GAAP accounting is so noisy that companies aren't even reporting when they restate their numbers...

GAAP accounting is so noisy that companies aren't even reporting when they restate their numbers...

Last week, the Wall Street Journal reported that pizza chain Papa John's (PZZA) restated its financial results back to 2009.

That in and of itself was not noteworthy. The big story was that the company had restated its numbers by more than 5% for several years back to 2009, and chose to not inform investors. Papa John's argued that the changes weren't significant enough to notify shareholders.

The U.S. Securities and Exchange Commission ("SEC") did not agree, and questioned Papa John's decision to not report the error.

This appears to be part of a growing trend of companies avoiding disclosing financial restatements. While this lack of disclosure is concerning, it also highlights that the complexities of GAAP are creating real issues for a company's management to even understand how to report its business' results.

As I mentioned in yesterday's Altimetry Daily Authority, even management teams need education on how to report and interpret their own financials nowadays...

In a 2006 U.S. Supreme Court case, Justice Antonin Scalia said an environmental regulation was 'turtles all the way down'...

In a 2006 U.S. Supreme Court case, Justice Antonin Scalia said an environmental regulation was 'turtles all the way down'...

His words were in reference to a story of a scientist and an old woman arguing about the nature of the universe. While the scientist said the solar system orbited around the sun, the woman argued the earth stood upon the back of a great turtle.

To this, the scientist asked what the turtle stands on, with the woman replying that this turtle rests upon an older, larger turtle. When the scientist asked what this turtle stood on, the woman replied triumphantly, "It's turtles all the way down!"

While this metaphor is commonly applied to philosophy, it's also useful in industry analysis when trying to map complex relationships between customers and suppliers. While all companies have suppliers and customers, eventually there's a supplier who should be declared the end of the line. This can be seen in the electronic-payments industry.

While "e-payments" have grown massively over the past decade, cash is still the most frequently used payment option for consumers. With around one-third of all transactions still made in cash, there is still significant room for expansion for the major industry players.

Not only is the digital-transaction space rapidly growing, it's ever-increasing in complexity. When we highlighted credit-card company Mastercard (MA) back in October, we mentioned that businesses like PayPal (PYPL) and Square (SQ) use the credit-card companies as underlying payment infrastructure.

But it doesn't end there...

Companies like Mastercard are not responsible for the technology behind the credit-card processing which goes on behind the scenes. With more than 40 million credit-card transactions per day, these businesses require the services of financial-technology companies to manage their transactions.

Many analysts have identified these payment-processing companies as potentially attractive investment options because these firms are the ultimate supplier that the booming e-commerce market stands on. And one of the most prominent is Fidelity National Information Services (FIS), also known as just "FIS."

