Dumping manure on motorways is one way to make yourself heard...

Dumping manure on motorways is one way to make yourself heard...

Over the summer, European farmers made headlines for their dramatic protests of possible climate restrictions. In addition to the manure, protestors set hay bales on fire and blockaded roads with tractors.

These folks are worried about new climate-crisis policies. Organizations such as the United Nations have been trying to cut global greenhouse gas emissions through emission-reduction goals.

The focus of the green-energy movement has long been on fossil fuels like coal and oil. But recently, folks have started to take a closer look at other industries...

According to Bloomberg, food systems are responsible for one-third of global greenhouse gas emissions. And agricultural production makes up the bulk of that.

Amid pressure from climate activists, the Dutch government plans to halve nitrogen emissions from agriculture by 2030. Irish farmers are expected to cut emissions by 25%. And Denmark is targeting a 65% reduction.

These goals could shrink or completely close many farms. The Dutch government has set aside almost $26 billion to buy out the biggest emitters in the country.

It's not only in Europe, either. New Zealand said it will begin taxing agricultural greenhouse emissions by 2050.

As I'll cover today, these farmers' protests might be too little, too late. It's going to get a lot tougher to be in the agricultural industry from here.

Last year, agricultural companies crushed it...

Last year, agricultural companies crushed it...

Russia's invasion of Ukraine left the rest of the world scrambling. One of Russia's first moves was to prevent Ukraine from exporting goods out of its ports on the Black Sea.

That caused supply shocks for a lot of goods. Ukraine makes up 46% of the world's sunflower oil exports... and nearly 10% of wheat exports. Prices for these goods skyrocketed.

Sunflower oil started 2022 at about $1,300 per ton, and wheat at $7.58 per bushel. In the following months, both products almost doubled in price. Sunflower oil nearly reached $2,400 per ton. Wheat got up to $12.09 per bushel.

This was a wake-up call for nations around the world. They needed backup plans for food security. So many countries decided to invest in their own agricultural production.

Demand for things like farming equipment, fertilizers, seeds, and food processing all rose dramatically.

We can see this through the iShares MSCI Global Agriculture Producers Fund (VEGI). It holds a basket of some of the world's biggest agricultural companies.

VEGI's top three holdings are farm-equipment maker Deere (DE), food processor Archer-Daniels-Midland (ADM), and seed and agrichemical company Corteva (CTVA).

The fund as a whole did better than the market last year...

The fund as a whole did better than the market last year...

It returned about 5% versus the S&P 500's 19% loss.

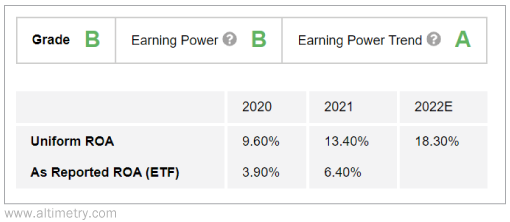

When we look at VEGI's performance metrics using the ETF Analyzer, it's easy to see why.

The ETF Analyzer works like the Altimeter – it uses Uniform Accounting data to display easy-to-digest grades across a number of categories. But instead of doing this for individual stocks, it does it for exchange-traded funds and mutual funds.

It reviews data points like the quality of the fund's holdings and how expensive or cheap they are.

Just like in school, an "A" grade means the fund passes with flying colors. An "F" grade means things aren't looking so good.

VEGI's aggregate Uniform return on assets ("ROA") was 13% in 2021. That number is expected to jump to 18% once all companies have reported 2022 earnings.

The fund earns a "B" Performance grade and an "A" for Earning Power Trend. Take a look...

As the data shows, VEGI's holdings have posted strong and improving returns from 2020 through 2022.

You might expect several more years of tailwinds for the agricultural industry, based on what we saw last year.

This trend isn't guaranteed to last forever, though.

We can't ignore the latest wave of climate activism...

We can't ignore the latest wave of climate activism...

Last year was an anomaly. The world had to act quickly to prevent failures in our food system. Not all agricultural companies are going to be that successful going forward.

Agricultural companies will face a lot of scrutiny thanks to new climate goals. Farmers will need to think carefully about making changes in order to stay in business.

Last year, investors in agriculture almost couldn't lose. That won't be the case in 2023.

Tomorrow, I'll cover a part of the agricultural sector that has been a target of climate activism for some time. One stock in particular did well last year, but may struggle in the face of increasing international pressure to reduce emissions.

And in the meantime, remember that the outlook for this industry has changed. You can still win with agriculture stocks... But you'll need to get tactical.

Regards,

Rob Spivey

January 17, 2023

Dumping manure on motorways is one way to make yourself heard...

Dumping manure on motorways is one way to make yourself heard...