After the Cold War, the Pentagon had to make some tough decisions...

After the Cold War, the Pentagon had to make some tough decisions...

For the first time in more than 40 years, the U.S. no longer needed to defend itself against the Soviet Union. So the Pentagon initiated a wave of military base closures.

One of those closures was at Griffiss Air Force Base in Rome, New York. It wasn't far from where I (Rob) lived at the time. The closure was a huge deal for the area.

Locals argued that shutting down the base would be a huge economic loss for the community. The closure became so contentious that Congress set up a committee hearing all about it. That hearing extended to other closures as well.

Similar battles still take place today... except now, the Pentagon doesn't fight about closing its own bases. Instead, the arguments are about which of its weapons systems or platforms to shut down.

If you're thinking these fights sound counterproductive, you're in good company. But as I'll discuss today, the Pentagon's inefficiency may actually benefit aerospace and defense (A&D) companies.

Contracts and lobbying keep the wheels on for A&D...

Contracts and lobbying keep the wheels on for A&D...

Just recently, the U.S. Navy moved to retire its Littoral Combat Ship ("LCS") program... including most of its current operational fleet.

Many of these ships are considered abject failures. They come with major maintenance issues and high repair costs. One of the ships has been on one deployment in its entire lifetime. Right after that, it spent 19 months under repair.

The Navy argued that discontinuing the program would save the service about $4.3 billion in costs. All of that could be repurposed elsewhere to better effect.

It seemed like sound logic. Then the lobbying started...

The LCS program has an extensive, diverse supply chain. It crisscrosses the U.S., including the Wisconsin shipyard where the hulls are assembled... the Florida and California bases where the boats are moored... and a number of other states where individual parts are manufactured. It also includes specialists from as far away as Germany.

Under pressure from industry defense groups, members of Congress passed resolutions to slow the discontinuation of the program. They had to protect their local economies.

But for the A&D industry, this is actually a feature of the system... not a bug.

A&D companies spread their factories and supply chains to as many states as possible. This allows them to build dependency across local economies.

It also makes it nearly impossible to cut any program without serious backlash...

It also makes it nearly impossible to cut any program without serious backlash...

Diverse supply chains help protect revenue for A&D companies. But generally accepted accounting principles ("GAAP") make this step seem like a waste of money.

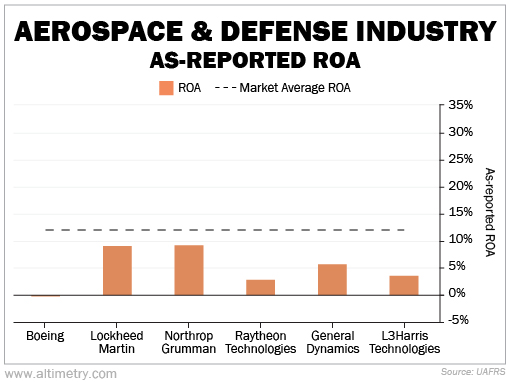

We can see this through the as-reported return on assets ("ROA") for a number of top defense companies – Boeing (BA), Lockheed Martin (LMT), Northrop Grumman (NOC), Raytheon Technologies (RTX), General Dynamics (GD), and L3Harris Technologies (LHX).

As-reported ROA for each of these companies is well below the 12% corporate average. Take a look...

Based on that chart, you might think this extra spending is a waste of time. None of these top defense companies have strong as-reported ROAs.

Uniform Accounting shows why A&D companies are spending to build diverse supply chains, though. It actually makes a huge difference for their businesses.

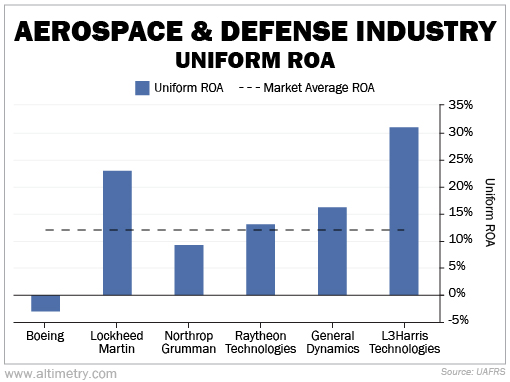

As you can see in the following chart, the A&D industry boasts much higher Uniform ROAs on average (except for Boeing, which is still working through years of production setbacks).

Lockheed Martin and L3Harris have Uniform ROAs of 23% and 31%, respectively. Check it out...

Uniform Accounting shows us that the strategy pays off. Most of the top A&D players are booking strong Uniform returns.

The A&D industry has made itself critical to local economies all across the country...

The A&D industry has made itself critical to local economies all across the country...

Because of this, it has effectively built itself a strong government backing. That makes it harder for the military to cut contracts... which translates to consistent A&D revenues.

And because it's so painful to cut small programs, there's not a huge risk that others will follow suit. It would take a lot for the government to unwind this web of production and local government interests.

This is a feature of how the industry develops its production locations. It makes its strong returns harder to challenge... and that's a good thing for A&D investors.

Regards,

Rob Spivey

February 16, 2023

After the Cold War, the Pentagon had to make some tough decisions...

After the Cold War, the Pentagon had to make some tough decisions...