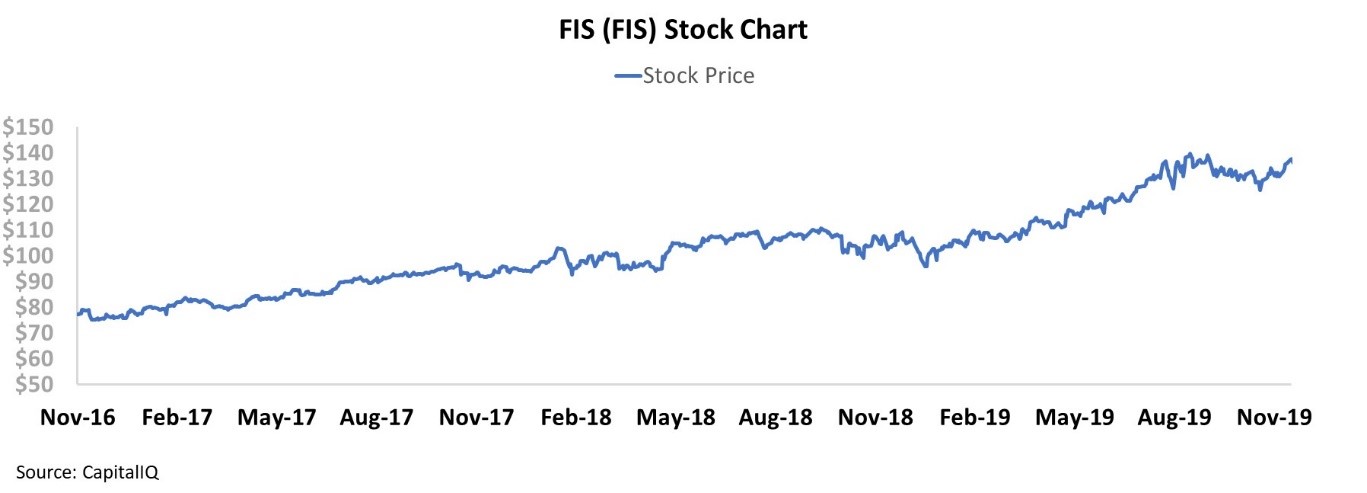

The company provides the technology for payment processing, retail banking, and investment banking. FIS has recently expanded through a rigorous mergers and acquisitions ("M&A") program. Over the past three years, the company's stock price has trended steadily upwards, from $77 per share in November 2016 to more than $135 today.

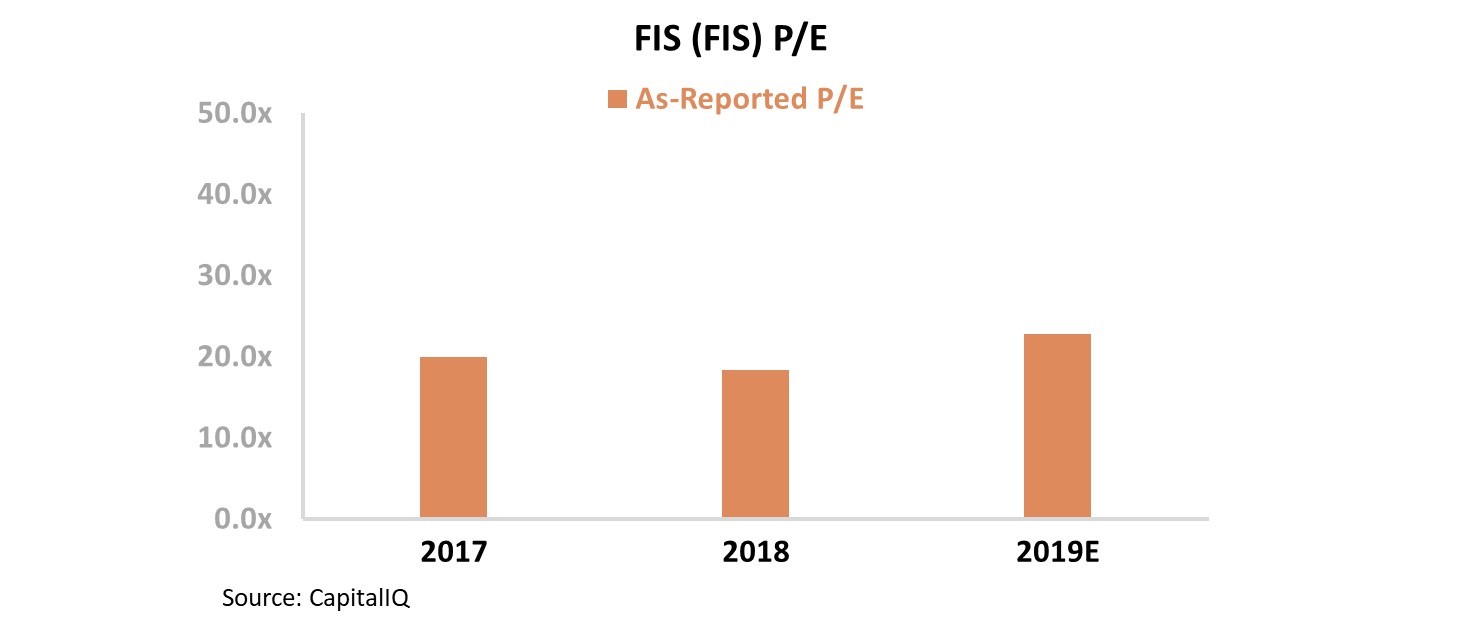

When looking to understand if FIS is still a good buy after such a big run higher, many investors have turned to the price-to-earnings ("P/E") ratio. With continued growth opportunities as the cashless economy expands, and an average as-reported P/E ratio of more than 22, FIS still appears to be an attractive investment opportunity.

