Joel's note: The Altimetry offices are closed tomorrow for New Year's Day. We'll be back in touch with the Daily Authority on Monday, January 4.

Many employers have been pleasantly surprised by how productive working from home has been...

Many employers have been pleasantly surprised by how productive working from home has been...

Folks working remotely no longer need to spend long periods of time commuting. Additionally, they can avoid disturbances that come with being in the office. Meetings are more streamlined, often with less small talk.

However, some people are hurting from the work-from-home trend. While there may be less water-cooler talk, a whole new set of distractions come into play at home.

For instance, parents are forced to juggle work with taking care of children who are themselves learning remotely.

Creativity has also decreased due to fewer in-person interactions. It's harder to organize and innovate over the phone or through teleconferences. Sitting in the house all day without colleagues around isn't always conducive to creative solutions.

This new work environment also enforces a new kind of inequality. New hires are bearing the brunt of the work-from-home burden. It's tough to assimilate into a new company culture without meeting teammates and bosses in person. These new workers are finding it tough to develop social connections.

Here at Altimetry, we've even noticed this with our six-month co-op interns, who we bring on from Northeastern University twice a year. They have to work much harder to get ramped up on our business... and it's more difficult for us to get them comfortable with contributing like we normally expect our co-ops to.

Ultimately, many people are struggling to adapt to working from home, despite its benefits. Decreased social interactions and a host of at-home distractions are hurting creativity, organization, and connections.

Some companies have tried to solve the downsides of remote learning in creative ways...

Some companies have tried to solve the downsides of remote learning in creative ways...

One industry leading the charge is event management. While in-person events are postponed, these firms have adapted to remote events, as we discussed in yesterday's Daily Authority.

One example is Eventbrite (EB) – a ticketing and experience platform. The company allows users to browse, create, and promote local events.

While many people would normally be looking for New Year's party tickets on Eventbrite this time of year, 2020 has been a different story.

Eventbrite charges fees to organizers in exchange for its online ticketing services. The lack of in-person events has hurt the company, but also poses an opportunity for the future. These new revenue streams from virtual events could be additive to Eventbrite's offerings in the coming years.

But to balance Eventbrite's current struggles with its future opportunities, we need to dig deeper...

But to balance Eventbrite's current struggles with its future opportunities, we need to dig deeper...

Looking at our Altimeter platform can shed some light on the company.

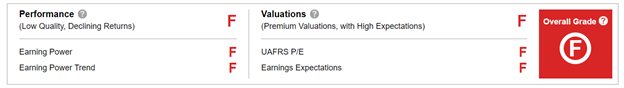

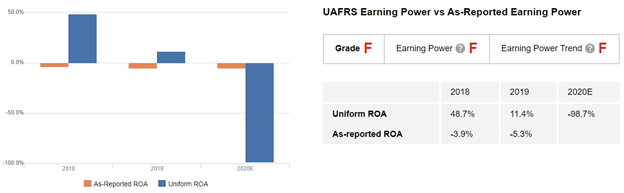

The Altimeter breaks down Uniform Accounting metrics into digestible grades, so users can easily understand how companies rank on profitability and valuation. Through the power of Uniform Accounting, we sift through the "noise" of as-reported financial metrics to determine a company's real earnings and value.

Due to the broad cancelation of in-person events in 2020, it's no surprise that Eventbrite earns an "F" grade across the board. The company's normal revenue streams are virtually nonexistent this year.

However, once we take a deeper look at Eventbrite's profitability, we can get a better sense of its prospects. In 2018 and 2019, the company had a strong and positive Uniform return on assets ("ROA"). This is in contrast to as-reported metrics, which paint Eventbrite as a negative-return business.

And yet, even before the pandemic, the company's Uniform ROA declined significantly in 2019 due to increased competition in the space.

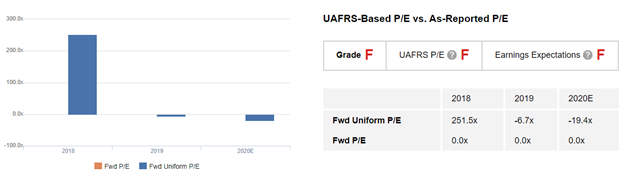

Additionally, Eventbrite has a negative Uniform price-to-earnings (P/E) ratio. Because the company had negative earnings in 2019 and 2020, it earns an "F" grade for Valuations as well.

However, looking at Eventbrite's Uniform price-to-book (P/B) ratio, we can see what the company trades at relative to its assets instead...

However, looking at Eventbrite's Uniform price-to-book (P/B) ratio, we can see what the company trades at relative to its assets instead...

Eventbrite has a Uniform P/B ratio of 2.6, meaning the market expects returns of roughly 2.6 times cost-of-capital returns of just less than 5%. This is only slightly higher than the Eventbrite's Uniform ROA of 11% last year.

These returns were generated even without the additional revenue streams created in 2020. When in-person events resume, Eventbrite will have new digital event business revenue to supplement its traditional in-person event offerings.

Despite Eventbrite's "F" grades, looking at the name in context helps to understand the firm's outlook. The company has generated positive returns in the past and is adding new revenue streams this year... so it may be able to turn those failing grades around.

As we move into 2021, we're not yet at a point where society can return to normal. However, when we do get a sense of normalcy back later in the coming year, Eventbrite could set itself up to return stronger than before.

And a hope for things to return to normal is something all of us can certainly toast to as we close the book on 2020 tonight.

Regards and Happy New Year,

Joel Litman

December 31, 2020

Many employers have been pleasantly surprised by how productive working from home has been...

Many employers have been pleasantly surprised by how productive working from home has been...