Investing is a 'no-called-strike game'...

Investing is a 'no-called-strike game'...

At least, that's what legendary investor Warren Buffett likes to say.

Baseball players don't have the luxury of waiting for the perfect pitch – three strikes and you're out. In contrast, Buffett knows that part of what makes him such a successful investor is his patience.

You don't have to buy and sell every stock you see. You'll never "strike out" by passing on certain opportunities. You can (and should) wait for the right stock at the right time.

It's a philosophy that JPMorgan Chase (JPM) CEO Jamie Dimon seems to have taken to heart.

Dimon has been at the helm of the bank since 2005. In that time, the market has encountered its fair share of crises and financial storm clouds.

And every time, Dimon and JPMorgan have come out on top... avoiding much of the pain that harms or even kills the competition.

Today, we'll take a closer look at Dimon's strategy over the years... and the recent choices that set JPMorgan up for success in the wake of March's bank failures.

The bedrock of JPMorgan's balance sheet is built on others' failures...

The bedrock of JPMorgan's balance sheet is built on others' failures...

Take its bailout of investment bank Bear Stearns in 2008. JPMorgan only paid about $1 billion for the bank. In the process, it got Bear Stearns' brand-new $1.2 billion office building.

In the same year, it picked up failed bank Washington Mutual's $188 billion in deposits and $307 billion in assets... all for less than $2 billion.

Since Dimon took over as CEO, JPMorgan's Uniform return on equity ("ROE") has averaged about 15%.

To understand a bank's profitability, we can't rely on our usual measure... return on assets ("ROA"). This is because banks aren't run like other companies with traditional assets.

Instead, they generate profits from the difference in interest on the money they borrow and the money they lend. This difference is the ROE.

For context, most banks' cost of capital is around 9%. The industry average Uniform ROE is around 10%. JPMorgan's strategy of scooping up failed banks at a discount has helped propel returns higher than its peers'.

And it's not done yet. Earlier this year, JPMorgan took advantage of the regional-bank collapse started by Silicon Valley Bank ("SVB")...

SVB's collapse knocked down several other dominoes, including sterling private-bank franchise First Republic Bank. JPMorgan scooped up First Republic for pennies on the dollar.

Dimon may have something else up his sleeve... With venture capital-friendly SVB gone, it appears JPMorgan is taking advantage of this newly formed gap in the market. The bank has begun hiring a significant number of bankers and executives who specialize in startups and venture-capital companies.

It just so happens that a lot of First Republic's client base was in the startup space. While many startup companies banked with SVB, their executives frequently banked with First Republic.

This is a massive growth opportunity for JPMorgan. Not only did it acquire an excellent banking franchise... it's also gearing up to capture all of SVB's venture-capital business.

And yet, the market is bearish about the bank.

Investors expect JPMorgan to break its 18-year streak...

Investors expect JPMorgan to break its 18-year streak...

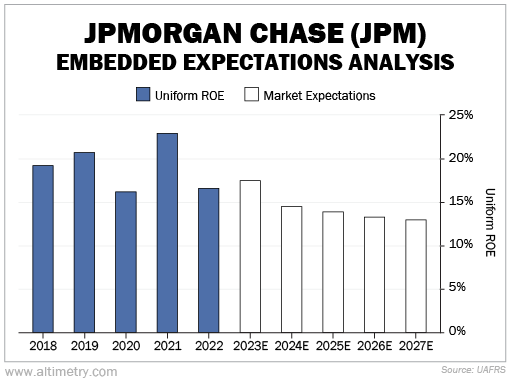

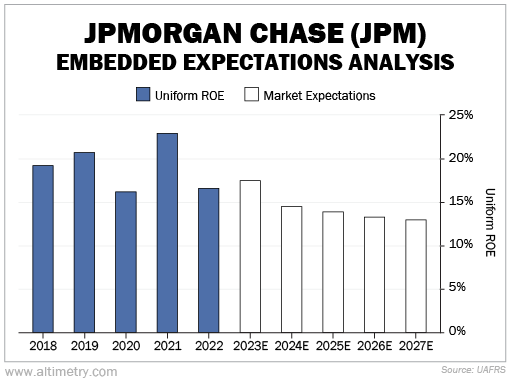

We can see this through our Embedded Expectations Analysis ("EEA") framework.

We begin by looking at a company's current stock price and calculate what the market expects from the company's future cash flows. We then compare that figure with our own cash-flow projections.

In short, it tells us how well a company has to perform in the future to justify what the market is paying for it today.

The market expects JPMorgan's Uniform ROE to drop to 13%... a figure it hasn't seen since the 2008 financial crisis.

See for yourself...

JPMorgan is a sector leader for a reason. The company's Uniform ROE hasn't dropped below 14% for almost 20 years. Yet investors think it's headed even lower from here.

They're blatantly ignoring the bank's tried-and-tested strategy. It has a proven track record of using others' weaknesses to power its own business higher.

Dimon has shown time and again that he won't rush in when everyone else does. He'll wait for the right time to strike. That's what he's doing now with the First Republic acquisition and JPMorgan's plan to fill the gap left by SVB.

If Dimon's moves this year are as successful as they were during the Great Recession, investors betting against JPMorgan are sorely mistaken.

Regards,

Joel Litman

August 9, 2023

Investing is a 'no-called-strike game'...

Investing is a 'no-called-strike game'...