All year long, investors treated interest-rate cuts as a simple story...

All year long, investors treated interest-rate cuts as a simple story...

Until they didn't.

The Federal Reserve finally slashed rates in September. The market took it as a signal that we'd re-entered a major rate-cutting cycle.

Within a few weeks, traders were expecting rates to drop as low as 2.5% by late 2026, without much drama.

But the path of monetary policy is rarely so clean. And over the past month, expectations have shifted...

It's not because the underlying economy has weakened. Earnings growth remains strong. Credit conditions are still healthy.

Investors simply got ahead of the Fed.

Central-bank members are no longer speaking with one voice...

Central-bank members are no longer speaking with one voice...

A December rate cut, which seemed like a done deal in early fall, has become a point of debate.

Fed Chair Jerome Powell even went on the record at the end of October, saying a December cut is "not a foregone conclusion."

His comments sparked some of the sell-off over the past few weeks. In the wake of the news, the market fell as much as 5%... and it's still down 2%. Powell also dampened the market's expectations for future rate cuts.

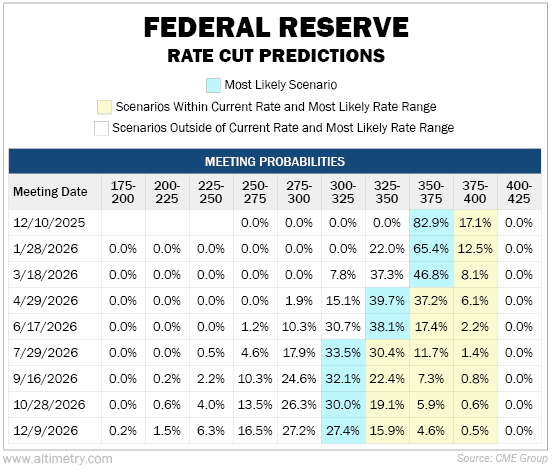

Longtime subscribers know we get a sense of market interest-rate expectations through the CME FedWatch Tool. It tracks sentiment in the futures market.

Remember, just a month or so ago, investors thought we'd get rates as low as 2.5% next year. But now, they're not convinced rates will drop below 3%.

Check it out...

Some Fed officials don't want to cut rates any further until inflation reaches the 2% target. Others argue that cooling labor data warrants more support.

This divide has the market concerned about what's next.

The reset hasn't changed the bigger picture, though...

The reset hasn't changed the bigger picture, though...

It has simply pulled some heat out of a market that got a little too comfortable.

At the same time, investors seem to be forgetting about an important event that's just around the corner...

Powell's term ends on May 15, 2026. And President Donald Trump has spent the year pushing for much lower rates.

A divided December meeting won't alter that trajectory. Trump has made it clear he'll appoint a new Fed chair who favors more rate cuts.

This environment goes far beyond the next six weeks.

Near-term bumps haven't changed the mid-term story...

Near-term bumps haven't changed the mid-term story...

Rate cuts are still the path forward.

Earnings growth remains strong. Expectations are running at or above 9% growth per year over the next two years. As rates keep falling, credit conditions should improve further.

If anything, today's slightly cooler sentiment makes the overall setup healthier.

Taken together, this adjustment in expectations sets up a favorable backdrop for the end of 2025... and into 2026.

The recent sell-off takes a bit of pressure off sentiment. The economy underneath remains intact.

Regards,

Rob Spivey

December 1, 2025

All year long, investors treated interest-rate cuts as a simple story...

All year long, investors treated interest-rate cuts as a simple story...