In the wake of the 2008 financial crisis, Washington got serious about bank safety...

In the wake of the 2008 financial crisis, Washington got serious about bank safety...

And amid all the new rules and regulations, one stood out... the Supplementary Leverage Ratio ("SLR").

The SLR forced banks to hold more capital against all assets – even the safest ones like U.S. Treasuries. It was meant to guarantee banks had enough liquidity for when they incurred losses, and to prevent insolvency.

But now, that rule is under review. Regulators are preparing to ease the SLR, possibly exempting low-risk assets from the calculation.

And the timing couldn't be more important.

A move like that would instantly free up lending capacity across the banking sector... just as credit demand and earnings potential are starting to rebound.

In short, rolling back the SLR could unlock a powerful earnings tailwind across the economy.

The SLR is weighing down the lending engine...

The SLR is weighing down the lending engine...

The rule was born out of fear. Lawmakers didn't want another 2008-style collapse.

So they forced banks to hold capital against all exposures, including safe assets like cash, Treasurys, and central bank reserves.

In theory, the SLR would limit leverage systemwide. In practice, it discouraged lending and penalized market makers in the $29 trillion Treasury market.

It forced banks to step back in moments of stress... instead of stepping in.

But the conversation is shifting. Regulators are considering excluding these low-risk assets from the SLR.

Such a move could unlock as much as $2 trillion in new lending firepower, according to analysts at Autonomous Research.

And this change could ripple far beyond the banking sector...

And this change could ripple far beyond the banking sector...

Regular readers know the entire economy runs on credit. When banks lend more freely, small and midsized businesses can invest, hire, and grow.

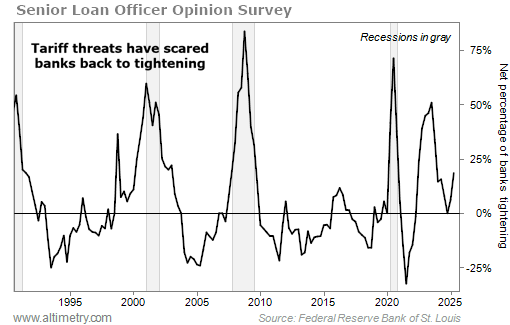

This particular change is coming at a great time, because credit hasn't fully "opened" for several years. The Federal Reserve's Senior Loan Officer Opinion Survey ("SLOOS") explains why...

The SLOOS is a quarterly survey conducted by Fed regulators. It asks loan officers whether their lending standards have tightened, loosened, or stayed the same over the past three months.

Put simply, it measures how eager banks are to extend loans... and how accessible credit is to both businesses and consumers.

Banks started tightening their standards in 2022 – around the time inflation started rising and the Fed stepped in with interest-rate hikes.

That tightening stopped a couple quarters ago. We expected them to start easing soon...

Then "Liberation Day" happened.

Banks panicked, assuming high tariffs would mean higher business costs for companies. And they hiked their standards yet again.

Check it out...

The trend might look disheartening at first glance. We seem to be going backward, not forward.

But tightening standards alone aren't a reason to panic... especially if these deregulatory pushes encourage banks to lend more.

An SLR rollback could be the spark that gets bank lending back on track...

An SLR rollback could be the spark that gets bank lending back on track...

And that, in turn, could power the whole economy higher.

Credit access is the lever that could lift earnings. Without the SLR, banks could deploy more capital at higher yields.

But the bigger story is what that means for corporate America.

Freer credit leads to more investment. More investment fuels stronger earnings. And as profits expand, the stock market follows.

The credit engine is starting to rev. This time, policy might finally be stepping out of the way.

Regards,

Rob Spivey

June 16, 2025

P.S. Two months ago, with markets all over the world crashing, I stepped forward with our most important buy alert of the year...

At the time, it seemed like a risky position to take. But everything that has happened since then has proved me 100% correct.

That's why, for the next 72 hours, I'm reissuing my advice – and offering a critical second chance to take advantage of the only stock market story that really matters.

It's not too late to make your move. But it is getting close. Don't miss out again... Click here for the full story.

In the wake of the 2008 financial crisis, Washington got serious about bank safety...

In the wake of the 2008 financial crisis, Washington got serious about bank safety...