Amid the tragic consequences of the coronavirus pandemic, it's easy to forget the pressure on sports...

Amid the tragic consequences of the coronavirus pandemic, it's easy to forget the pressure on sports...

Back in October, we talked about how the industry is suffering from the delayed return to normalcy both in the U.S. and across the globe.

That means limits or outright bans of fans in stadiums have continued into 2021. For example, only 22,000 fans – and 30,000 cardboard cutouts – were in attendance at the Super Bowl earlier this month.

The restrictions are also hurting America's pastime: baseball. MLB teams have taken the opportunity to trim the cost of the minor leagues.

Currently, the major league teams help pay for and sponsor local minor league teams. In exchange, the minor league serves as a talent funnel for the MLB.

Numerous minor league fields dot the country... But the MLB is scrapping more than one-quarter of small clubs, located mainly in Appalachia and the rural West.

As a huge baseball fan and a season ticket holder for the Boston Red Sox, I've watched these developments with a minor level of horror. The elimination of this arm of baseball will destroy thousands of jobs... and change how many folks enjoy the game.

Food catering represents just one sports-related job sector affected by the pandemic...

Food catering represents just one sports-related job sector affected by the pandemic...

One of the many industries supporting sporting events are the food vendors who keep attendees quenched and fed during the game.

In the early days of baseball, many of these vendors were local restaurants that established carts or stalls inside the stadium. Today, vendors are large, multinational corporations that operate beyond stadiums... They also cater to businesses like hospitals, school cafeterias, and office parks.

The way these players make money is often by increasing volume. If they have more contracts in an area, they can reduce their unit costs – both by negotiating lower prices for goods and spreading fixed costs. And by developing new products and ways to reduce costs, bigger companies can lower costs even further.

In this industry, bigger often really is better.

Today, Britain-based Compass Group (CPG.L) is a global leader in the industry...

Today, Britain-based Compass Group (CPG.L) is a global leader in the industry...

It has operations in 45 countries and serves more than 5.5 billion meals per year. And yet, GAAP metrics paint a bleak picture of profitability.

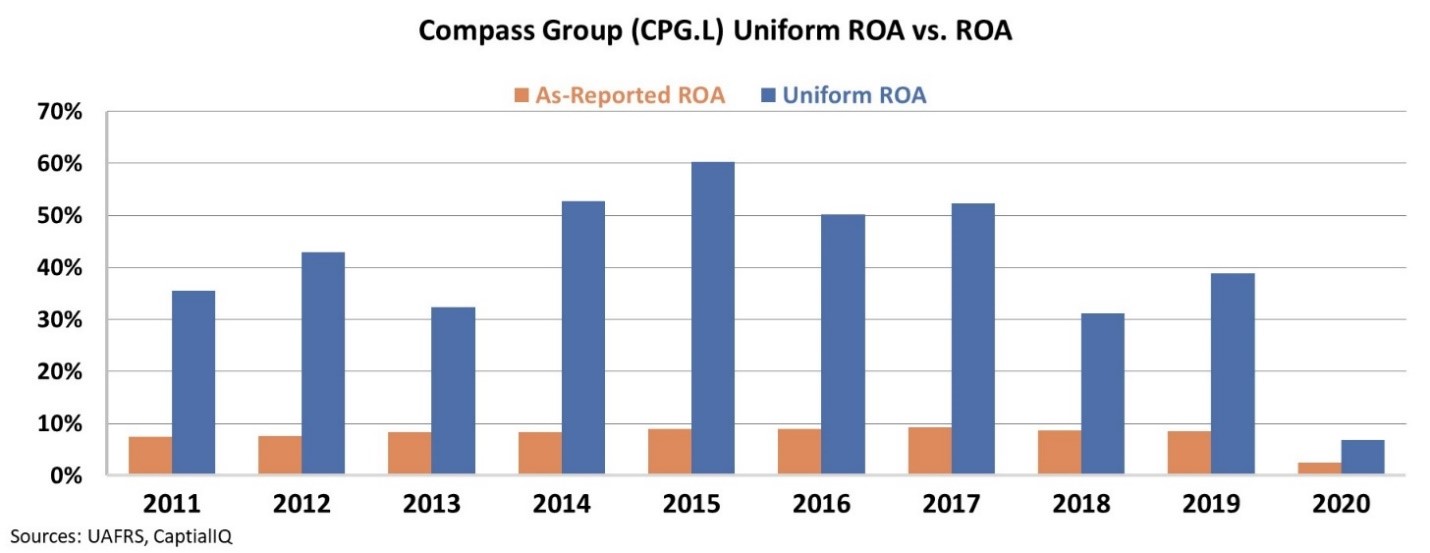

Using only the as-reported numbers, it appears the company has seen returns stagnate. Since the Great Recession, Compass' return on assets ("ROA") hasn't broken through 9% – staying consistently below corporate-average levels of 12%.

