According to management consulting firm McKinsey, the recovery from coronavirus pandemic will be digital...

According to management consulting firm McKinsey, the recovery from coronavirus pandemic will be digital...

Meaning that it'll be a recovery that will be from the home.

Last month, McKinsey Digital put together an interesting report on some of the recent trends – as well as ones that could happen – that the firm has seen as the economy recovers from the pandemic.

One of the key things for a template to recovery was to look at Chinese consumption trends during and after the pandemic relative to history. A major signal that jumped out was that offline consumption didn't recover as much as the economy as a whole did after the pandemic receded in China. Instead, people kept buying things online.

Similarly, since the pandemic struck the U.S., significantly more people have become first-time users of digital options for entertainment, groceries, apparel, utilities, and other types of consumption. Simply put, folks are getting more comfortable doing things online.

And as McKinsey highlights, the level of change in working from home in many industries is staggering... It's so dramatic that it will be almost impossible to totally reverse.

Before the pandemic, less than 5% of employees in finance worked remotely. Compare that to today, with more than 70% working remote. For IT, media, and telecom, this figure jumped from 9% to 84%. And for manufacturing – which many would assume needs to be a hands-on role – remote work has risen from 2% to 61% of total work during the crisis.

Of course, McKinsey is attempting to sell consulting services – that's how the company makes money. So a major focus of the report was how companies can take advantage of this shift... and how McKinsey can help.

But that's important, because initiatives like this from McKinsey are only going to further amplify the trends that are growing stronger for the "At-Home Revolution." Beyond just working from home, this also involves playing at home, supplying yourself at home, and protecting your home.

As the trend plays out, certain businesses will be major winners... and we've identified 12 that are poised to profit for readers of our Altimetry's Hidden Alpha newsletter. To learn more about what this trend means for investors – and gain instant access to these recommendations – click here.

Economics are dictated by supply and demand...

Economics are dictated by supply and demand...

Factors like limited supply and high demand can create massive profits for companies. In the June 9 Altimetry Daily Authority, we discussed how this dynamic can make for a good monopoly or oligopoly.

But the truth is, most industries don't enjoy forces like high barriers to entry, inelastic demand, and limited replacements.

In fact, most markets have real competitive pressures – meaning it's difficult (if not impossible) to build a sustainable competitive advantage.

You might assume that since consumer staples like food, paper products, and gasoline are in demand by pretty much everybody, they'd be profitable.

However, all of these products are commodities. This means that it's hard to differentiate your product. And without product differentiation, industry participants have to compete on price.

Even with massive, stable demand, we tend to see commodity products like gasoline generate average returns.

This is a supply-side issue... The supply roughly matches demand, and suppliers don't have pricing power. Branding or other efforts to create perceived value aren't working.

Another great example is in the semiconductor industry. Just about every device you own requires at least one of these little chips to operate, and the number of devices that use them are continuing to skyrocket.

Before these products reach you, all of the components have to go through extensive testing, right down to each integrated circuit ("IC").

These are the building blocks for semiconductors. Each IC is tested and packaged for chipmakers to turn into full chipsets.

It should go without saying the demand for IC testing and packaging is huge, stable, and growing.

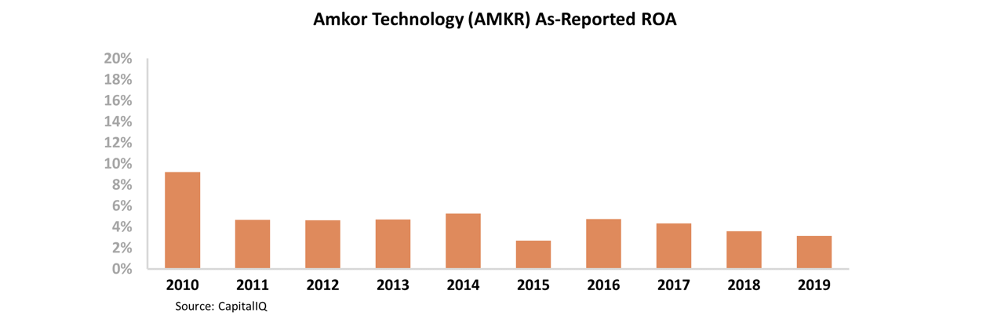

Today, Amkor Technology (AMKR) is one of the main IC testers. Despite the fact that IC testing is in high demand and it's a necessity, it's not a value-add service. As a result, it should be no surprise that Amkor's profitability has largely been average over the past decade...

