Credit has been a shadow hanging over this market for years...

Credit has been a shadow hanging over this market for years...

Banks spent 2022 and 2023 tightening their lending standards. Corporations scrambled to refinance looming maturities.

And investors worried that, eventually, the squeeze would spill into earnings.

Even at the start of this year, credit was still the story. For the first time in 10 quarters, net tightening had dropped to zero toward the end of 2024. It looked like banks were done pulling back.

Then came "Liberation Day."

Investors worried tariffs would break balance sheets, damage cash flows... and restart the credit crunch.

That fear showed up in the second quarter, when banks went right back to tightening. For a moment, it looked like they had slammed the brakes all over again.

But these days, the data shows something different...

Banks are finally getting comfortable with the tariff story...

Banks are finally getting comfortable with the tariff story...

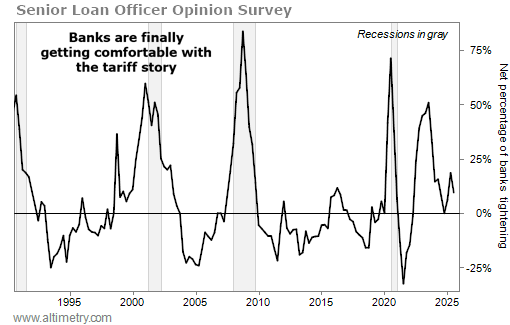

Regular readers know we measure bank lending standards through the Senior Loan Officer Opinion Survey ("SLOOS").

The SLOOS is a poll conducted every quarter by Federal Reserve regulators. It asks loan officers if their lending standards have tightened, loosened, or stayed the same over the past three months.

Said another way, it tells us how willing banks are to make loans... and how easy or difficult it is for corporations and consumers to access credit.

In the wake of Liberation Day, net tightening soared to 18.5%. But in the latest SLOOS reading, that number was down to just 9.5%...

Don't get us wrong – that's still a cautious reading. But it's less panicked. And it's a clear sign that banks are getting comfortable with the new tariff backdrop.

We're seeing the same trend across other credit indicators...

We're seeing the same trend across other credit indicators...

Investment-grade and high-yield spreads remain near their tightest levels of the cycle. Companies are refinancing debt at favorable terms.

And as earnings keep growing, the fear of a credit-driven slowdown is fading.

This is how credit cycles tend to move. Banks are slow. But lending standards and credit spreads say the backdrop is improving.

We should know even more once mid-September rolls around. That's when we expect the central bank's next rate decision... and all signals point to Fed Chair Jerome Powell cutting rates by at least 0.25%.

That doesn't mean we're in the clear. Valuations are still stretched. And sentiment remains elevated.

Still, credit is getting easier. Earnings remain strong. Those are the real long-term drivers of the market. And both are moving in the right direction. Positive changes should keep supporting stocks beneath the surface.

The mood on Wall Street has shifted from fear to relief...

The mood on Wall Street has shifted from fear to relief...

Not long ago, credit markets looked like they were heading straight into crisis mode. But cracks of light are beginning to show.

The latest signals suggest banks are finding their footing in this new environment.

Lending conditions are still cautious. But they're no longer in freefall.

In other words, the credit market that once seemed like a ticking time bomb may finally be stabilizing.

Regards,

Rob Spivey

September 8, 2025

Credit has been a shadow hanging over this market for years...

Credit has been a shadow hanging over this market for years...