It looks like this is farewell to interest-rate hikes...

It looks like this is farewell to interest-rate hikes...

The Federal Reserve put a pause on raising rates since it upped them to 5.25% in July. Since then, all its most-watched metrics have all moved as hoped.

The central bank wanted to push unemployment to at least 3.8% by year end. It's already at 3.9% as of October, the most recent data available.

Inflation has fallen to 3.5%. While it's still above the Fed's 2% target, it's better than the year-end expectation for 3.7%.

And for the sixth quarter in a row, banks tightened their lending standards... meaning credit availability is dropping. It's getting harder for companies to secure loans.

In short, the economy is cooling off. The Fed's strategy is working. Today, we'll explain why that's an urgent sign investors should take a hard look at their portfolios.

At last month's Federal Open Market Committee meeting, Fed Chair Jerome Powell said current policy is 'significantly restrictive'...

At last month's Federal Open Market Committee meeting, Fed Chair Jerome Powell said current policy is 'significantly restrictive'...

Powell means that the Fed has been making it more expensive to borrow money... on purpose.

That's one of its main mechanisms for slowing down inflation. However, if the Fed's policy gets too restrictive, it's almost certain to throw the economy into a recession.

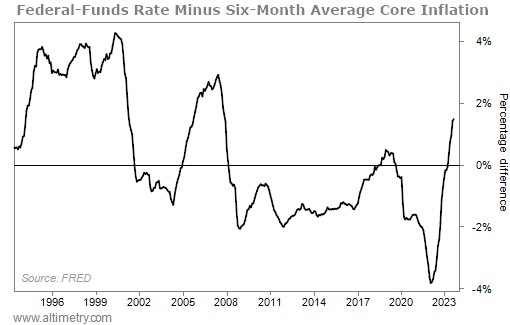

We can see this by calculating the difference between the current federal-funds rate (the interest rate that the Fed controls) and trailing six-month average core inflation. It gives us a sense of just how loose or restrictive the Fed's policy is over time.

Inflation surged at the start of the pandemic. The Fed was slow to respond... By March 2022, six-month average inflation outstripped the federal-funds rate by nearly 6%.

The Fed had a lot of ground to recoup when it finally woke up last year. It raised rates faster than any time since the 1980s. And now that inflation has slowed faster than the Fed's target, the gap has flipped.

Today, the federal-funds rate is as restrictive as it has been in 16 years. Take a look...

The Fed's policy is already restrictive... meaning inflation should keep falling and unemployment should keep rising. Any more rate hikes would cause unnecessary damage to the economy.

In fact, the central bank will have to think about cutting rates sooner than later...

In fact, the central bank will have to think about cutting rates sooner than later...

Just look at the last two times Fed policies were this tight... in 2001 and 2007. Both times, we entered a recession within a few quarters.

The Fed set out to give us a recession, and it's delivering. Even if it starts cutting rates tomorrow, the economy is already going cold.

Inflation is falling. Unemployment is rising faster than expected. Banks continue to restrict lending. This is a tough environment for investors.

The types of investments that worked this year won't cut it in 2024. Focus on defensive, high-quality stocks to minimize your losses.

Regards,

Joel Litman

December 6, 2023

P.S. If you've been watching stocks waver in recent days and wondering, "Is this it?"... you must listen to my brand-new urgent message.

In short, a new financial crisis has quietly taken hold of the U.S. stock market. It involves both the recent volatility and a devastating shift that nobody sees coming – and if you're following the usual crisis playbook, your money is more at risk than any time in recent history.

I'll step forward with the full story tonight at 8 p.m. Eastern time. Get the details and reserve your spot by clicking here.

It looks like this is farewell to interest-rate hikes...

It looks like this is farewell to interest-rate hikes...