Here at Altimetry Daily Authority, we've previously discussed the surge in home buying...

Here at Altimetry Daily Authority, we've previously discussed the surge in home buying...

This is taking place within the context of the "At-Home Revolution." Stuck inside and working remotely, urbanites are switching out small apartments in cities for bigger homes in the suburbs. It looks like working from home is here to stay, and folks want a quiet and separate place to complete work.

Considering this societal shift, it's no surprise that existing home sales are surging. People want to upgrade their living situation... and those folks selling their houses are doing the same.

We can see further proof that this trend will be here to stay through high advance home purchases. According to real estate database company Zillow (Z), the percentage of homes still in blueprint form sold in October was at the highest monthly level since 2005.

This means 39% of homes bought in October weren't even built yet at the time of purchase.

With many homes guaranteed to be built in coming months and years, demand for furniture, homes, and appliances is likely to stay high. Upon building completion, the homeowners will need to continue spending money to make their new house into the perfect home.

Another important metric, homebuilder confidence, is also a bullish signal for the industry. The National Home Builders Association's Housing Market Index reached an all-time high in October, which shows how confident the folks who are building the homes are about the industry.

One homebuilder that's well-suited to benefit from the current environment is NVR (NVR)...

One homebuilder that's well-suited to benefit from the current environment is NVR (NVR)...

The company is different from other large competitors like D.R. Horton (DHI) and Lennar (LEN) in the sense that it's close to a "pure play" homebuilder. While NVR has a mortgage banking arm as well, it doesn't take part in community development and infrastructure building.

Instead, NVR solely builds homes on plots in communities that are ready to develop. NVR accomplishes this through an intelligent strategy of using options. Other homebuilders buy large swaths of land speculatively, hoping to develop later if the land price appreciates. While this can lead to large gains, it can backfire if the land price doesn't move higher.

On the other hand, NVR pays landowners a deposit for roughly 10% of the value of a lot of land. NVR then has the right to buy the lot for a set price for a certain amount of time. If NVR doesn't buy the land, it loses the deposit. However, if NVR pursues the plot, it can end up with a significant profit after building on it.

This conservative strategy is safer... and protects the company during downturns. NVR performed better than other homebuilders during the Great Recession.

Additionally, the strategy allows the company to stay more "asset light" than other homebuilders.

It's no surprise then that our Altimeter tool likes the company...

It's no surprise then that our Altimeter tool likes the company...

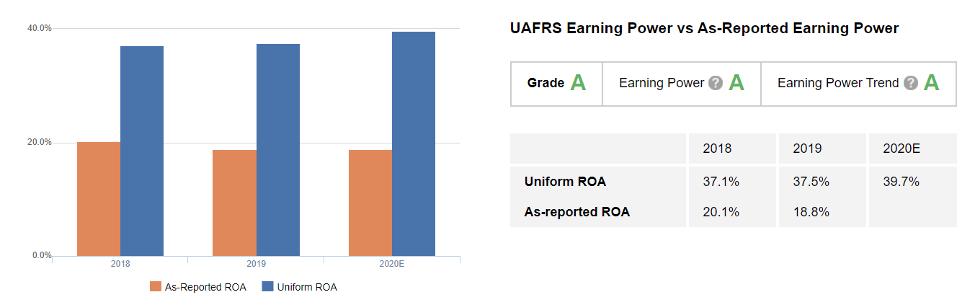

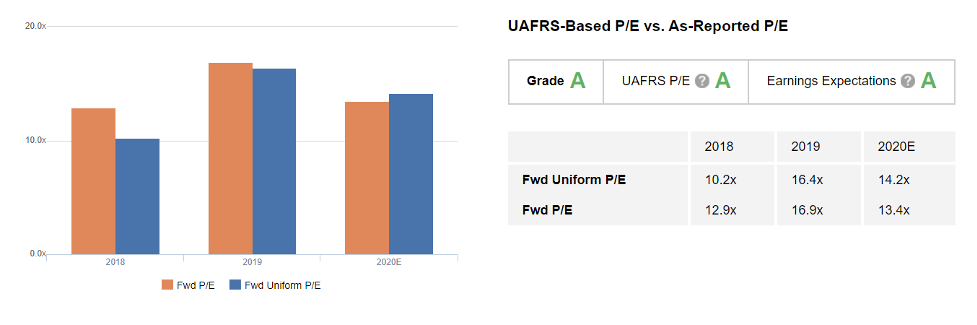

The Altimeter breaks down the Uniform Accounting metrics into digestible grades so users can easily understand how companies rank on profitability and valuation. Through the power of Uniform Accounting, we sift through the "noise" of as-reported financial metrics to determine a firm's true earnings and value.

Looking at NVR's Uniform return on assets ("ROA"), this metric has ranged between 37% and 38% over the past two years. This is well above both the company's as-reported metrics and corporate averages. Furthermore, thanks to its unique business model, expectations are for Uniform ROA to improve to 40% this year. This all means that NVR receives an "A" grade for Earning Power and Earning Power Trend.

Additionally, even with demand for homes skyrocketing this year, it doesn't appear that the market is fully pricing in this trend. NVR's Uniform price-to-earnings (P/E) ratio has fallen this year to 14 times. This is below market averages... and shows that the market may be too pessimistic about the company.

Therefore, the Altimeter gives NVR another "A" grade for valuation.

Uniform Accounting and The Altimeter show investors that NVR is a high earner and is modestly priced. And as homebuying demand will likely stay high in the months and years ahead, the company will be one to watch to drive shareholder value.

Regards,

Rob Spivey

December 17, 2020

P.S. With Uniform Accounting, we can identify 130-plus financial inconsistencies that the GAAP metrics don't account for. Then our multimillion-dollar system fixes these inconsistencies to get a stock's real value.

When this system is paired up with a megatrend like the "At-Home Revolution," the results are powerful... And right now, we've found the best ways investors can take advantage of this big societal shift for massive potential upside in the months and years ahead. Learn more here.

Here at Altimetry Daily Authority, we've previously discussed the

Here at Altimetry Daily Authority, we've previously discussed the