A lot of companies have needed help in the past few years...

A lot of companies have needed help in the past few years...

In the midst of the pandemic, many businesses were able to refinance their debt at low rates. The government gave out loans to small and midsized businesses that were run well prior to the pandemic.

Between the U.S. Treasury Department's Paycheck Protection Program ("PPP") and the Federal Reserve's Main Street Lending Program, the U.S. government gave companies a bridge.

And low interest rates and reserve requirements – meaning how much money banks needed to keep at the Federal Reserve – meant companies could refinance debt out several years into the future...

These actions weren't normal. It's not often that we see the government give out so much money, so loosely, to keep companies afloat.

As we start to move on from COVID-19, many folks worry that this refinancing free-for-all will come back to bite us. Companies that should have gone under have survived for far too long... meaning there's not enough room for new and improved businesses.

It's the same scenario that has held back Japan's economy since the 1980s. And it's a scary prospect for the U.S. to face.

Astute subscribers know that last week, we flagged the Japanification of the U.S. economy as one of consulting firm McKinsey's two most likely scenarios from here. We also said that the U.S. has the strength and position to avoid this outcome.

Today, I'll explain why we're still in far better shape than Japan was during its economic bubble. As you'll see, we can rest assured the U.S. financial system is working as it should.

It all comes down to 'creative destruction'...

It all comes down to 'creative destruction'...

By that, I mean in order for the economy to keep growing, we have to let the laggards lose. It's the only way to push innovation forward.

Since interest rates started rising last year, that creative destruction has begun to show up. Companies that should have gone bankrupt... have gone bankrupt.

In June alone, another dozen or so companies went belly-up. That includes ATM maker Diebold Nixdorf and aerospace supplier Incora.

Defaults have been on the rise for months. In terms of bankruptcies, this has been the worst start to a year since the end of the Great Recession. We're even on pace to see more bankruptcies than we did during the pandemic.

These companies have just been using pandemic-era government programs to delay the inevitable. They couldn't keep it up forever.

Credit-ratings agency Fitch has proved this. The agency studied 30 companies that delayed their maturities or took on more debt during or after the pandemic. Twenty-four of them have either defaulted or undergone some other form of restructuring.

Failure was always on the horizon for these companies...

Failure was always on the horizon for these companies...

It was only a matter of time.

Bankruptcies are vital to any good capitalist economy. Companies that can't pay their debts have to go under. It allows capital to be allocated to areas with more opportunity.

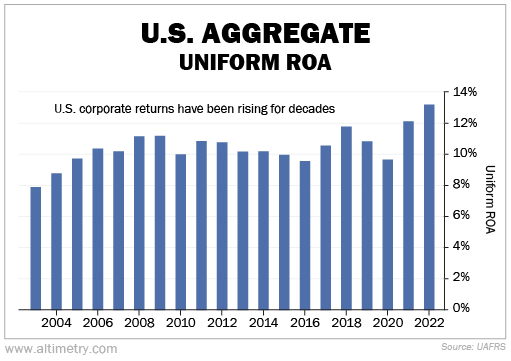

That's one of the key ways in which the U.S. differs from 1980s Japan. This willingness to not "save sacred cows" has allowed our aggregate Uniform return on assets ("ROA") to rise for most of the past 20 years.

Take a look...

In 2022, Uniform ROA averaged just over 13%. That's far higher than the 8% levels we saw in 2003.

The U.S. economy rewards well-run companies. It punishes those that aren't. This is what will set us on a path away from Japanification.

It's why we're still bullish on U.S. stocks... even though we could be in a sideways market for a while.

Regards,

Joel Litman

July 10, 2023

A lot of companies have needed help in the past few years...

A lot of companies have needed help in the past few years...