themselves. It also means those managers are likely to be more cost-conscious.

And yet, looking at our Altimeter tool, the as-reported metrics show that Affiliated has below-average returns...

And yet, looking at our Altimeter tool, the as-reported metrics show that Affiliated has below-average returns...

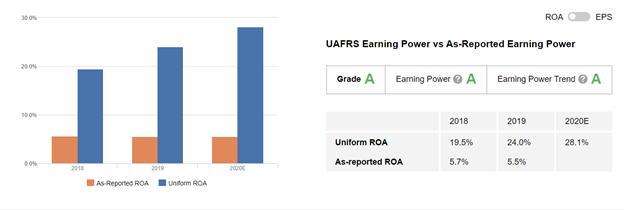

The company's as-reported return on assets ("ROA") has only ranged between 5% and 6% over the past two years. Additionally, Wall Street's expectations are for as-reported ROA to stay at 5% this year.

That doesn't look like the performance of a firm that's getting cost benefits from scale or from bringing superior managers into the fold.

But Uniform Accounting starts to explain reality. It shows that Affiliated's profitability metrics are improving – Uniform ROA has risen from 19% in 2018 to 24% in 2019... and this is expected to climb to 28% this year.

This improvement stands in stark contrast to much of the asset-management space. And the company isn't finished executing on its strategy. Affiliated has already acquired two companies last year. Additionally, the firm has a healthy cash balance and may be looking to continue putting its capital to work in the coming months and years.

Due to the power of this intuitive and impressive strategy, Affiliated earns an "A" grade across the board for Performance.

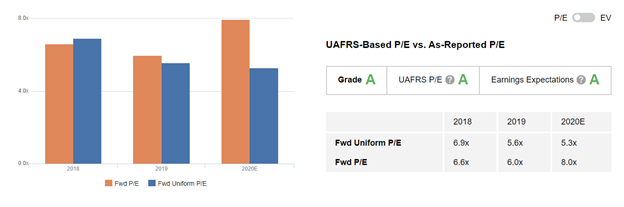

And Affiliated isn't just performing well... It's also trading at a cheap valuation. While a company producing a 5% ROA may deserve a low valuation, one with an ROA above 20% likely doesn't.

Uniform Accounting indicates that Affiliated's real price-to-earnings (P/E) ratio is 5.3. This is well below the market average and the company's historical averages. Such a low P/E ratio implies the market is expecting Uniform ROA to collapse in the coming years.

However, if Affiliated can continue consolidating smaller asset managers and offering a superior solution for investors, it may be able to sustain its performance.

Uniform Accounting shows how well Affiliated's strategy works. The company continues to acquire smaller players that are struggling in the current market. With no end in sight for consolidation in the industry, Affiliated can likely continue this strategy for the foreseeable future.

The Altimeter gives Affiliated a rare "A" grade across the board – a grade that only 3% of companies in the database earn. Considering the strong fundamentals and bearish expectations for the company, it's a stock worth keeping an eye on.

Regards,

Rob Spivey

January 14, 2021

P.S. With The Altimeter, you can do a deep dive into the stocks in your own portfolio to see how they grade out based on the Uniform numbers. You can find out which ones are likely set up for strong performance ahead... and which ones may be ticking time bombs. Learn more here.