Ken Griffin didn't build the biggest hedge fund in the world on pure luck...

Ken Griffin didn't build the biggest hedge fund in the world on pure luck...

He did it by understanding how the market operates.

That's how he managed to lock in a 38% gain through Citadel last year... and booked a $16 billion return, the biggest single-year gain in hedge fund history. And he did it even as the market fell 20%.

These days, Griffin is preparing for a recession. And yet, most folks don't seem to be listening...

Retail investors and trend chasers are racing to follow the artificial-intelligence ("AI") mania. They're sending tech stocks like Google parent Alphabet (GOOGL) and chipmaker Advanced Micro Devices (AMD) soaring. Semiconductor giant Nvidia (NVDA) is up 190% since the start of the year.

It's telling that some of the most successful institutional investors in the world are moving in a different direction.

Griffin doesn't seem thrilled about the market's prospects for 2024. He says Citadel is looking at the high-yield credit market as a way to bet on things getting worse in the short term.

We agree.

Today, we'll talk about why Griffin's focus makes sense as we gear up for a recession. And we'll discuss the credit signs that tell us a downturn could be on the way.

Tough times lead to more defaults... and that's what we're starting to see today.

Tough times lead to more defaults... and that's what we're starting to see today.

When you invest in a company's bonds, you're buying a piece of its debt. So if more companies are going bankrupt, the risk of holding those bonds is higher.

As a result, investors demand an even higher yield as compensation.

Bond prices and yields move in opposite directions. So if yields are on the upswing, the prices of those bonds will fall. And that tends to start with the most risky bonds – which is why they're sometimes called "high yield" bonds.

High-yield bonds are issued by companies with riskier balance sheets... meaning they're more likely to default. When the economy gets worse, these bonds' yields tend to rise the most.

More bonds are also getting downgraded to high-yield status...

More bonds are also getting downgraded to high-yield status...

According to Barclays, the full-year volume of downgrades in 2023 is on pace to be the highest since 2020.

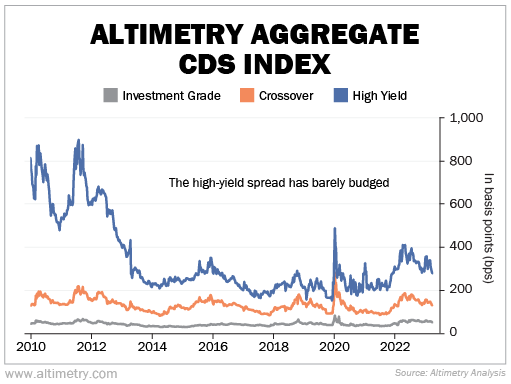

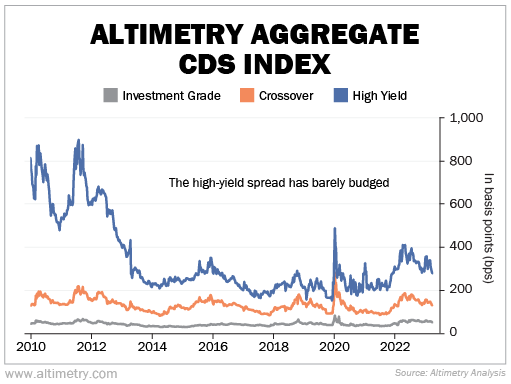

And yet, the market doesn't seem all that worried. We can look at how the market views credit risk by looking at credit default swap ("CDS") spreads.

CDS spreads represent the difference between the "risk-free rate" and what companies pay to finance their debts. We've aggregated all CDS spreads across high-yield bonds, investment-grade bonds, and crossover (the lowest-rated "safe" bonds and the highest-rated "junk" bonds) to get a sense for how the market views credit risk today.

For high-yield credit, spreads are currently below 300 basis points ("bps"). Said another way, to refinance, risky companies need to pay roughly 3% higher than today's U.S. Treasury yield.

That's not much higher than the spread's average for the past five years... and it's way lower than it was last year.

Take a look...

As you can see, the high-yield spread spiked much higher than the other categories during the Great Recession. We're nowhere near those levels of fear today.

The market isn't remotely spooked about corporate health. Look at how high those CDS spreads were just after the Great Recession. It's common for them to get up to 700 basis points, if not higher.

Defaults are on the rise... and the market is asleep at the wheel.

Defaults are on the rise... and the market is asleep at the wheel.

While everyone else focuses on AI and tech, Ken Griffin is waiting for a high-yield bargain sale. He knows the prices of these distressed corporate bonds will soon plunge.

And if you're paying attention, you could profit right alongside Griffin...

Make sure you have cash ready on the sidelines. When credit spreads widen, there will be great opportunities to buy cheap bonds with huge yields... while everyone else is scrambling for cover.

Regards,

Joel Litman

July 7, 2023

Ken Griffin didn't build the biggest hedge fund in the world on pure luck...

Ken Griffin didn't build the biggest hedge fund in the world on pure luck...