If FIS can continue driving its acquisition strategy in its growing market, many investors may think that the company's stock could continue to rise.

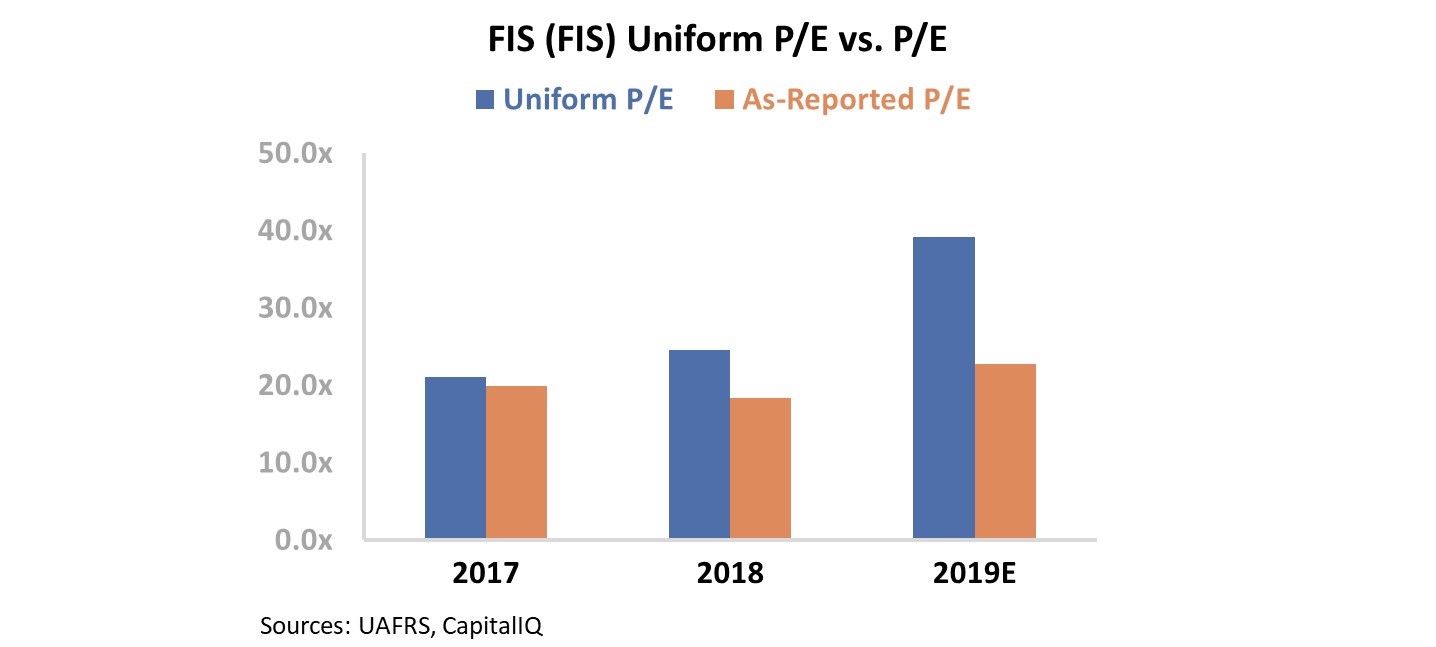

However, this thesis is built on the flimsy structure of GAAP accounting. Without accounting for goodwill, operating leases, and other adjustments, it's impossible to say if FIS is accurately priced after its acquisition spree. But under Uniform Accounting, the economic reality for FIS is much different...

The Uniform P/E for FIS has not held steady, but instead has risen significantly over the past few years. The company's current Uniform P/E is near 39 – almost twice the market average! Take a look...

After such a large stock run, FIS has become an expensive purchase rather than a smart investment into a still growing field. While the company has improved its profitability through its M&A program, the market has already priced this into the stock price.

Simply using as-reported metrics to guide investment decisions would be akin to claiming the world truly does stand on the back of a giant turtle. However, with Uniform Accounting, we can invest with a true understanding of business fundamentals.

Regards,

Joel Litman

December 10, 2019

GAAP accounting is so noisy that companies aren't even reporting when they restate their numbers...

GAAP accounting is so noisy that companies aren't even reporting when they restate their numbers...