Despite demand growing exponentially since 2010, Amkor's return on assets ("ROA") has essentially remained flat – at or below long-term average levels.

As semiconductor demand has grown, so has the supply side. It's a boring, stable, commodity business.

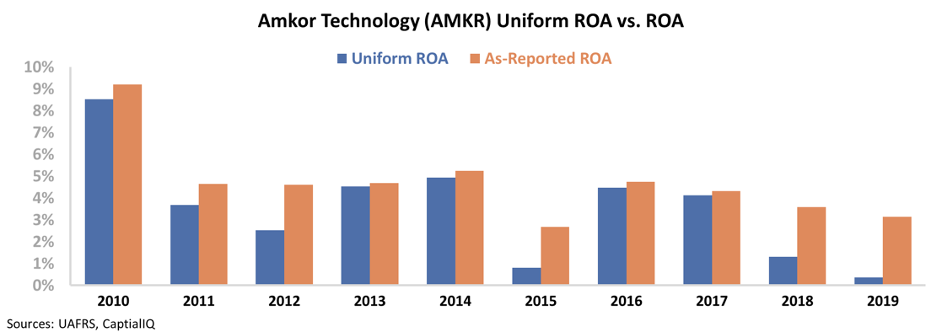

But once we apply our Uniform accounting metrics, we can see that Amkor has performed even worse than average in the last several years. The company's returns are accelerating lower.

After adjusting for misleading as-reported accounting standards – such as depreciation, research and development (R&D), and excess cash – it's clear that although Amkor's products are necessary, they aren't profitable.

Since 2016, the company's Uniform ROA has collapsed from 4% to nearly 0% last year.

At these levels, Amkor is barely generating any cash at all. Furthermore, the company's real ROA helps explain why it's such a cheap stock...

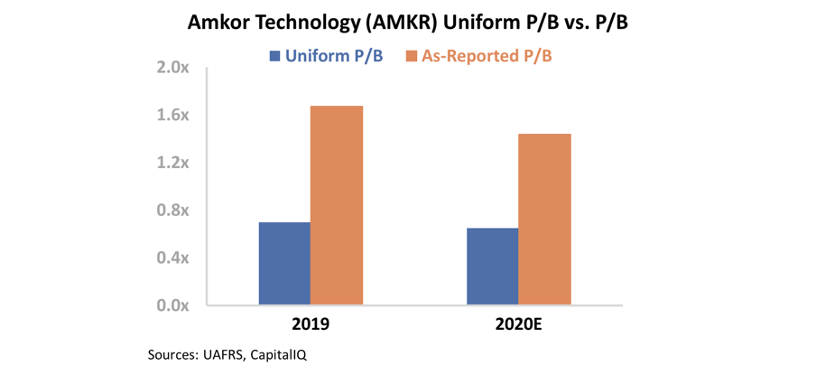

For companies with below-average profitability, it's more useful to look at their valuation relative to their assets or equity rather than their earnings.

Amkor is trading at more than 1 times its traditional as-reported price-to-book (P/B) ratio. Knowing the company's weak returns, investors might look at this and think Amkor's valuations are too high.

In reality the company's Uniform P/B ratio is 0.7. In other words, the company's valuation is trading at 70 cents for every dollar of assets it owns.

Levels much lower than this are reserved for companies that are at high bankruptcy risk... which Amkor isn't.

Given Amkor's current profitability levels, the company might struggle to see its valuations improve back towards book levels of 1 or higher. On the other hand, it has a floor to valuations thanks to its asset base.

As long as Amkor continues to be a commodity business, the company can expect to see its profitability and valuations remain muted.

As-reported metrics might make you think Amkor is expensive considering its weak performance – potentially leading to false "sell" signals. But in reality, this name is just one to avoid. Amkor is cheap for a reason... with limited basis for its stock to rise, and limited ability for its stock to fall.

Regards,

Rob Spivey

June 19, 2020

According to management consulting firm McKinsey, the recovery from coronavirus pandemic will be digital...

According to management consulting firm McKinsey, the recovery from coronavirus pandemic will be digital...