Even in good times, it looks like Compass has weak returns... so investors could be hesitant to consider a company that might be losing existing contracts with sports leagues and other clients rethinking the need for these services.

But investors looking at these numbers are thrown off by GAAP metrics...

But investors looking at these numbers are thrown off by GAAP metrics...

Due to as-reported distortions in interest expense, goodwill, and more, the real story for Compass is much different.

In reality, the company's Uniform ROAs have been well above the corporate average – even reaching highs of 60% in 2015. Thanks to its ability to staff on demand and not directly own its facilities, Compass can have high returns and generally cut costs in a normal environment when needed, in order to match expenses to revenues.

Of course, 2020 was an extraordinary year. No level of cost-cutting would have allowed expenses to totally match the decline in revenue this year... so Compass' Uniform ROA did drop significantly. However, considering that returns have never been that low before, it also goes to show how resilient the company is in a normal environment.

And more important, investors – looking at bad as-reported data – don't recognize how resilient Compass' returns can be...

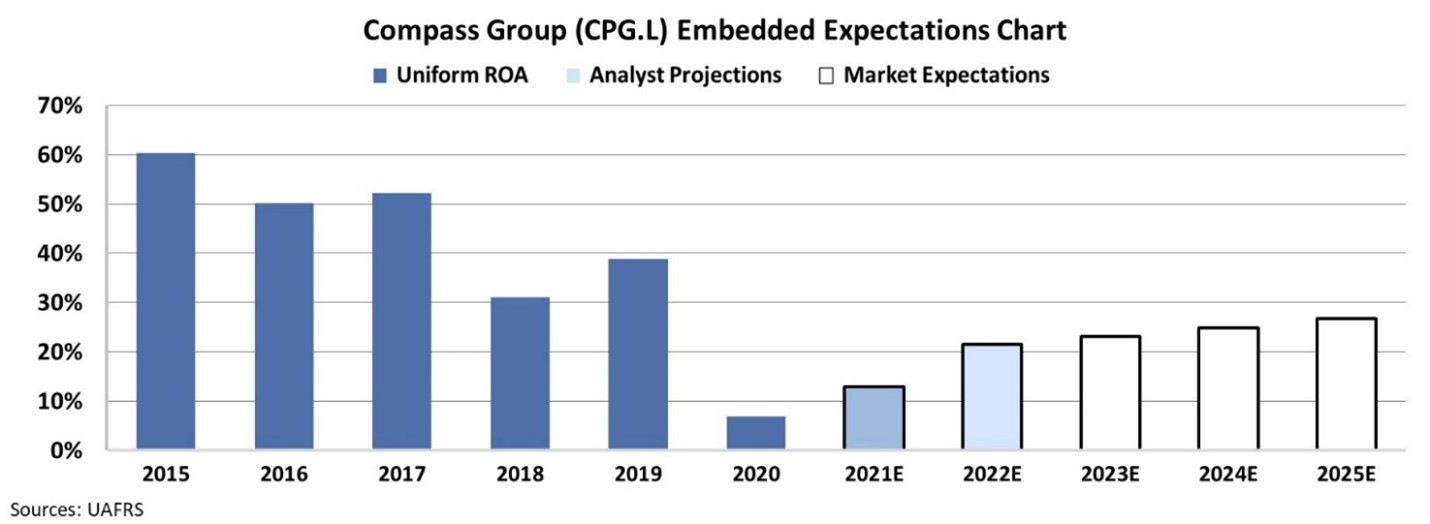

For this, we can examine how the market is pricing in Compass to perform after the pandemic.

For this, we can examine how the market is pricing in Compass to perform after the pandemic.

Most investors determine stock valuations using a discounted cash flow ("DCF") model, which takes assumptions about the future and produces an "intrinsic value" of a particular stock.

However, models with garbage-in assumptions only come out as garbage... So here at Altimetry, we turn the DCF model on its head. We use the current stock price to determine what returns the market expects a company to make. This is the basis for our Embedded Expectations framework.

In the chart below, the dark blue bars represent Compass' historical corporate performance levels in terms of ROA. The light blue bars are Wall Street analysts' projections for the next two years. Finally, the white bars are the market's expectations for how Compass' ROA will shift over the next five years.

As you can see, Wall Street analysts already expect Compass' returns to start to recover and hit 22% by 2022. The market is pricing in returns to move slightly higher from there – reaching 27% by 2025.

However, with Compass able to match supply and demand so well in a normal environment, expecting returns to sit this low going forward looks unreasonable. Its scale alone means it has more resilient returns than the market – looking at bad GAAP data – may recognize.

Compass is well-positioned for when sports – and the rest of the world – return to normal... The market just doesn't seem to get it yet.

Regards,

Rob Spivey

February 17, 2021

Amid the tragic consequences of the coronavirus pandemic, it's easy to forget the pressure on sports...

Amid the tragic consequences of the coronavirus pandemic, it's easy to forget the pressure on sports...