Just a few years ago, the term 'unicorn' was all the rage...

Just a few years ago, the term 'unicorn' was all the rage...

These are privately owned venture-capital ("VC") supported startups worth more than $1 billion. As an estimated 0.07% of startups ever reach a billion-dollar valuation, these select firms are as rare as the mythical creature they're named after.

Many startups have been holding off on going public until they've maximized growth potential, attempting to achieve unicorn status.

Public companies are scrutinized by investors and are often pushed to pursue near-term profitability as opposed to long-term growth. By staying private, some of these unicorns could pursue growth without having to answer to shareholders. Companies like social media giants Facebook (FB) and Twitter (TWTR), as well as ride-hailing business Uber (UBER) were just a few firms that waited until they were already massive to go public.

In recent years, the VC community has coined another term related to these companies: "hectocorns." The prefix "hecto" is derived from Greek and indicates 100, meaning a hectocorn is a $100 billion unicorn.

Currently only one or two hectocorns exist in the world, depending on how investors define them. According to market-research firm CB Insights, ByteDance is currently worth $140 billion. The company owns the popular social media app TikTok, and has been in the news recently due to federal government scrutiny over its U.S. operations.

The other is Ant Financial, worth a forecast $225 billion ahead of its initial public offering ("IPO"). However, its position as a hectocorn is debatable... as it's not really VC-financed due to its ties with Chinese e-commerce giant Alibaba (BABA).

As more and more companies wait to go public until later in their lifecycles, the potential to see more hectocorns may be growing...

Unlike the recent trend of unicorns waiting to go public, historically startups used to rush to the public markets...

Unlike the recent trend of unicorns waiting to go public, historically startups used to rush to the public markets...

Anyone who used to look at public biotech firms would find a plethora of companies hemorrhaging money. These businesses relied on equity markets to quickly gain access to capital and fund research projects. Unlike many firms today, these biotechs would go public without being anywhere close to profitability. This was merely an avenue to raise the capital they needed for growth.

This was taken to the extreme during the late 1990s with the dot-com bubble. Any company with a website and business plan could go public and raise hundreds of millions of dollars.

Pets.com was one of the more heavily publicized failures of the era. Despite reporting just about $600,000 in revenue in 1999, the company received a more than $80 million valuation upon going public. It went bankrupt within a year as the Internet bubble burst, and investors realized the company's business model would struggle to profit.

Today, there's a lot less patience in the public markets for companies with narrow paths to profitability... But the route of going public hasn't been totally abandoned by startups. Some firms still go public without being close to profitability.

Earlier this year, we discussed how Uber and Lyft (LYFT) have gone public despite massive losses. In 2019 alone, Uber lost $8.5 billion... with its path to profitability continually getting pushed back. The days of these unicorns losing money clearly aren't over.

Another unicorn that appears to be unable to turn a profit is Pinterest (PINS). The company went public in April 2019 and was worth $16 billion at market close. Pinterest is an image sharing and social media site that puts an emphasis on e-commerce and visual searches.

