Japan was supposed to be the next superpower...

Japan was supposed to be the next superpower...

In the late 1980s, the island nation looked like it was on top of the world. It was on its way to pass the U.S. in gross domestic product, and everyone was in awe.

And then, something happened that sent the Japanese market plummeting. It still hasn't recovered to this day.

It's not some mystery... Japan had fueled much of its mania on cheap debt from Japanese banks.

Companies had borrowed tons of money to grow and invest. And when the economy slowed down, all those companies couldn't pay back their debt.

If you've been paying attention to the U.S. economy lately, this should sound familiar. It was already getting tougher to access loans, even before March's run on banks. And that trend has accelerated because of the chaos.

Banks are requiring more income verification on their loans... only supporting higher-quality borrowers... raising interest rates... and even just saying "no." Now, it looks like the Federal Reserve is starting to wake up.

Some Fed leaders have voiced concerns about what this means for lending and the U.S. economy. Chicago Fed President Austan Goolsbee said what we're seeing now is just the beginning.

We agree... although we don't think it's going to lead to a calamitous economic collapse, like some folks claim.

Even so, the U.S. needs to choose its next moves carefully. As we'll show you, if the U.S. banking system doesn't watch out, it might set itself up to recreate Japan's mess.

Japanese banks didn't want to force these companies into bankruptcy...

Japanese banks didn't want to force these companies into bankruptcy...

If they did, they'd have to realize these losses on paper.

Plus, many of these banks were part of massive conglomerates in a relationship known as "keiretsu." A keiretsu is an interlocking business network... meaning these banks had lent to their troubled sibling firms in the conglomerate. Letting one go under could have a domino effect on the rest of the system.

The banks were also worried about what so many bankruptcies would do to employment and the economy as a whole. So instead, they refinanced these loans to companies at the same low rates.

Let me say that in a different way. Instead of letting these companies go under... taking the loan losses... and cleaning up their balance sheets... these banks just papered over the issues.

It stifled growth and created what are called "zombies" – companies that can't even afford the interest on their debt. And it turned the banks into zombie banks that weren't doing their job of extending credit.

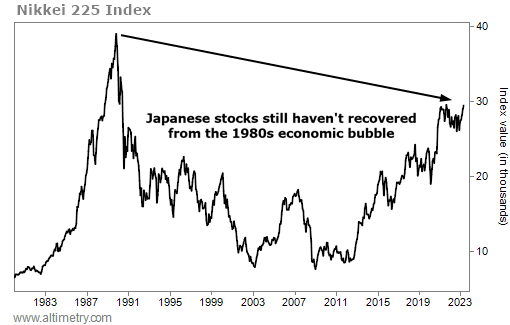

As I already mentioned, Japan's market still hasn't recovered. The Nikkei 225 Index, which tracks the companies in the Tokyo Stock Exchange ("TSE"), reached an all-time high in 1989. It has been below that level for more than three decades.

Take a look...

Japanese banks were making bad decisions... and keeping companies that should've gone bankrupt alive. That's why the infamous Japanese economic crisis was so bad.

Rather than letting some companies fail and then rebuilding, the way our recessions usually work, the whole system just stagnated.

Right now, many U.S. regional banks are at risk of doing the exact same thing...

Right now, many U.S. regional banks are at risk of doing the exact same thing...

For many of these banks, it makes more sense to extend and help refinance loans than to push for a real refinancing at higher rates. After all, the latter could lead to defaults... which could blow up banks' capital levels and sink them.

Many companies can't afford the loans they've taken out at current higher rates. So the banks are afraid to play hardball.

If they did, it would likely be the first step toward the Japanification of the U.S. financial system...

Fortunately, the situation in the U.S. isn't entirely set up like Japan. In Japan, the banks were shielded from the market by the conglomerates and the government.

In the U.S., the market can force the issue for banks it's really worried about. That's what has happened to a number of regional banks in recent months.

Granted, the market has overreacted in some of these cases. But it's healthy that U.S. investors can push banks to do what they should. Since these banks are having to confront their issues, they're more likely to clean up their dirty laundry... or get snapped up by other banks that will run things better.

The market is taking many of these midsized regional banks to task. That being said, there are more than 4,000 banks in the U.S. Plenty of the tiniest banks, both public and private, are flying under the radar.

These banks don't have loans that are about to default. They have borrowers who are locked in at artificially low rates, meaning the banks can't loan more. They also have borrowers who can afford their loans now... but can't afford them at higher rates.

And since they aren't under the market's microscope, they're the exact kind of banks that could mirror what happened in Japan. And like we saw with the Nikkei, that could seriously slow down economic growth in the U.S.

Interest rates need to come down so these banks can have sustainable balance sheets. Until that happens, we could be headed for a short-term lending winter.

We're still at risk of the Japanification of chunks of our financial system. That means continued weak growth as we head into a recession... and even when we come out of it.

The market is sitting close to its 2023 highs. Some investors are taking a more optimistic view of the market. Don't get complacent... To be successful in this environment, you have to be smart and focused with your money in the coming months.

Regards,

Rob Spivey

May 15, 2023

P.S. In a choppy and uncertain environment – like we're seeing today – it's important to watch out for catalysts that could make waves in the market. My colleague and Altimetry founder Joel Litman says that's exactly what he's found. And investors only have a little more than a month to prepare...

Joel recently went on-air for an urgent briefing, in which he revealed the upcoming event that's set to move $10 trillion worth of stocks in a single day. According to Joel, the last time this event took place, 118 stocks crashed between 20% and 90%. But if you know what to look for (and how to prepare your portfolio), you can still come out on top. Get the full story here.

Japan was supposed to be the next superpower...

Japan was supposed to be the next superpower...