This home-fitness brand is all flash and no substance...

This home-fitness brand is all flash and no substance...

Peloton (PTON) just reminded everyone earlier this month that the "At-Home Revolution" doesn't mean perpetual growth for all of the companies exposed to it.

The stationary bike and treadmill maker missed on both top- and bottom-line estimates. It also took an axe to its forecasts, guiding revenue down from $1.5 billion to between $1.1 billion and $1.2 billion for next quarter... and reduced its full-year estimates from a consensus $5.4 billion to between $4.4 billion and $4.8 billion.

The At-Home Revolution was a popular investing theme, and three kinds of companies participated in it, each with different levels of sustainability:

- The firms with a one-time bump as preexisting demand was suddenly pulled forward.

Deck renovations are a great example. Those who had extra time on their hands and a newfound attention to the quality of their homes suddenly decided to renovate in 2020 rather than wait a few years. This also includes home theater systems, solar panels, and furniture.

- Companies whose offerings suddenly became more viable, albeit for unsustainable reasons.

This includes at-home education tech companies like Chegg (CHGG), which we recommended in May 2020 and was up 94% when we closed it seven months later. Peloton also falls into this category. Consumers anticipated at-home exercise to become a permanent lifestyle change, but as gyms reopen, Peloton's value to customers is beginning to dwindle.

- Companies for which the At-Home Revolution unlocked faster secular growth trends (i.e., telehealth).

The pandemic caused consumers and businesses to realize that certain tasks were better at home. This spawned entirely new ways of doing business and creating new demand, like video conferencing and grocery delivery.

We've spent a lot of time talking about the At-Home Revolution, and we think now is the right time to tell our readers that as we approach a full recovery from the pandemic, only this category remains viable from an investment standpoint.

It may be time to close the book on companies that were compelling 15 months ago due to a temporary shift toward all things at home.

Investors who remain bullish on the wrong At-Home Revolution names may be set up for failure...

Investors who remain bullish on the wrong At-Home Revolution names may be set up for failure...

Even after Peloton's stock dropped more than 40% post-earnings, the market still isn't fully grasping how unsustainable last year's tailwinds are.

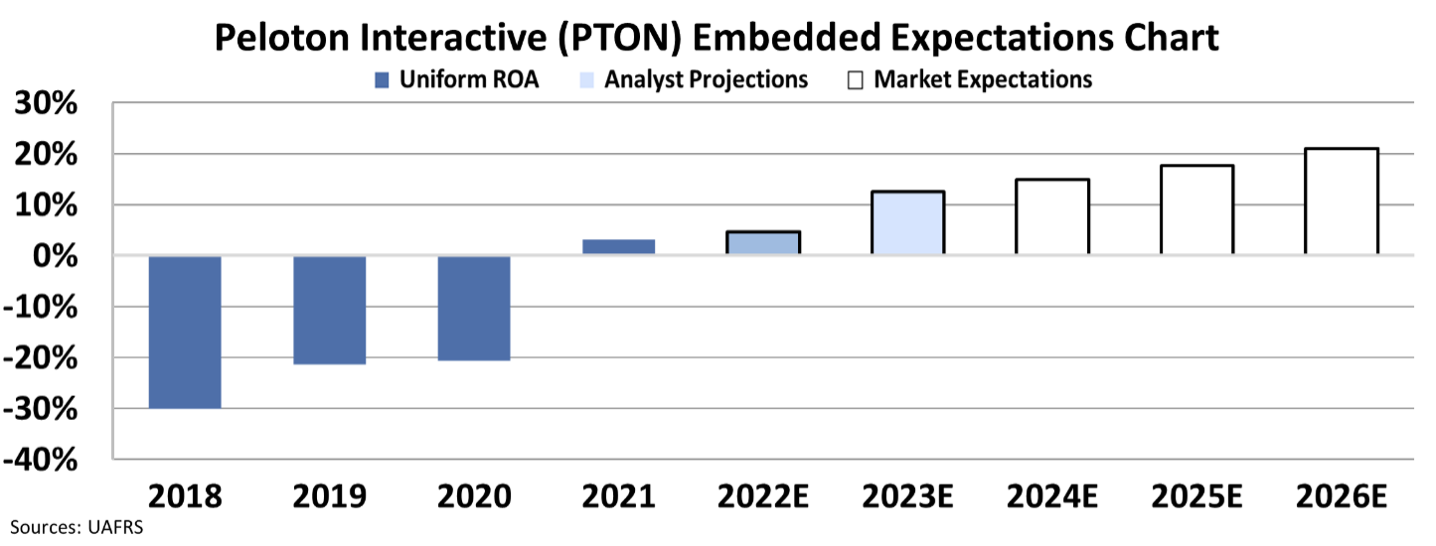

We can see this by comparing performance implied by the current valuations to consensus analyst expectations. Similar to Tesla (TSLA), another popular stock we discussed yesterday, analyst expectations are leagues lower than market-expected performance.

Let's assume the company grows at 20% a year, which is in line with Wall Street revenue growth estimates. Peloton – which saw its return on assets ("ROA") barely turn positive in 2020 thanks to the pandemic tailwinds – would need to see ROA spike to 21% going forward.

That's the performance needed to justify today's stock price. Take a look:

This sort of ROA is reasonable for many companies selling leisure products. Bowflex maker Nautilus (NLS), for instance, has a 14% ROA. But with Peloton struggling to show growth now that ROA has turned positive, it may be unrealistic for the company to sustain these improvements as the At-Home Revolution's tailwinds fade.

Expectations were even loftier before its first-quarter call. Unsurprisingly, when the company failed to hit those consensus estimates, the market was disappointed and shares tumbled.

Embedded Expectations is the reason PTON shares were down nearly 40% in a single day earlier this month...

Embedded Expectations is the reason PTON shares were down nearly 40% in a single day earlier this month...

Even after the drop, we still think Peloton's expectations are too aggressive.

However, the At-Home Revolution isn't a closed book just yet. The trick is to find companies that are experiencing new, secular growth opportunities as consumers permanently rethink the role that their homes play in their lives.

We've found five companies still riding this trend, three of which are obvious buys at today's levels. You can learn how to gain instant access to these names – and claim a special, 75% off offer – by clicking here.

Regards,

Joel Litman

November 17, 2021

This home-fitness brand is all flash and no substance...

This home-fitness brand is all flash and no substance...