Why would the CEO of one of the largest global consulting houses step down at 54?

Why would the CEO of one of the largest global consulting houses step down at 54?

It was the question the audience was asking itself at a recent event held at the Harvard Club last month in Boston on "How a Global CEO Reinvents the Workforce."

As I mentioned in yesterday's Altimetry Daily Authority, my close friend and colleague Miles Everson spoke at this event.

Over two years ago, Miles stepped down as global head of consulting and advisory at PwC – also known as PricewaterhouseCoopers – one of the "big four" super consultancies.

For those unaware, PwC is among the top five largest private companies in the U.S. Globally, the firm posts annual revenue of more than $40 billion.

Miles saw a massive disruption happening in how employees, contractors, and personnel vendors interact and even "feel" about their employer/clients... and vice versa.

Though he could have retired, his decision to leave wasn't so that he could spend time on a beach.

Miles left PwC to become the CEO of a much smaller, yet highly innovative firm called MBO Partners. The Virginia-based firm's mission is to assist companies worldwide with something called "workforce optimization."

There's a massive disruption in how employees, contractors, and personnel vendors interact with firms and vice versa.

Miles sees an amazing opportunity to help transform the global workforce, with great promise for the firms that embrace the coming change.

At the event, Miles discussed how important it is to embrace the workforce in its entirety – calling for businesses to build trust with all those who contribute to the firm's success, including nonpermanent subcontractors and freelancers.

Too often, companies think of their employees as "part of us" and contractors and other personnel as outsiders to the firm.

True workforce optimization leads to improved efficiency and enhanced creativity, innovation, and growth. It leads to lower costs and increases economic profitability for the business.

Miles spoke of how it also increases "business resilience" to shocks in the economy and the system, as we have seen around the world.

He also warns against the antiquated concept that a single firm, no matter how big, could store in-house all of the knowledge needed to compete and grow.

Instead, the right knowledge – and the right knowledge workers – need to be viewed with more flexibility, ready and accessible by the firm when required.

CEOs often say, too casually, of course, that "people are their greatest asset."

Miles is helping management teams define what that best asset truly is and how to build and cultivate it to compete and win in the coming decades.

If you are interested in hearing what this means for investors, you can sign up for the 2021 Stansberry Conference & Alliance Meeting in October. Miles will be speaking about how this will affect markets for years to come.

If you think Miles' view of workforce disruption is a one-off issue, you are missing a massive wave of change happening…

If you think Miles' view of workforce disruption is a one-off issue, you are missing a massive wave of change happening…

While Miles is the CEO of a highly disruptive and innovative private firm, other publicly listed companies serve as peers to the strategy and future that Miles envisions.

Smart investors recognize the opportunity.

With other people's money on the line, investors are often a great canary in the coal mine as far as learning about change within an industry... long before the actual disruption occurs.

For instance, there's a reason auto suppliers with no exposure to electric vehicles have been priced at a discount for 10 to 15 years now... because investors know they're going to be disrupted by the coming industry transition.

The same applies to coal companies and other businesses in industries faced with extinction: They can trade at single-digit valuations for now, but eventually, they will disappear altogether.

However, the flip side is true for companies with business models that position them to be the disruptors: They are likely to be priced for creating massive value once the market realizes their potential.

Long before Adobe (ADBE) finished its Software as a Service ("SaaS") transformation or Tesla (TSLA) turned a profit, investors caught wind and began piling into shares.

MBO Partners – Miles' firm – isn't public, so we can't look at its valuation, but other companies are focused on the same disruption.

One, in particular, is Upwork (UPWK). The freelancing platform focuses on helping companies, and independent contractors match supply and demand for each other's skills and needs. It's not the same business. However, it does provide a strong comparable.

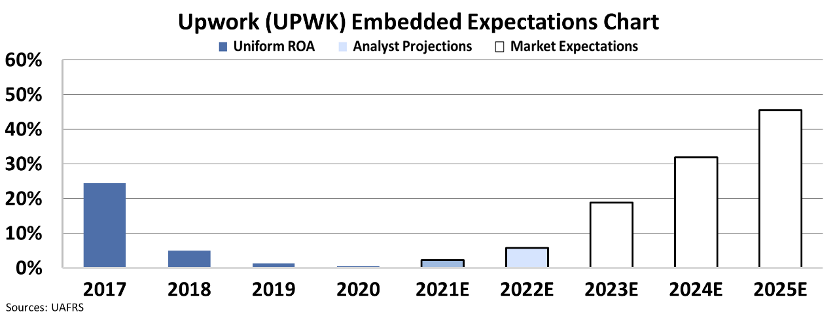

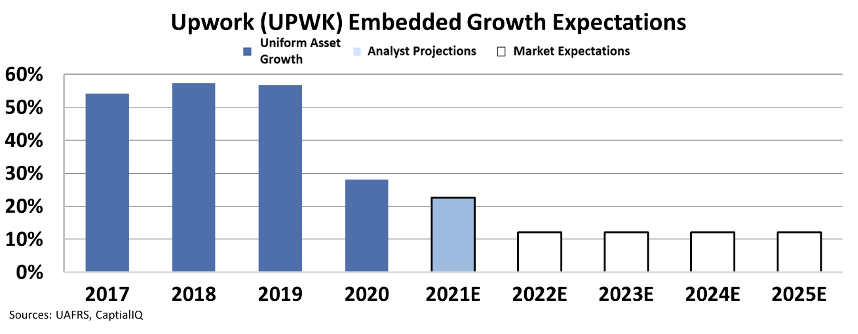

Looking at the market's future expectations for Upwork, which we can do with our Embedded Expectations Analysis framework, we see that investors are betting trends in workforce disruption will continue.

Specifically, we see that the market is pricing Upwork's return on assets ("ROA") to rise from 0% in 2020 to 46% by 2025, all while growing the business by 12% a year.

A company with returns nearly four times the market average, along with strong growth in assets, is a powerful combination.

It pays to stay informed about which industries and companies that investors believe are next. This is more evidence that when the market thinks a disruption trend is real and important to the players themselves and investors, it prices it well in advance.

Regards,

Joel Litman

August 27, 2021

Why would the CEO of one of the largest global consulting houses step down at 54?

Why would the CEO of one of the largest global consulting houses step down at 54?