During the economic shutdown, work got busier than ever...

During the economic shutdown, work got busier than ever...

The pandemic-induced recession and recovery are often described as K-shaped instead of more typical recoveries. A simple recovery might be V-shaped if there is a sudden and short dip before a quick recovery, or W-shaped if there are two dips before the real recovery.

However, this recovery did not affect everyone equally. Some benefited, and some suffered. Hence, the K-shaped or split recovery.

In cable news, you will often see the K-shaped recovery refer to the split between the wealthy, who took advantage of the stratospheric economic rebound, and those who were crushed amid the furloughs and layoffs in the restaurant, travel, and entertainment businesses.

We see the K-shaped recovery in a lot more places. For example, we frequently talk about the "At-Home Revolution," in which the companies that served "life at home" saw a boost while the rest didn't.

Companies needed to quickly adapt products and services to fit the new modus operandi. But the unintended consequence of turning the home into the office is that work-life balance tended to fall by the wayside.

For example, bosses quickly learned that their direct reports are online for most of the day, and 7 p.m. became a "fair game" work hour. With nowhere to take vacations, workers weren't getting the breaks they needed.

Even more so, for investment banking analysts, life quickly went from "wait during the day for your managing director to get back from meetings, then work all night," to "work all day, then work all night."

A March internal survey of Goldman Sachs (GS) investment banking analysts was leaked to the public. The bombshell report revealed 100-hour workweeks, abusive management, and severely declining mental health – which was even worse than the already harsh treatment of junior staff in the investment banking world.

Whether they work for a Silicon Valley or Wall Street company or someplace else, many employees nationwide are burned out.

It should be no surprise that people plan to make up for the lost leisure time with global travel and entertainment reopenings. A recent survey by management consulting firm Korn Ferry (KFY) found 79% of U.S. professionals plan to use more vacation days in 2021 than in prior years. The survey also revealed that a whopping 82% say they'll work less frequently when they take time off.

As we mentioned in the July 16 Altimetry Daily Authority, taking time off is a good thing. Happier and healthier employees are routinely shown to produce better work that requires fewer revisions than their overworked and overstressed counterparts.

Yesterday we talked about how several travel outlets may be starting to restrict inflow again. Here at Altimetry, we are very encouraged to see several of our U.S. employees take time off. They're getting away from company e-mails and chats to recharge their batteries.

We sincerely hope that as summer draws to a close, you have also taken some time to unplug and relax. After all, we are humans, not robots. Being happy is important.

As the return to vacationing continues to unfold, even despite the recent setbacks, hotel companies are winning alongside the overworked professionals...

As the return to vacationing continues to unfold, even despite the recent setbacks, hotel companies are winning alongside the overworked professionals...

One hotel goliath, Marriott International (MAR), is particularly well-positioned. Not only does Marriott have a brilliant franchising strategy that boosts efficiency, but it also recently launched Homes & Villas, an upmarket competitor to Airbnb (ABNB).

These businesses are phenomenally efficient. For example, about 70% of Marriott's global properties are franchised, which adds nothing to its asset base but yields astronomical fees to use the Marriott name.

Moreover, compared to its counterparts that own and operate their hotels, Marriott's franchising and home-sharing businesses face less exposure to a possible relapse into travel bans. Marriott can continue to collect franchising fees and doesn't need to worry about paying for expensive properties despite the halt in revenues.

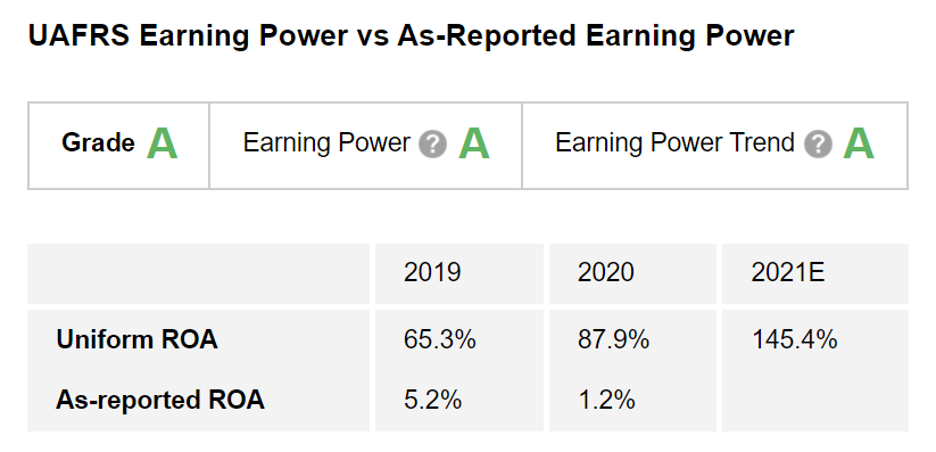

If you looked at the company's as-reported return on assets ("ROA"), which follows the rules laid out by the GAAP accounting, it would appear this model doesn't, in fact, bear fruit. The company reported a crash from an already weak 5% ROA in 2019 to a dismal 1% in 2020.

When you look at Marriott's ROA on a Uniform basis, which makes common sense adjustments to the financial statements to show a more realistic picture of a company's economic productivity, the picture looks far different.

Marriott's Uniform ROA improved from an already robust 65% in 2019 to a lofty 88% in 2020 – even in the face of global headwinds.

This shows the franchising model is minting money. When paired with Marriott's "something for everyone" solution set and a competent management team, it is clear why The Altimeter gives it "A" performance grades across the board.

Only the best companies with the most robust business models score this well.

A good investment needs a good company, where the market doesn't quite understand why it's so good...

A good investment needs a good company, where the market doesn't quite understand why it's so good...

To understand what the market is thinking, we often use our Embedded Expectations tool to see what returns are baked into a stock's current price.

Last week, we received a question from one of our readers, asking us about the Embedded Expectations feature in the Altimeter.

Along with the grades you see above, we have streamlined the model powering the Embedded Expectations tool into a letter grade for valuations.

Using The Altimeter's valuation grade, it's possible to see what the market is pricing in for the company. The valuation grade is comprised of two components – Uniform price-to-earnings (P/E) ratio and Earnings Expectations.

The Uniform P/E ratio measures the company's P/E ratio relative to the market as a quick benchmark for the stock being cheap or expensive versus the market.

Meanwhile, Earnings Expectations compares market expectations for earnings growth versus the company's actual projections, which helps highlight real embedded expectations for the company.

Using tools such as Embedded Expectations and Earnings Expectations, we can identify businesses primed for huge upside...

Using tools such as Embedded Expectations and Earnings Expectations, we can identify businesses primed for huge upside...

In Altimetry's High Alpha, we've found several "Survive and Thrive" companies poised to win during the economic recovery. They are growing faster than the market realizes with tremendous upside.

Subscribers to High Alpha have reached more than a 30% gain on one of our "Survive and Thrive" tourism-related recommendations.

To learn more about High Alpha – and gain instant access to these portfolio recommendations – click here.

Regards,

Rob Spivey

September 2, 2021

During the economic shutdown, work got busier than ever...

During the economic shutdown, work got busier than ever...