This season's holiday shopping data is coming from an unlikely source...

This season's holiday shopping data is coming from an unlikely source...

Last week, we highlighted that Cyber Monday made the wrong kind of history.

Rather than continuing the historical trend of increasing sales every year, sales declined for the first time.

Thanks to some high-quality data, we know that this is nothing worth panicking about. Overall, holiday sales continue the trend of breaking prior records. The fact that only Black Friday and Cyber Monday are down – while overall sales are up – speaks to the supply chain constraints companies are facing.

The numbers show us that the U.S. consumer is as strong as ever. Supply issues will get resolved eventually, and every other indication shows that the economy will continue to roar ahead.

This powerful data isn't coming from Walmart (WMT), Alphabet's Google (GOOGL), Amazon (AMZN), or consulting company McKinsey.

It's coming from Adobe (ADBE).

That's right, the company that we all know for its Reader and Photoshop software is now the go-to source for holiday retail shopping data.

How Adobe reached into the world of online shopping...

How Adobe reached into the world of online shopping...

Aside from its popular PDF and photo-editing software, Adobe sells Creative Cloud, offering a suite of high-end products for professional creators. This is what most people have come to know and love from the Silicon Valley titan.

But Adobe has been quietly expanding from its niche...

Housed under the "digital experience" segment, Adobe also offers services for companies hoping to understand their customers better. Among these services is an e-commerce analytics data model that many consider superior to Google's more popular "enhanced e-commerce" service.

Adobe has been publishing data about this year's holiday season as part of an awareness and marketing campaign about its analytics team's capabilities.

The digital experience segment was a natural byproduct of strides Adobe has made to transform its own business over the last decade. That transformation was the adoption of a Software as a Service ("SaaS") business model, which has made it easier than ever to onboard new customers and sell them new kinds of products.

Like Canadian e-commerce giant Shopify (SHOP), Adobe is among the early adopters of the SaaS revolution...

Like Canadian e-commerce giant Shopify (SHOP), Adobe is among the early adopters of the SaaS revolution...

Along with Salesforce (CRM) and Intuit (INTU), Adobe proved to the world that the SaaS model is better and more profitable than selling expensive, one-time software licenses.

Salesforce and Intuit proved that the SaaS model could work for businesses. Adobe pioneered it for consumers, especially with its Creative Cloud.

But in the meantime, the business-to-business opportunity lurked on the sidelines. It was an opportunity Adobe just couldn't ignore. And all it needed to do was adopt its existing SaaS infrastructure to focus more on data and analytics for corporate clients.

That was long before SaaS was as ubiquitous as it is today. It was viewed as a competitive advantage, not a necessity. Hence, Adobe experienced some first-mover advantages and grew ahead of the broader SaaS business intelligence industry.

It has tripled its digital experience business over the past 10 years, becoming an integral tool for many companies engaged in digital sales. Its legacy business has also tripled since 2015.

The software world has since followed in Adobe's footsteps, and non-SaaS software services are largely considered outdated. With the popularization and lowered entry barriers to the cloud, software companies now have little excuse but to offer a SaaS option to their customers.

Uniform Accounting exposes why SaaS has led to massive gains for investors...

Uniform Accounting exposes why SaaS has led to massive gains for investors...

Adobe's business transformation led the stock to rise from around $27 in 2011 to around $615 today, a gain of more than 2,100%... enough to turn every $5,000 into more than $110,000.

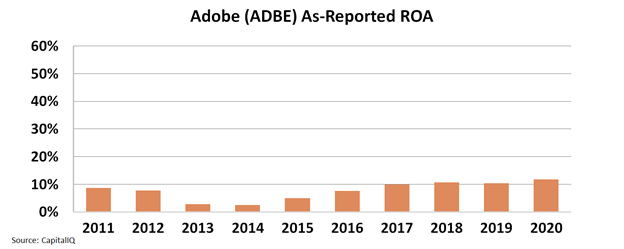

But you wouldn't know it by looking at the as-reported metrics. In 2011, Adobe had 9% return on assets ("ROA"). By 2020, it was just 12%. The as-reported numbers would suggest that the shift to SaaS has barely impacted Adobe's business.

Take a look at the as-reported ROA since Adobe embarked on its SaaS journey:

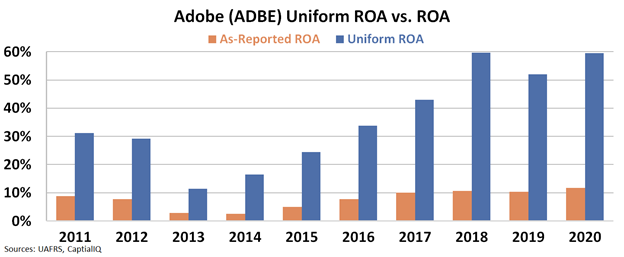

Fortunately, Uniform Accounting tells a much clearer story...

Adobe has made dozens of acquisitions over the past decade, which has caused its as-reported balance sheet to balloon with goodwill, keeping ROA low.

In reality, these acquisitions have been transformational, helping Adobe become a dominant leader in the cutting-edge world of tech. Take a look at Adobe's real numbers:

SaaS opened a world of possibilities for Adobe. Customer acquisition became easier than ever... subscription revenues are steady and predictable... and as Adobe's customer base grew and profitability improved, longtime investors have watched as the stock has turned into a 20-bagger.

We've found a company taking a page out of Adobe's playbook, and we think it could eventually turn into a 20-bagger, too...

We've found a company taking a page out of Adobe's playbook, and we think it could eventually turn into a 20-bagger, too...

We back-tested the numbers and found that 72 of the last 75 times a tech company shifted to the SaaS model, shares went up an average of 759%. Adobe wasn't the only moonshot, either... Others rose as much as 2,710%, 3,093%, 5,530%, 3,233%, 2,694%, and more.

And we believe it's about to happen again. As soon as 9:30 a.m. tomorrow, we expect a little-known tech company could see its shares rise thanks to its quiet shift to SaaS. Get all of the details here.

Regards,

Joel Litman

December 7, 2021

This season's holiday shopping data is coming from an unlikely source...

This season's holiday shopping data is coming from an unlikely source...