Major entertainment player Warner Bros. Discovery (WBD) is bringing its business front and center...

Major entertainment player Warner Bros. Discovery (WBD) is bringing its business front and center...

The company is known for hit content that ranges from HGTV and the Food Network to Cartoon Network and the DC Comics franchise. But lately, its financial decisions have been in the headlines as much as its entertainment.

The company wrapped up a public merger in April. Then, in August, news came out that popular streaming service HBO Max was cutting 36 of the company's movies and TV series with basically no warning.

Warner Bros. Discovery also announced that its already-filmed Batgirl movie would never be released.

These moves seemed to come out of nowhere at first. But it quickly became clear that the company was writing off its content in the name of building a tax break.

The merger promised to save the combined Warner Bros. Discovery $3 billion. But in reality, write-downs only added up to $825 million.

So now, management is resorting to cutting staff. The company laid off roughly 100 Warner Bros. Discovery employees following its successful run at the Emmy Awards.

These cost-cutting measures are understandable based on as-reported numbers...

These cost-cutting measures are understandable based on as-reported numbers...

Businesses want to save money and boost returns. That's nothing new. Plus, the post-merger Warner Bros. Discovery has more than $50 billion in debt. So it makes sense that the company would be looking for ways to bring that number down.

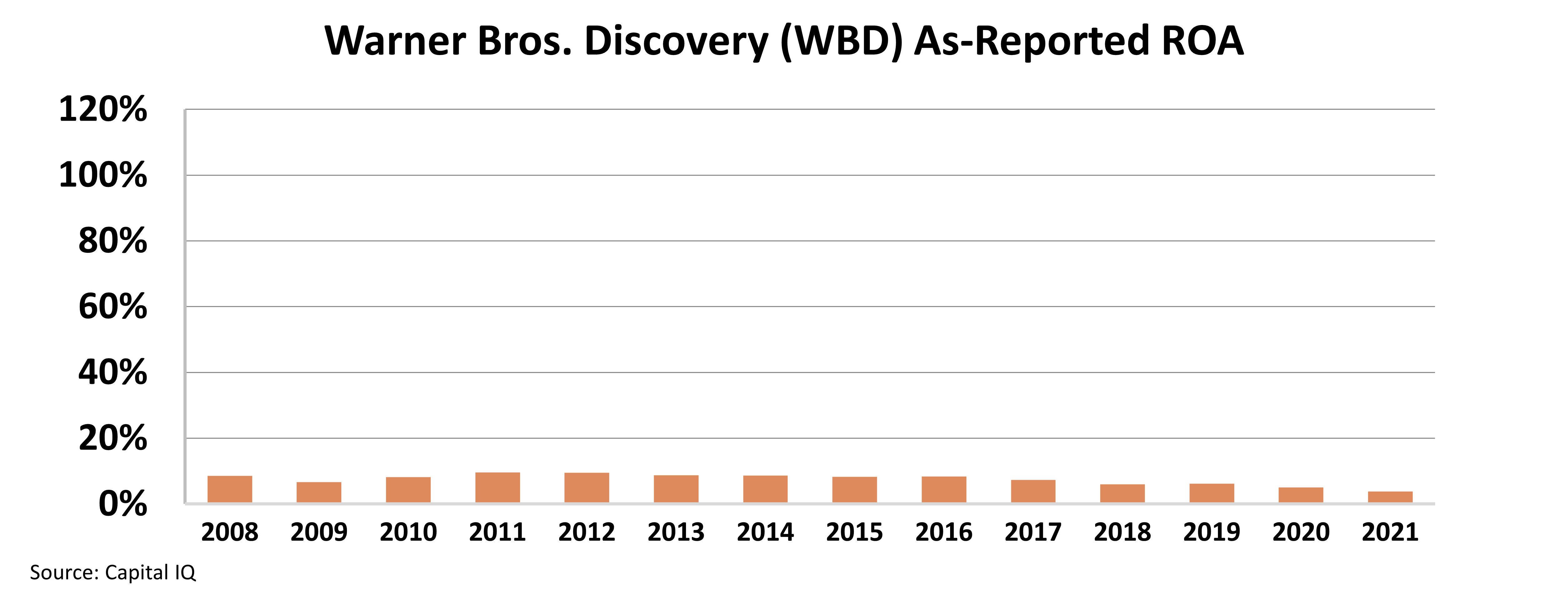

On an as-reported basis, return on assets ("ROA") looks like it has been declining for more than a decade. Check it out...

