Two weeks into 2026, the bond market is sending a powerful message...

Two weeks into 2026, the bond market is sending a powerful message...

Companies are laser-focused on capital. They're raising money by issuing bonds... at a blistering pace.

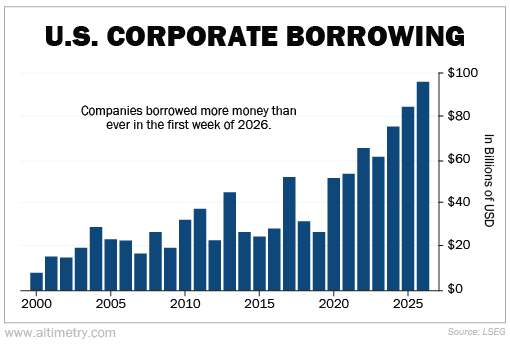

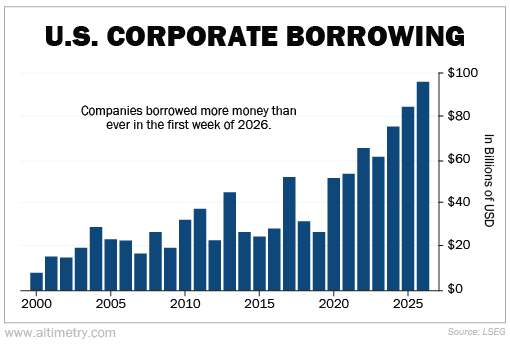

Wall Street has never seen anything like it. In the first week of 2025, companies borrowed more than $80 billion. This year, they blew past that number.

Right now, interest rates are falling... So it costs less to borrow money. Some bonds are helping companies refinance debt at lower rates. But there's more to the story.

Corporate America has big plans for growth... and those plans require funding.

With bond-fueled financing on the rise, we're gearing up for a better 2026 than many folks expect.

Corporate investments have shattered every precedent...

Corporate investments have shattered every precedent...

According to LSEG data, companies issued more than $95 billion of investment-grade bonds in the first week of 2026.

Semiconductor manufacturer Broadcom (AVGO) raised $4.5 billion. French telecom company Orange raked in $6 billion. And Japan's Sumitomo Mitsui Financial raised $5 billion.

That made it the busiest opening week ever. That level of corporate borrowing even surpassed the COVID-19 surge. Take a look...

Why does this matter? Because first-week bond issuances give us a good idea about corporate spending for the rest of the year. And that ties into growth.

Right now, corporate decision-makers expect to deploy capital, not sit on their hands.

It's a clear sign that companies will keep investing and growing. That makes 10% annual earnings growth seem possible...

As we wrote in early December, expectations are running at or above 9% growth for 2026.

That's a great sign for the stock market this year...

That's a great sign for the stock market this year...

Take Broadcom, which is at the center of the AI boom. Last week, the company announced the launch of a next-generation system-on-chip... It's designed to unify high-performance computing, networking, and AI functions.

Broadcom's $4.5 billion raise, and this recent development, signal that there's more room to run in the AI sector.

Large financial institutions tend to move cautiously early in the year. So Sumitomo Mitsui Financial's $5 billion deals add another layer of optimism...

The company is planning a major expansion in India and Southeast Asia. This extra cash will help it fund growth in that region sooner rather than later.

Altogether, financial services firm Morgan Stanley (MS) expects investment-grade fundraising to approach $2.25 trillion in 2026. That means companies are poised for serious growth.

Borrowing more today means spending more tomorrow...

Borrowing more today means spending more tomorrow...

We just witnessed the hottest-ever bond issuance. That means companies are raising lots of capital.

They're going to spend and invest that money, which will boost earnings.

The market should benefit from this surge in the second quarter of 2026. A bigger uptick is likely in the second half of the year.

All of this suggests corporate earnings will keep rising despite negative investor sentiment.

The bottom line is, big earnings signal a strong market... and good opportunities for investors in 2026.

Regards,

Rob Spivey

January 14, 2026

Two weeks into 2026, the bond market is sending a powerful message...

Two weeks into 2026, the bond market is sending a powerful message...