The Russia-Ukraine war drove historic demand... in an unlikely place.

The Russia-Ukraine war drove historic demand... in an unlikely place.

For nearly a year, most of the focus has been on oil and gas. Russia supplies roughly 14% of the world's oil supply. As soon as it invaded Ukraine, all of that was at risk.

Europe in particular had relied heavily on Russian oil and gas. When it started sanctioning Russia, that meant it had to look elsewhere for its energy.

With such a large portion of the world's energy supply coming off the market, prices spiked. Oil reached its highest price since 2015... and natural gas since 2008.

But behind the scenes, the fertilizer industry fared even worse. You see, Russia is actually the biggest fertilizer exporter in the world. It exports 16% of the world's fertilizer supply.

After the first round of U.S. and European sanctions, Russia's Ministry of Industry and Trade recommended all fertilizer manufacturers halt exports.

Fertilizer prices reached an all-time high last March. That was a scary thought for farmers everywhere. But it meant a big bump for fertilizer stocks.

For some of these companies, 2022 was just the beginning. That's not true for everybody, though.

Today, we'll take a look at one U.S.-based fertilizer king that crushed earnings last year... but isn't likely to offer a repeat performance.

While farmers scrambled to cover costs last year, agricultural suppliers weren't complaining...

While farmers scrambled to cover costs last year, agricultural suppliers weren't complaining...

Agriculture prices skyrocketed. As I explained yesterday, many agriculture stocks crushed the market last year. That was mostly because of the supply shock caused by the Russia-Ukraine war.

Other countries had to learn to be more independent... which means a lot of investment in new equipment, seeds, and fertilizers.

In the U.S., fertilizer represents between 10% and 36% of the cost of our staple crops. And as farmers tried to grow as much as they could, it drove historic demand for fertilizer.

CF Industries (CF) is a big player in the fertilizer niche. CF is a nitrogen fertilizer business, and it has benefited from a huge demand boost in the past few years.

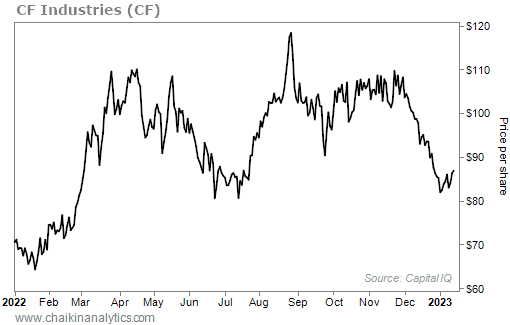

From the day Russia invaded Ukraine – February 24, 2022 – through its peak in August, CF's stock was up 51%. Take a look...

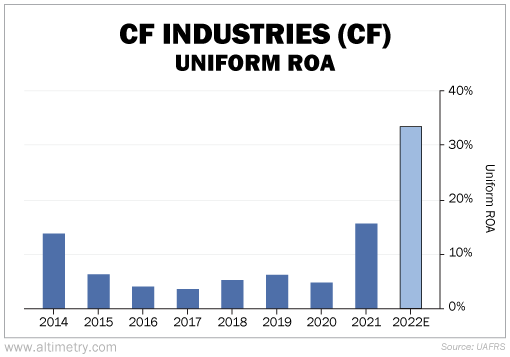

Naturally, surging prices should lead to surging profitability.

CF's Uniform return on assets ("ROA") was already a respectable 16% in 2021. When 2022 numbers are finalized, it's expected to reach as high as 35%.

Take a look...

CF Industries is expecting another banner year. But that doesn't mean the trend will continue forever.

As we covered yesterday, environmental regulators are setting their sights on the agriculture industry...

As we covered yesterday, environmental regulators are setting their sights on the agriculture industry...

CF Industries is highly profitable now. But fertilizer is a dirty business. Nitrogen-based fertilizers, like the kind CF makes, have been linked to serious water pollution in parts of the world.

In fact, these and other fertilizers have been linked to an 8,500-square-mile "dead zone" in the Gulf of Mexico that's covered in algae. The algae has killed almost everything underneath.

Nitrogen fertilizers are also manufactured with natural gas. This process is responsible for roughly 1% of the human-created carbon dioxide in the air each year.

With regulators taking a hard look at greenhouse gas emissions in agriculture, big fertilizer companies could be a future target.

Investors should be cautious. CF Industries' ROA has taken off in the past two years... But that doesn't mean it will continue to do so. We see significant potential headwinds as the green movement turns toward agriculture.

Regards,

Rob Spivey

January 18, 2023

The Russia-Ukraine war drove historic demand... in an unlikely place.

The Russia-Ukraine war drove historic demand... in an unlikely place.