Warner Bros. Discovery's as-reported ROA has never been great. But it looks like it's getting even worse. ROA was around 10% in 2011 but had slipped to 4% by 2021.

This makes these layoffs and drastic tax breaks understandable. Warner Bros. Discovery looks like it's losing profitability and struggling to get an edge.

But the layoffs might actually be doing more harm than good...

But the layoffs might actually be doing more harm than good...

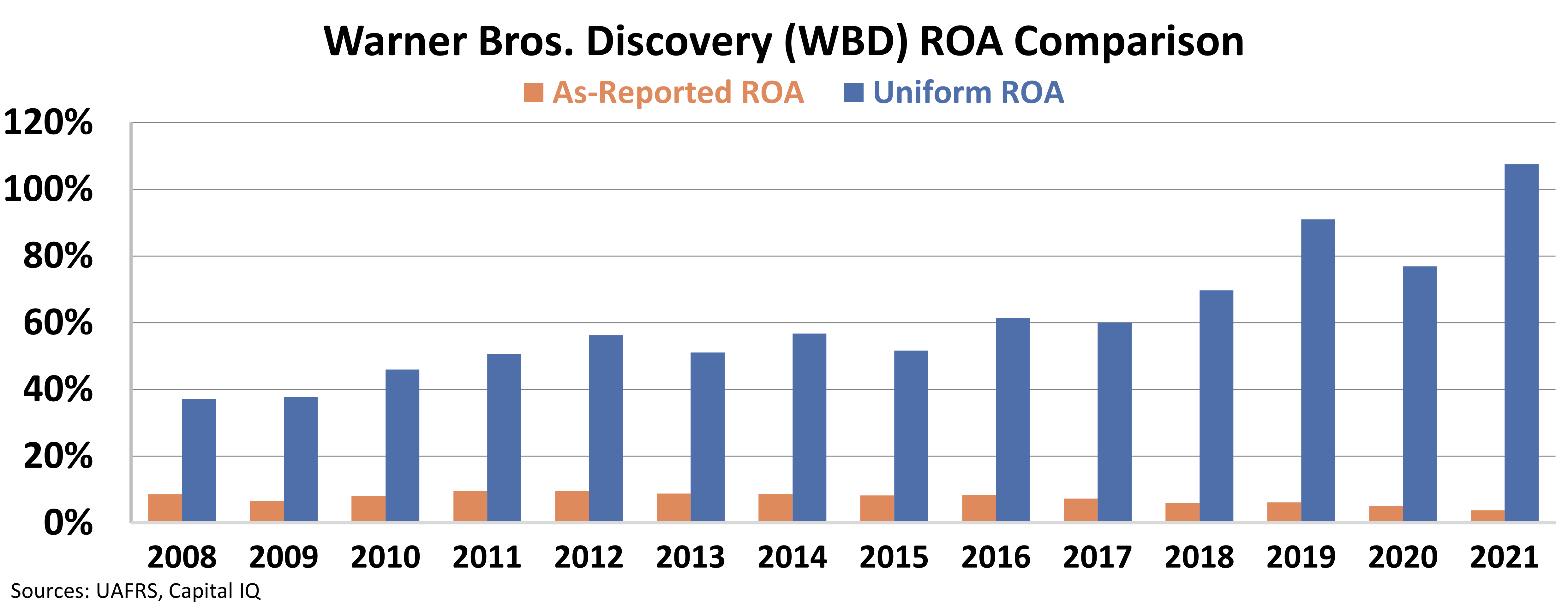

As-reported numbers make Warner Bros. Discovery look like a failing business. But Uniform Accounting removes distortions in that data, revealing a different picture.

It turns out that the company's austerity measures might be a costly mistake.

As you can see in the following chart, Warner Bros. Discovery has actually gotten more profitable almost every year since 2008. As the company has grown, its returns have taken off...

Uniform ROA has soared from 37% in 2008 to 107% in 2021. When a business is making good money, the last thing you want to do is slash costs and shrink operations.

It seems like management is looking at bad data... and it's making bad decisions as a result.

Warner Bros. Discovery should want to keep fans happy and do what's best for the business. To do that, it needs to invest in more staff, more productions, and more content.

As long as the company is on this destructive path, returns could fall in the coming years. That's a bad sign for investors.

Regards,

Rob Spivey

October 11, 2022

Major entertainment player Warner Bros. Discovery (WBD) is bringing its business front and center...

Major entertainment player Warner Bros. Discovery (WBD) is bringing its business front and center...