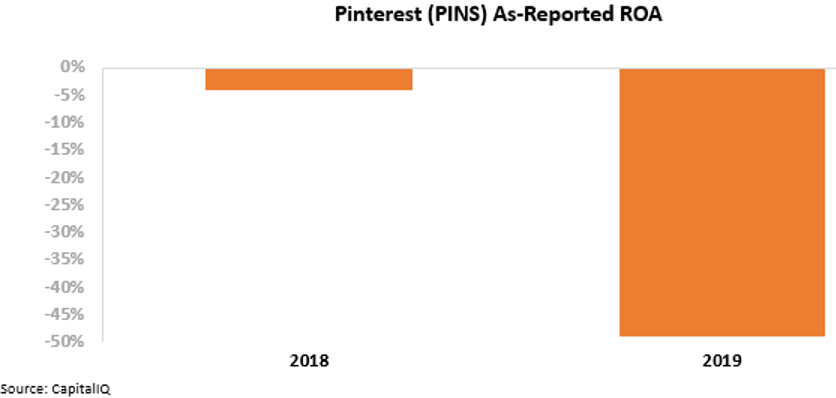

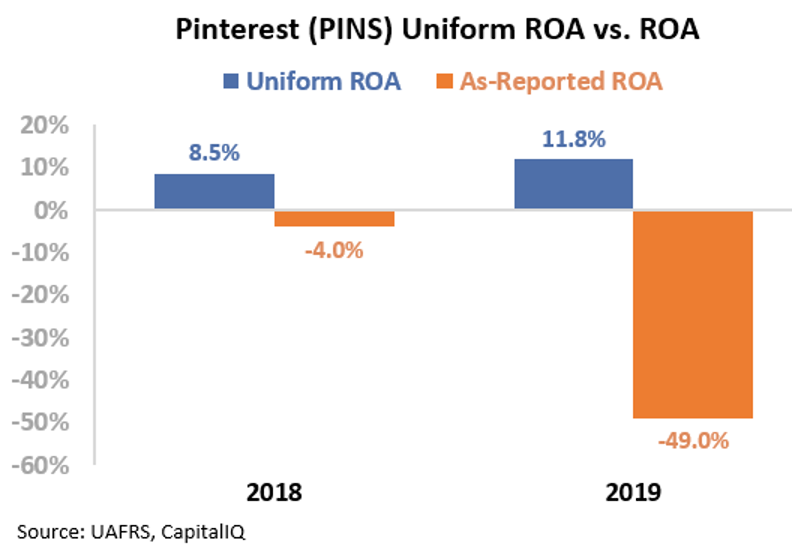

By looking at the as-reported metrics, investors see Pinterest as just another unicorn that's bleeding cash. In 2018, the company had a negative 4% as-reported return on assets ("ROA")... and this dropped sharply to negative 49% last year. Pinterest seems to be chasing capital without having the returns to back it up.

However, this picture of Pinterest's performance is inaccurate... It's pulled down by distortions in as-reported accounting. Due to the GAAP treatment of excess cash, among other distortions, the market doesn't realize the company's real performance.

Pinterest is actually a highly profitable unicorn that entered the market at the perfect stage of its life cycle.

In reality, the company's Uniform ROA was 9% in 2018... not negative. Since then, Pinterest's real returns have risen to 12%, as the company has taken advantage of trends toward digitalization and e-commerce.

Pinterest has also seen surging demand thanks to the coronavirus pandemic and the subsequent "At-Home Revolution." More people than ever are using the platform to think creatively about how they want to invest in and spend time at their homes. Additionally, extra downtime at home is driving more people to use social media sites.

However, understanding how the company has done in the past isn't enough to decide whether the stock is a compelling buy. To determine if Pinterest can continue to create value for shareholders, we can use the Embedded Expectations Framework to easily see market valuations.

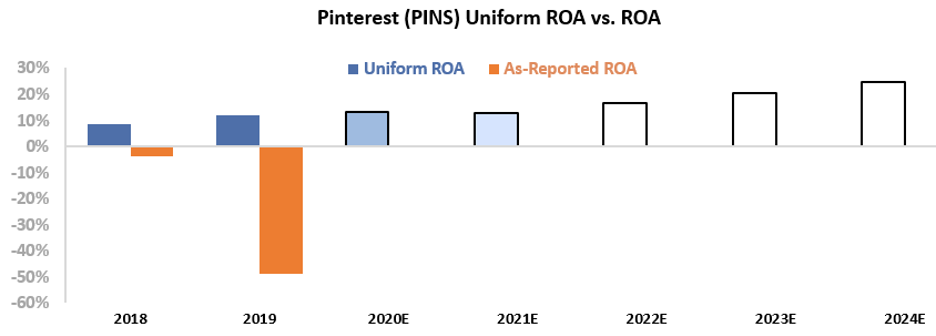

The chart below shows Pinterest's historical corporate performance levels, in terms of ROA (dark blue bars) versus what sell-side analysts think the company is going to do in the next two years (light blue bars) and what the market is pricing in at current valuations (white bars).

As you can see, analysts expect the company's returns to grow to 13% next year as Pinterest rides the At-Home Revolution and social media waves. The market is pricing in even more acceleration, with returns rising to 25% in 2024... That's a sizable increase.

While it's not clear if Pinterest can continue to grow profitability going forward, investors can get a full understanding of what the market has priced in to the stock... and thus adjust their expectations for how PINS shares will perform in the years ahead.

Ultimately, Uniform Accounting shows the true strength of Pinterest's business and the market's bullish outlook for the company. Pinterest is well set to capitalize on tailwinds in the social media world. Its more than 335 million monthly user base continues to grow, and continued interest in the visual shopping market could drive further profitability improvements.

Without Uniform Accounting, investors would have likely bucketed Pinterest as another unicorn going public before it should have. But by looking at the real numbers, they can understand that Pinterest is a strong operator that the market has priced for future success.

Regards,

Joel Litman

September 10, 2020

Just a few years ago, the term 'unicorn' was all the rage...

Just a few years ago, the term 'unicorn' was all the rage...